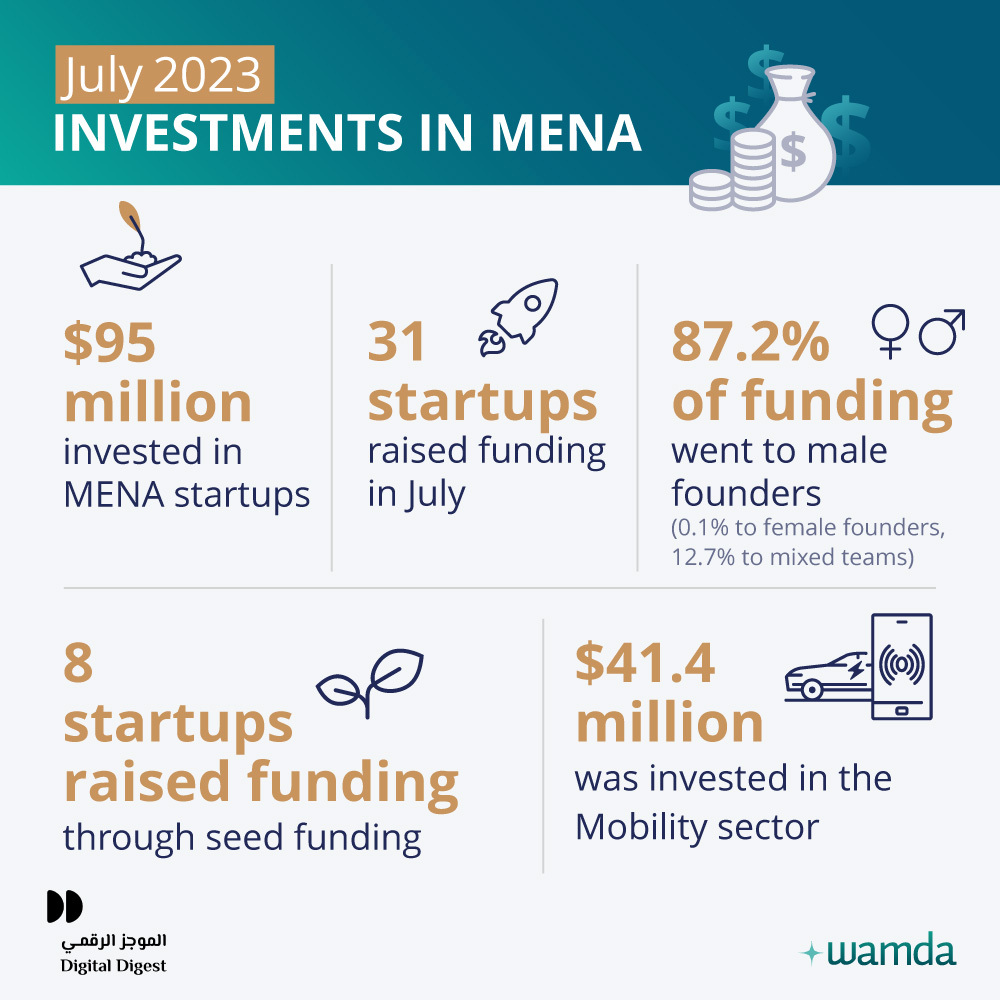

DUBAI, UAE — In a remarkable turn of events, startups in the MENA region secured a whopping US$ 95 million across 31 deals in July 2023. This marks a 167 percent surge from June’s US$ 35.6 million. However, it’s a slight decrease from the US$ 105 million observed in July 2022.

Despite the impressive funding, the deal volume in July 2023 saw a decline of 31 percent. Equity investments for the month stood at US$ 55 million, a 55 percent increase from June. This figure is influenced heavily by One Moto’s US$ 40 million lease financing round, as per a report by Wamda.

Country rankings

The UAE led the pack, but if One Moto’s contribution is excluded, businesses in the UAE raised just US$ 14 million over nine deals. In contrast, startups in Saudi Arabia secured US$ 18 million from five deals. Riyadh’s Foodtech Kaso was the standout, raising US$ 10.5 million in its Seed round. Egypt and Morocco followed, securing US$ 7 million and US$ 2 million respectively.

Industry insights

Seed and pre-Seed stage companies dominated the deal volume, accounting for 15 transactions. However, funding for late-stage and growth-stage firms has dwindled, causing a dip in venture capital activity for July.

While One Moto’s financing round propelled the mobility industry to the top in July, Foodtech emerged as the biggest beneficiary, amassing US$ 17 million across five deals. This boost is attributed to the rising adoption of enterprise SaaS solutions in the food and beverage sector. Surprisingly, fintech, despite being part of four deals, didn’t rank among the top-funded industries.

Gender disparities

Gender disparities persist in the MENA region. Female-founded firms continue to secure a minimal share of the funding, with most coming from accelerators and incubators. Jordianin Proptech Nomad, a graduate of the Flat6labs Amman accelerator program, was the only female-led startup to receive funding in July.

Mixed-gender founding teams fared better, raising US$ 12 million across six deals. In stark contrast, male-only led businesses raked in US$ 84 million, a staggering 87 percent of the total funds.

Internationally, US-based investors were the most active, participating in 10 transactions. Regionally, investors from Egypt and the UAE were involved in eight deals each, while those from Saudi Arabia took part in seven.

Noteworthy developments

July also witnessed significant acquisition deals. Notably, Jordan-born and Saudi-based HyperPay’s acquisition of Sanad Cash and the Abu Dhabi-owned EDGE Group’s purchase of OrxyLabs, both in Saudi Arabia. Additionally, Germany’s Delivery Hero acquired the remaining shares of Saudi’s HungerStation for US$ 297 million.

Other significant announcements include Agthia Group’s US$ 54 million tech-focused fund and 500 Global’s new accelerator program targeting Egypt-based managers. Lastly, eight startups, including Tenderd, Dharma, Kaco, Oumla, and Menthum, chose not to disclose their funding amounts. The latter four were each estimated to have secured US$ 100,000.