COP28: Rethink, reboot and refocus

Climate experts agree that a more pragmatic approach is needed for the energy transition. At COP21 in 2015, the world committed to limiting global warming to 1.5°C above pre-industrial levels by 2050. To stay on target, science indicates that emissions must be halved by 2030. With just seven years remaining to achieve this goal, COP28 UAE presents a prime opportunity to rethink, reboot, and refocus the climate agenda. TRENDS explores how this global event can pave the way for a green and prosperous world.

Digital banking

The digitization of banks — intended to address the three Cs i.e. Customer, Convenience and Cost — was not an an ‘option’ but a core necessity, particularly in the wake of the latest Covid-19 pandemic. In the GCC, when it comes to digitization not all banks are at the same stage of digital adoption.

There’s a race to innovate, differentiate and outstand. While some of the banks are way ahead of the curve, few are still lagging.

TRENDS takes a look at how the sector in the region is doing in terms of competition and collaborations to stay ahead in the new banking ecosystem.

Dubai goes the Monaco way

Dubai boasts a thriving community of startup incubators and accelerators, as well as regulatory sandbox schemes for the development and testing of new tech business models. The city tops the list for foreign direct investment (FDI) and technology transfer in startups, AI and robotics sectors.

The emirate is constantly working to become the world’s most significant destination for foreign investment and high net worth individuals (HNWIs).

TRENDS comes up with a few special reports that suggest that Dubai is another Monaco in the making in more ways than one.

CLICK HERE FOR FULL COVERAGE

GCC-Asia trade

There are several factors at play when it comes to strengthening relations between Gulf countries and their Asian counterparts. Oil has been central to GCC-Asian trade and is expected to remain so over the next decade.

Gulf economic diversification is also creating opportunities for Asian investment to flow into emerging sectors such as renewables, infrastructure and the digital economy.

TRENDS looks at the business possibilities, beside oil and gas, in both regions on which the two sides may further capitalize to catalyze their bilateral trade relations.

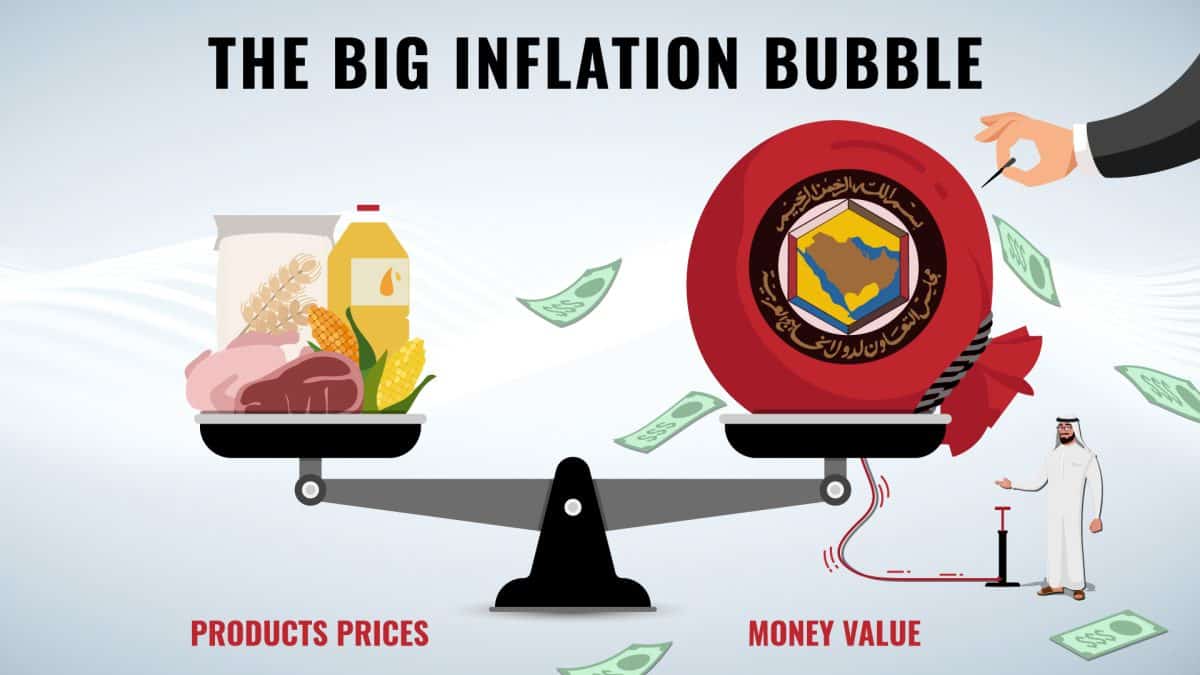

Inflation

The region, according to the GCC Statistical Center, is expected to face inflationary pressures from jumps in costs of imported raw materials and consumables.

All Gulf countries are forecast to have inflation rates in the range of 1-3 percent in 2022, with Qatar hitting the highest rate.

TRENDS finds out the impact of inflation on the regional economies.

Infra, innovation add to Dubai boom

Dubai’s economic resilience shines brightly in 2023. The emirate has showcased a remarkable 3.2 percent growth in the first half of the year. Key sectors, including transportation, trade, and real estate, have been pivotal in this economic surge. The Dubai Economic Agenda D33’s goals are not just on track but are being surpassed. TRENDS tries to find out how Dubai continues to solidify its position as a global economic powerhouse, blending innovation with sustainable growth strategies.

Metaverse and blockchain in GCC

Dubai Metaverse Strategy, announced by the emirate’s ruler Sheikh Mohammed bin Rashid Al Maktoum, is just one example how the GCC is proactively working to adapt the latest technology. The new strategy not only aims at creating jobs, enhancing technology trends, opening up business opportunities, and but it is also expected to add $4 billion to Dubai’s economy by 2030.

TRENDS takes an in-depth look at how the regional governments are reshaping their policies and programs to make the technological ecosystem more lucrative and useful for metaverse and blockchain.

CLICK HERE FOR FULL COVERAGE

Oil wealth adds to luxury boom

Driven by robust oil production and exports, the GCC economies have achieved significant growth, leading to increased affluence. This has fueled a continuous rise in luxury product spending.

Additionally, the region’s population has experienced substantial growth, particularly among the younger demographic.

TRENDS looks at how the rising number of high net worth individuals (HNWIs) in various sectors is driving demand for luxury goods and services in the region.

Ramadan

The pandemic had forced majority of people to observe fast while staying indoor, which had directly and indirectly affected trade and commerce. The markets are now gradually moving back towards normalcy as the COVID-19 restrictions have eased.

The Holy Month had been a fertile time for shoppers seeking savings. However, things are not the same due to COVID-19, which has been affecting the regional economies since 2020.

TRENDS tries to review the impact of Ramadan on economies and growth of the region amidst the pandemic. Attempts have also been made to delve into how the region is coping with global supply constraints, surging demand, rising prices and trimmed margins for wholesalers and retailers.

CLICK HERE FOR FULL COVERAGE