Istanbul — The recent news and analysis surrounding Bitcoin Exchange Traded Fund (ETF) approvals and the halving event taking place this year, have had a massive impact on the top crypto price.

Bitcoin has continued its rally in 2024, reaching the $48,000 level on Jan 9 and creeping towards the nearly $70,000 mark it reached in November 2021.

Two concurrent events are currently sparking the rise of Bitcoin, led by the U.S. Securities and Exchange Commission’s (SEC) expected approval of spot Bitcoin ETFs this week. The other is the approaching Bitcoin Halving event.

Regarding ETFs, Bloomberg analysts Eric Balchunas and James Seyffart raised the odds for a spot Bitcoin ETF approval by the SEC to 90 percent by 10 Jan 2024.

The next Bitcoin halving event is expected late this April when Bitcoin block rewards drop from 6.25 BTC to only 3.125 BTC per block.

And while crypto volatility is a mainstay for digital currencies, Bitcoin’s mass adoption is growing and projected in the next four years to have around 1 billion users, according to FX Street.

This means that we will likely see more governments embracing cryptocurrencies instead of banning or limiting their use.

According to a 2023 report by Chainalysis, countries in Central and Southern Asia are leading the way in grassroots crypto adoption.

BTC ETF price wars

Investment managers are engaged in what can only be called BTC ETF price wars, ahead of SEC’s decision, in a watershed for an industry that for a decade has tried to introduce the product to the market but was met with SEC rejections citing investor protection concerns.

There was a breakthrough last year when a federal appeals court ruled that the SEC had no right to deny Grayscale’s application to convert its existing Bitcoin Trust (GBTC), which charges a 2 percent fee, into a spot Bitcoin ETF.

The company said on Monday it would charge 1.5 percent for the proposed ETF, the highest among disclosed fees so far.

On Monday, 8 Jan 2024, BlackRock, VanEck, Ark Investments/21Shares and Bitwise, among many others, said in filings with the SEC that they expect to significantly undercut the average market rate for U.S. ETFs.

According to Reuters, Bitwise bid the lowest at 0.24 percent, compared with the 0.54 percent average for U.S. ETF products, followed by VanEck, Ark and 21Shares at 0.25 percent. BlackRock said it would charge 0.3 percent,

It is estimated that spot bitcoin ETFs could bring in anywhere from US$3 billion on its first day to $55 billion over five years on the conservative side.

Standard Chartered meanwhile recently anticipated inflows of $50 billion to $100 billion in 2024 alone.

A spot bitcoin ETF would give investors exposure to bitcoin without directly holding it, drawing potentially billions more dollars into the world’s largest cryptocurrency.

Fake SEC tweets inflate BTC price

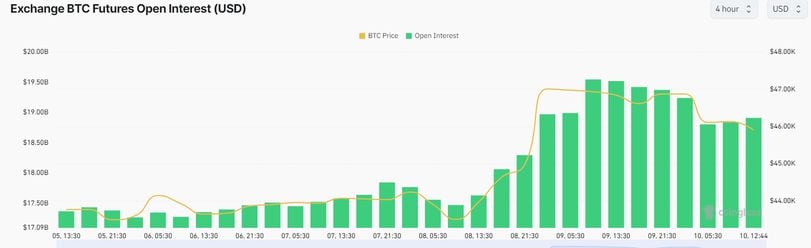

A series of fake tweets on 9 Jan 2024, from the SEC’s X account proclaiming ETF approvals caused nearly US$90 million worth of BTC long and short positions to be liquidated, Coindesk reported. Over $500 million in futures positions were opened during a 10-minute rush, spiking BTC prices to near $48,000. Following denials by the SEC, BTC fell to the current $44,000 price range.

Open interest spiked after fake SEC post (Source: Coinglass)

The SEC, tasked as a financial regulator with protecting trillion-dollar markets, drew its fair share of criticism for its apparent slack security measures to protect its account.

“The SEC will work with law enforcement and our partners across government to investigate the matter and determine appropriate next steps relating to both the unauthorized access and any related misconduct,” an SEC spokesperson said.

April 2024 Halving event

The halving in 2024 may be bad news for mining players who will see their rewards being halved, but it spells good news for BTC prices.

Mining reward halving will occur every 210,000 blocks, and with an average of one block added to the blockchain every 10 minutes, halvings occur every four years. Previous halvings took place in 2012, 2016 and 2020.

Reducing mining rewards is an important consideration for miners, impacting profitability and returns on investment on hardware and overhead running costs.

Hut8 CEO Jaime Leverton told Cointelegraph that the event will force miners to drive efficiencies in their operations to allow them to continue mining.

Taras Kulyk, founder and CEO of Bitcoin mining infrastructure provider SunnySide Digital, said that if the halving event is not met by increased Bitcoin prices or increased transaction fees, “lower-efficiency miners will need to shut down”. These are typically miners using 35 to 40 joule-per-terahash equipment.

Halving does bring spikes to BTC prices. The first halving occurred on 28 Nov 2012, when the reward was reduced from 50 to 25 BTCs per block. The second took place on 9 Jul 2016, when the reward was reduced from 25 to 12.5 BTCs per block. The third and latest occurred on 11 May 2020, when the reward was reduced from 12.5 to 6.25 BTCs per block.

Historically, BTC prices spiked following each halving event. After the first halving, BTC’s price jumped from $12.20 to $260 within a year. The second halving saw the price of BTC jump from $650 to $20,000 in December 2017.

The reasons behind that are directly related to demand-supply dynamics. Diminished returns for miners mean there will be fewer BTCs mined and this increased scarcity of new Bitcoins usually attracts higher demand, and thus greater prices.

As such, if the next halving happens without a hash rate drop, larger miners’ profitability would remain high, but BTC prices may likely not spike considerably beyond current levels.