Riyadh, Saudi Arabia — Middle Eastern pharmaceutical firm Avalon Pharma has announced its intention to float on the Saudi Exchange’s main market, offering 6 million shares, representing 30 percent of its issued share capital, in its initial public offering.

The book-building process for Avalon Pharma’s IPO will commence on January 14th and conclude on January 18th.

The company said in a statement that in the event that there is sufficient demand by Individual Investors, the number of shares initially allocated to participating parties will be reduced to 5.4 million shares, representing 90 percent of the total offering.

“This IPO is a historic moment for Avalon Pharma,” said CEO Dr. Omar Hassan.

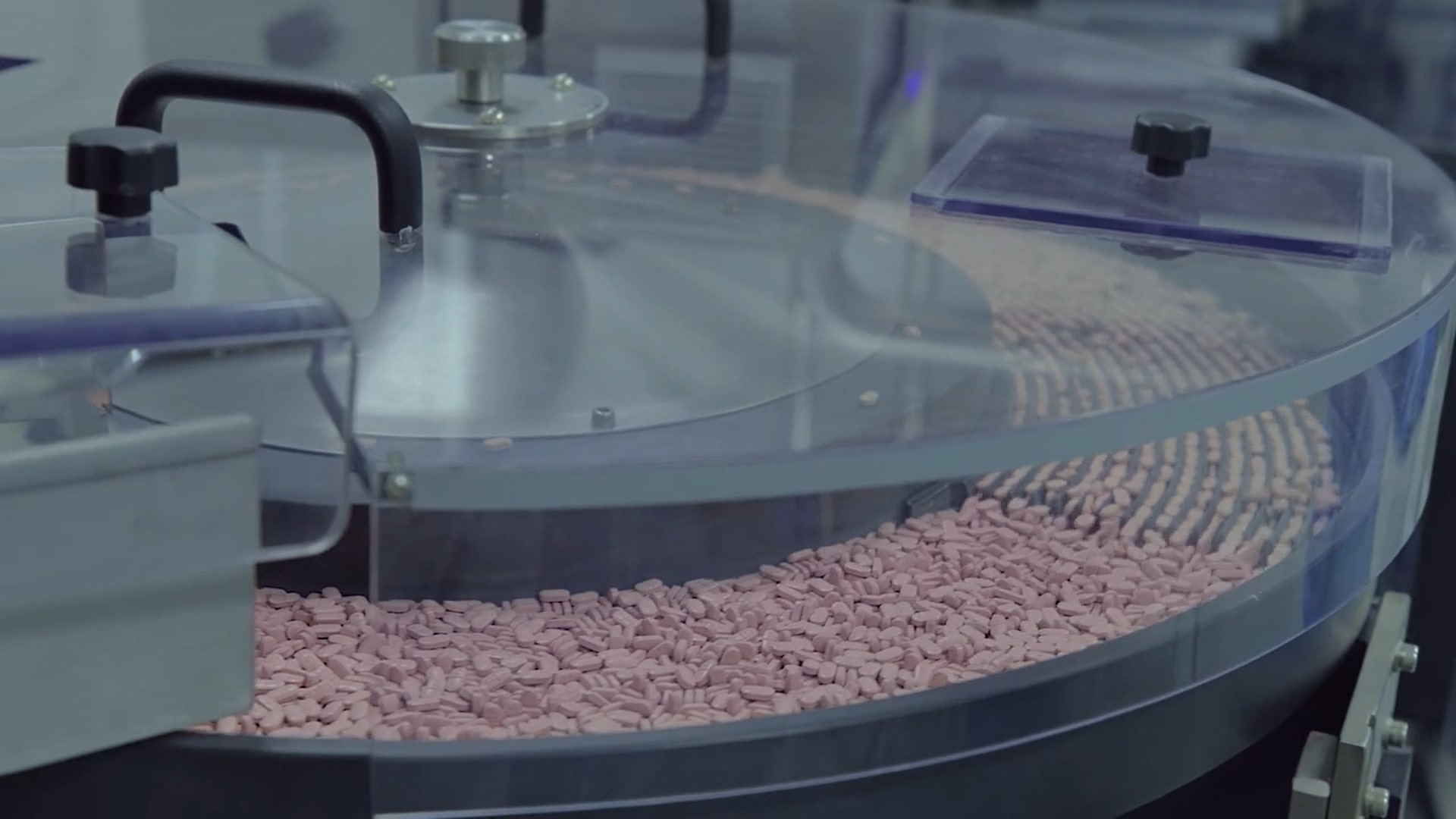

“The Saudi healthcare sector is experiencing unprecedented growth, and we are confident that our listing on the Tadawul will enable us to capitalize on this momentum. The capital raised will fuel our expansion plans, allowing us to bring more effective and affordable medications to families across the Kingdom,” he said.

Headquartered in Riyadh, Saudi Arabia, the company exports its products to over 10 countries across the Middle East and North Africa and is one of the fastest growing consumer pharma companies in Saudi Arabia.