DUBAI, UAE – Decline in oil output due to OPEC-agreed production cuts, a non-oil sector slowdown because of higher interest rates, and subdued external demand may act as a potential setback for the UAE’s economic growth in 2023, a latest report has highlighted.

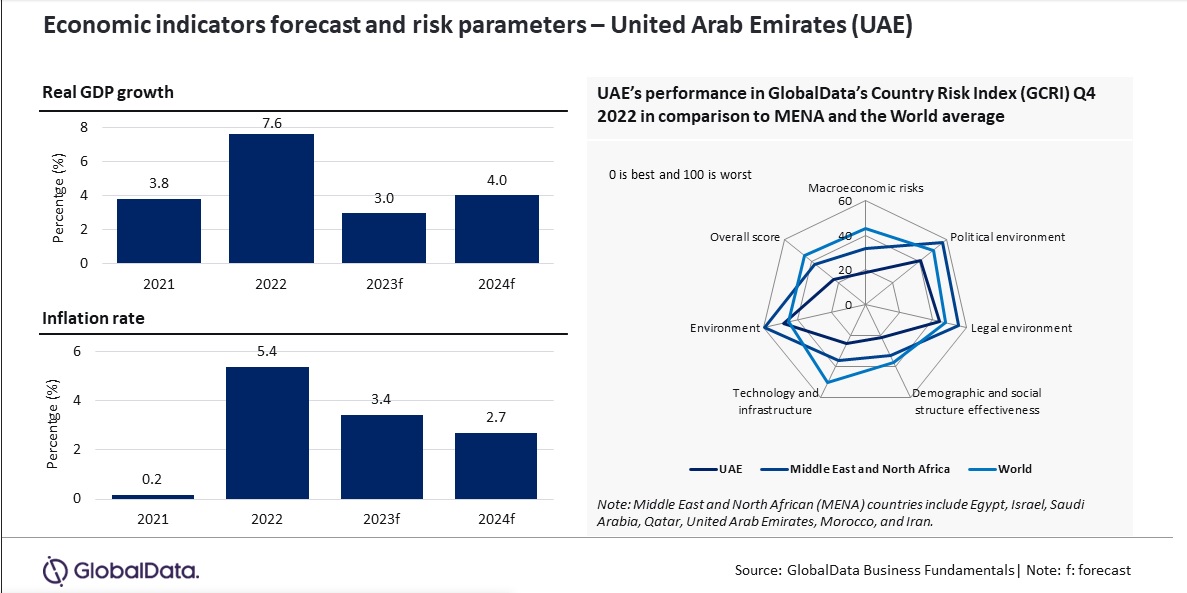

According to a forecast from GlobalData, a top-tier data and analytics company, the real GDP growth rate is expected to drop to 3 percent in 2023, from the previous year’s strong growth rate of 7.6 percent.

The report, “Macroeconomic Outlook Report: UAE,” reveals that the oil and gas industry, which accounts for about 30 percent of the country’s GDP and 13 percent of total exports, remains pivotal to the UAE’s economy.

Despite a major economic upswing in 2022 with a growth rate of 7.6 percent, the highest since 2007, the ongoing decline in oil and gas prices since the start of 2023 threatens to impact the UAE’s economic growth prospects adversely.

Indrajit Banerjee, an Economic Research Analyst at GlobalData, stressed the need for economic diversification to protect the economy from external shocks.

“To make the economy less vulnerable to external shocks, it remains crucial for the government to persist in its endeavour to diversify the economy. Abu Dhabi’s plan to invest $2.7 billion to double the size of the manufacturing sector by 2031, and the adoption UAE Circular Economy Policy 2031 that focuses on manufacturing, food, green infrastructure, and sustainable transport, reflects the government’s urge to transform to a more diversified economic base,” he said

He noted government initiatives, including Abu Dhabi’s $2.7 billion investment plan to double the size of the manufacturing sector by 2031 and the adoption of UAE Circular Economy Policy 2031, highlighting the government’s push for economic diversification.

The mining, manufacturing, and utilities sectors were the largest contributors to the gross value added (GVA) in 2022, at 31.2 percent. Financial intermediation, real estate, and business activities followed at 22 percent, with the wholesale, retail, and hotels sector at 15 percent. These sectors are expected to grow by 2.9 percent, 3.7 percent, and 2.5 percent respectively in 2023, lower than 2022’s rates of 9.6 percent, 12.4 percent, and 8.4 percent.

The UAE has initiated several development projects worth $23 billion since July 2022 to boost construction activities and job opportunities. Among these are the railway network project by Etihad Rail worth $11 billion, the Dubai urban tech district, and the Rashid solar park expansion, all set for completion by 2025. These initiatives are predicted to boost construction activities by an average of 2 percent over 2023-25.

However, a slowdown in exports growth from 4 percent in 2022 to 2.6 percent in 2023 is projected, with real household consumption expenditure also expected to decelerate to 4 percent in 2023 from 8.4 percent in 2022.

The UAE, ranked 10th out of 153 countries in the GlobalData Country Risk Index (GCRI Q4 2022), is considered a very low-risk nation. It also scores lower in political, macroeconomic, social, and environmental risks compared to the Middle East and North African averages.

According to data from the OPEC database, the UAE held 7.2 percent of the world’s oil reserves and 4 percent of natural gas reserves in 2021. A significant discovery by the Abu Dhabi National Oil Company (ADNOC) in May 2022, uncovering 650 million barrels of onshore crude oil reserves, has further strengthened the UAE’s position as a major producer and exporter of hydrocarbons.

“Even though, the UAE’s economic growth outlook for 2023 faces challenges, the ongoing diversification efforts and development projects aimed at strengthening the economy will play a vital role in reducing its vulnerability to external shocks,” said Banerjee.