-

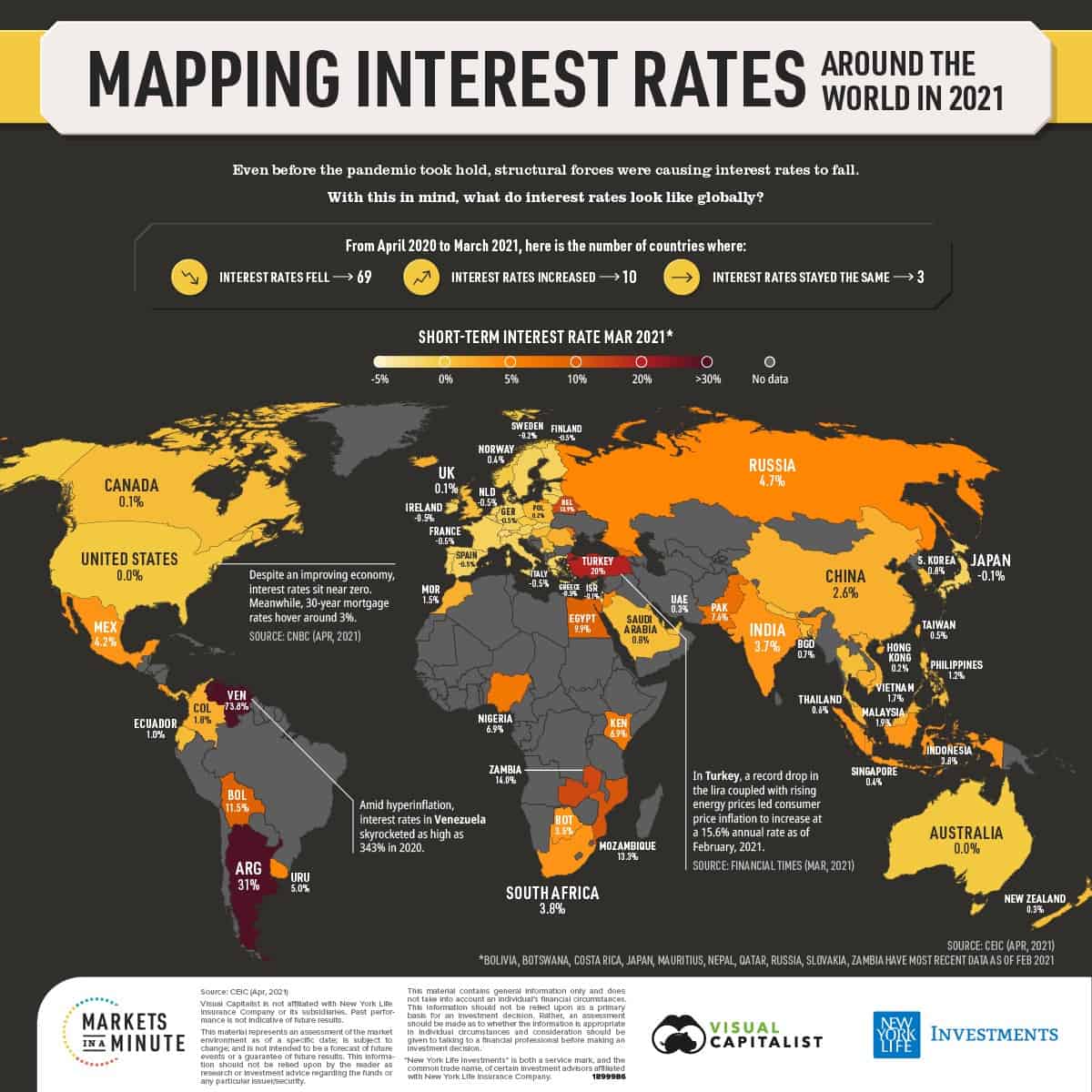

69 of the 82 countries tracked by CEIC data see the lending rates fall

-

Saudi Arabia, UAE witness rise in rates by 0.8 and 0.3 bps

Benchmark lending rates — the basic rates set by central banks in countries for banking institutions to follow — rose at a much slower clip in bigger economies in Middle-Eastern and North African (MENA) countries than in smaller ones since the beginning of the Covid-19 pandemic, according to CEIC Data.

For example, Saudi Arabia and the United Arab Emirates saw the rates rise by just 0.8 and 0.3 basis points, respectively, from April 2020 to March this year. Israel, in fact, saw its central bank reduce the rates by 0.1 percentage points in the same period!

Egypt, on the other hand, saw the interest rate rise by 9.9 percentage points, while the number was as large as 20 percentage points in Turkey. Morocco, however, bucked that trend somewhat with a hike of 1.5 percentage points in the rate.

Meanwhile, across the world, interest rates rose in 10 countries, fell in 69, and were unchanged in just three countries, said CEIC Data in its survey of 82 countries.