New York, United States – Consumer goods giant Procter & Gamble painted a mixed picture in its earnings report Tuesday, as price hikes supported revenue growth but customers appeared to pull back in some purchases.

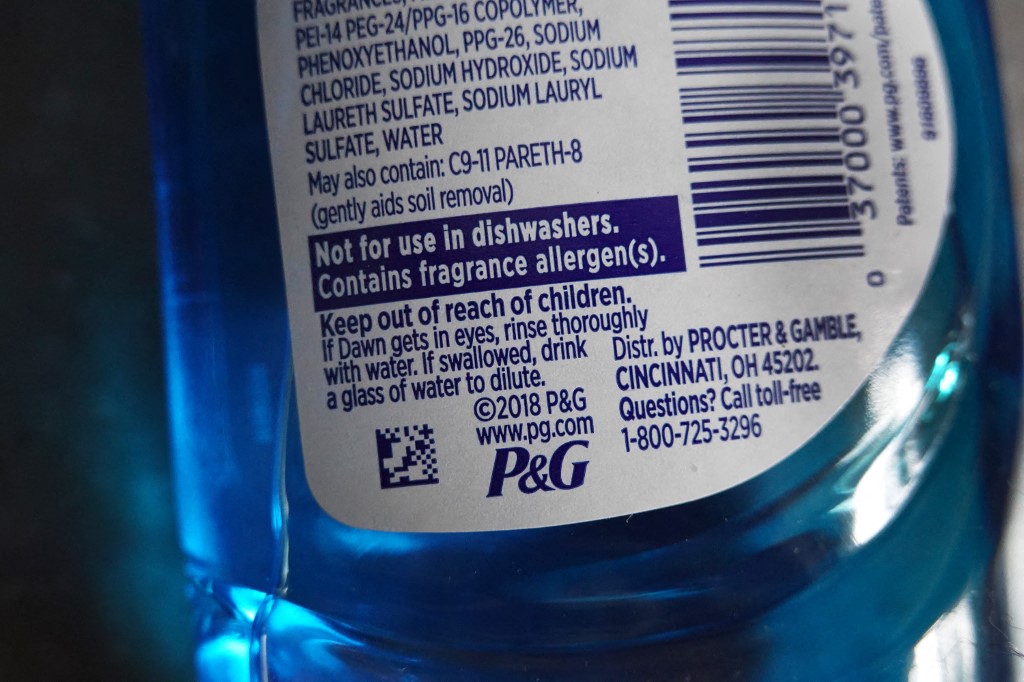

The company behind Bounty paper towels, Gillette razors and Tide detergent saw its revenue rise three percent from a year ago to $21.4 billion in the quarter ending in December.

This was slightly lower than expected, and analysts are eyeing the performance of P&G and other consumer companies on whether they can keep prices up even as inflation cools.

P&G also reported that earnings per share had dropped 12 percent to $1.40, partially due to logging a $1.3 billion charge on its Gillette business.

The company said last year it would book the charges as it adjusted the value of the razor brand, which it bought in 2005.

Excluding that one-time hit, P&G’s net earnings per share jumped 16 percent to $1.84, beating expectations.

The increase was driven by a rise in net sales and increase in core operating margin, the company said.

But P&G’s product volumes were nearly flat overall for the quarter, suggesting that consumers may be pulling back as higher prices bite.

“Volume rounded down to a decline of one point as continued volume acceleration in North America- and Europe-focused markets was offset by softer shipments in Greater China, Eastern Europe and Middle East Africa regions,” said P&G chief financial officer Andre Schulten.

But he added on a conference call that pricing helped with sales growth, noting that October to December “was another strong quarter.”

Chief executive Jon Moeller added that the performance came despite “notable headwinds, which should be temporary.”

“Tensions in the Middle East will hopefully ease,” he said, adding that the impact after price increases are usually not permanent as well.

While executives noted that China sales were hit by weaker consumer confidence and lower sales of SK-II driven by recent anti-Japanese brand sentiment, they expect the overall business opportunity in China to remain intact due to its market size.

On Tuesday, P&G maintained its organic sales growth outlook in the range of four to five percent. This measure excludes the impacts of acquisitions, divestitures and currency fluctuations.

It also held fiscal 2024 sales growth forecast in the range of two to four percent.

P&G shares were up 4.7 percent on Tuesday morning.