DUBAI, UAE — As the world’s largest cryptocurrency trading platform, Binance, grapples with allegations of wash trading, the global crypto market is in a state of flux. The potential fallout from these allegations is particularly significant for the Middle East, a region that has witnessed a surge in cryptocurrency interest and activity.

Wash trading, a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace, is at the heart of the allegations against Binance. The Wall Street Journal (WSJ) first brought these allegations to light, which were later substantiated by charges filed by the U.S. Securities and Exchange Commission (SEC).

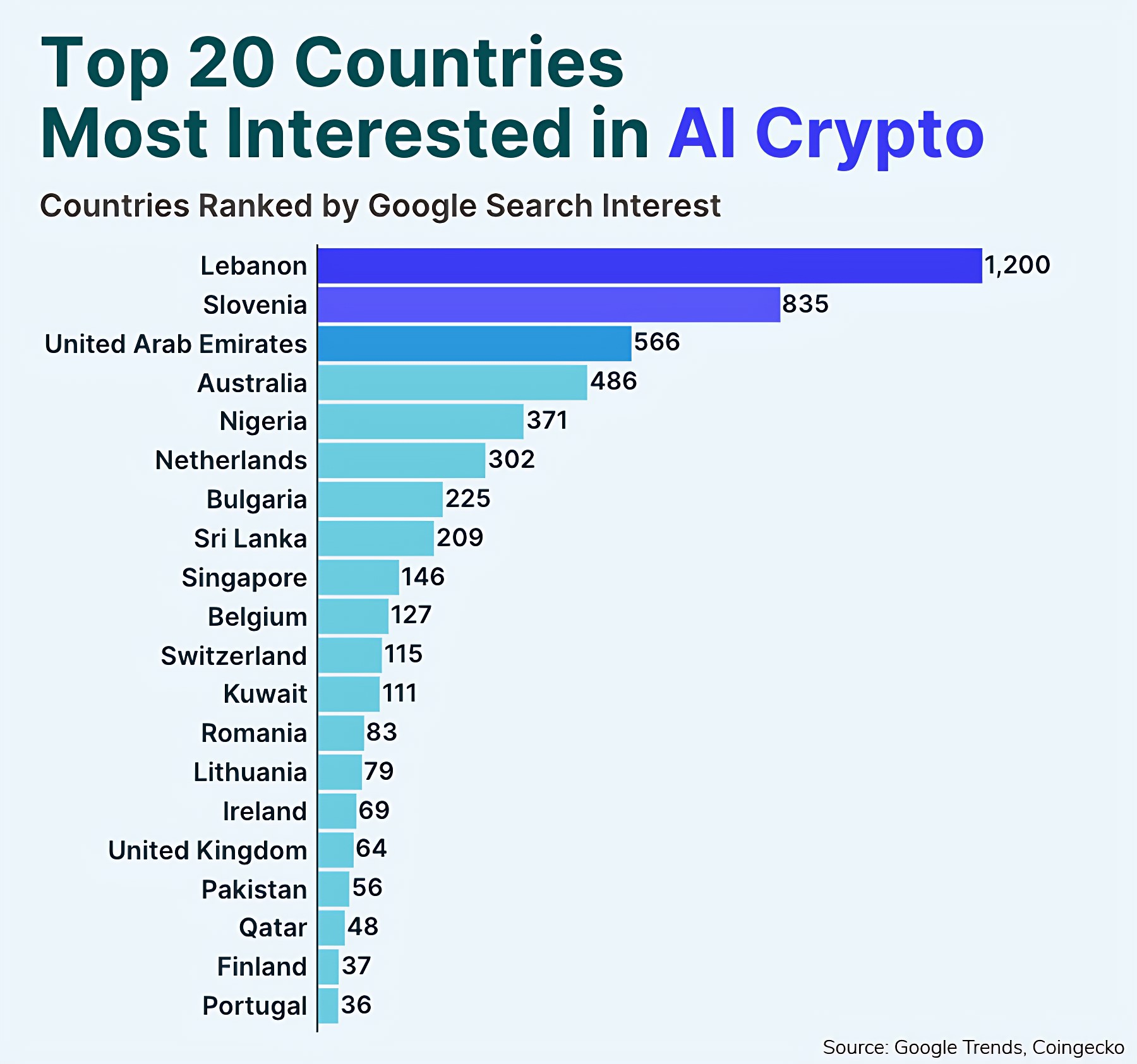

The Middle East, particularly countries like Lebanon and the UAE, have seen a surge in interest in cryptocurrencies, especially AI cryptocurrencies. Amidst economic hardships, residents are turning to crypto investment as an alternative means of making ends meet.

However, the rise of cryptocurrency has also seen an increase in illicit activities. The allegations against Binance could potentially lead to increased regulatory scrutiny in the region.

Interestingly, Rudy Shoushany, founder and CEO of the digital transformation talk show DxTalks, suggests that if the accusations against Binance are true, the platform might face trial in the US but not in other countries where this law is not applicable.

In an interview with TRENDS, he said, “The lawsuit against Binance is only applicable in the US until now, and it is based on internal information and leaks; it also accuses Zhao personally, alleging that he is aware of it and is covering it up, in coordination with a Swiss company he also owns.”

“Accusing Zhao personally is very dangerous and can have a negative impact on Binance to start with, and potentially any other companies he owns as well,” Shoushany added.

However, as of now, there is no objective evidence to prove that Binance U.S was part of wash trading, although auditors will investigate this matter.

Shoushany said, “It is not easy to detect wash trading; it starts with suspicion, and then an investigation is requested to track all the information, transactions, and account holders.”

Proving wash trading in crypto is particularly challenging because the industry is still 50 percent unregulated, making the detection of wash trading almost impossible.

“There are still ways to track, monitor, and block wash trading, but these are new technologies and are still under testing. In contrast, many different behaviors and levels of sophistication in tracing wash trading are challenging to detect,” said Shoushany.

Crypto activities in the region

The Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority recently granted cryptocurrency firm Rain permission to offer brokerage and custody services to residents. Meanwhile, Kuwait’s Capital Markets Authority issued a new circular to clamp down on crypto activities in the country.

Cryptocurrency exchange Bitget is set to expand its operations to the Middle East, with plans to hire up to 60 new staff members in the region. The allegations against Binance, therefore, come at a critical juncture for the Middle East’s crypto market. They underscore the need for robust regulatory frameworks to ensure transparency and protect investors.

The recent lawsuits against the world’s top two crypto exchanges, Binance and Coinbase, by the US financial regulator have sent shockwaves through the global crypto industry. Amid this escalating crackdown, the Middle East is emerging as a potential beneficiary and a new frontier for the crypto industry.

Coinbase’s CEO visited the UAE, signaling that it could become a strategic hub for the US company. This move could boost the UAE’s push to become a global leader in the cryptoeconomy.

Zurich-based private bank Julius Baer is looking to expand its crypto services in the Middle East. The bank’s Middle East subsidiary, JBME, is seeking a digital assets license from the Dubai Financial Services Authority (DFSA) to offer custody services for cryptocurrencies like Bitcoin and Ether in the region.

The lawsuit against Binance is only applicable in the US until now, and it is based on internal information and leaks; it also accuses Zhao personally, alleging that he is aware of it and is covering it up, in coordination with a Swiss company he also owns.

Rudy Shoushany, founder and CEO of the digital transformation talk show DxTalks

The MENA region has seen a staggering increase in crypto adoption, with users obtaining a total of $566 billion worth of crypto between July 2021 and June 2022, a 48% increase compared to the previous year.

Several MENA countries, including the UAE, Saudi Arabia, and Iran, are making significant strides in CBDC pilot programs. The Middle Eastern arm of cryptocurrency exchange OKX has been granted a minimal viable product preparatory license by Dubai’s Virtual Assets Regulatory Authority (VARA) as part of its plans to expand into the region.

As the US tightens its grip on the crypto industry, the Middle East is emerging as a new frontier, ready to capitalize on the next global financial boom wave. The region is ripe with opportunities, driven by forward-thinking consumer habits, advancing crypto infrastructure, the arrival of CBDCs, and the possibility of legislative clarification.

However, the Binance case serves as a stark reminder of the potential pitfalls of the crypto market and underscores the need for vigilance and robust regulatory oversight.

Impact on the crypto market

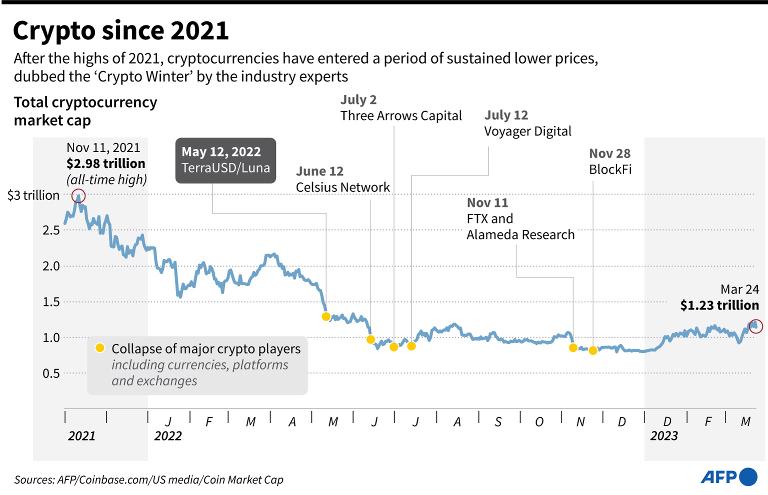

The cryptocurrency market reached its peak in November 2022, hitting a high of US$ 2.9 trillion, but it subsequently decreased to nearly US$ 0.8 billion in 2023 until the banking crisis hit the United States. This crisis helped the crypto market regain some of its losses, bringing it up to US$ 1.1 billion.

Despite liquidity risks, the crypto market has benefited from the recent banking sector crisis in the US Bitcoin has surged 40 percent to about US$ 27,700 since the Silicon Valley crisis erupted on March 10, 2023.

The Commodity Futures Trading Commission (CFTC) oversees commodity and derivatives markets, including Bitcoin. Companies such as brokers facilitating trading for U.S. clients of these products must register with them.

The lawsuit notes that Binance, which had a trading volume of US$ 34 trillion in 2021, did not require customers to provide information to verify their identity before trading. It also “failed to implement basic compliance procedures designed to prevent and detect terrorist financing and money laundering,” according to the agency.

A Reuters report suggest that the Binance platform has processed at least US$ 10 billion in payments for criminals and companies seeking to evade U.S. sanctions.

In response to the accusations of securities violations brought by the U.S. Securities and Exchange Commission against Binance, cryptocurrency prices fell. However, crypto-traders are awaiting the results of the investigation to determine their investments.

On the other hand, a spokesman from Binance stated that the SEC’s allegations regarding wash trading are entirely unfounded and based on a fundamental misunderstanding of the facts and a misapplication of the relevant law. He also explained that Binance viewed the trading as “entirely legitimate interactions” involving independent strategies. The spokesperson added that the size of the trading activity did not necessarily impact the overall trading volume, according to the Wall Street Journal.

Allegations of engaging in wash trading are not new. Coinbase, a major cryptocurrency exchange in the United States, faced similar legal issues from the CFTC.

The financial markets regulator alleged that the trading platform had engaged in wash trading for over six weeks in 2016. The disagreement was eventually resolved in 2021, with the CFTC issuing an order for Coinbase to pay fines of US$ 6.5 million.

In the long term, such investigations are a healthy development for the crypto ecosystem. They weed out bad actors and redirect capital from cryptocurrencies with high regulatory risks to Bitcoin.

However, some market experts have expressed concern that the commission’s allegations could derail the platform, and the lawsuit is likely to have far-reaching effects on the cryptocurrency industry. Many agree that there must be a global strategy to govern crypto exchanges.