Dubai, UAE–In November 2022, the Crown Prince of Saudi Arabia, Mohammad bin Salman, unveiled Ceer, the kingdom’s first electric-vehicle brand. The oil-rich country in the words of the crown prince was “igniting a new industry” that could see it become a manufacturing hub for both petrol-powered and electric cars.

The push was part of Saudi Arabia’s broader industrial strategy and its plans to tackle climate change. By 2030, it will make 500,000 EVs a year, roughly equivalent to annual demand for cars in Saudi Arabia today.

While the kingdom took its first bold steps toward a path to build an industrial sector, news emerged of Foxconn, the biggest assembler of Apple Inc. iphones, being in talks with Saudi Arabia to jointly build a $9 billion multipurpose facility that can manufacture microchips, electric-vehicle components and other electronics like displays.

Yet it was the clearest indication of the kingdom’s desire to diversify its economy away from oil and be the Middle East’s manufacturing hub. Today, the kingdom is not alone in the race to establish itself on a new path to achieve high economic growth.

To its east, the United Arab Emirates (UAE) is making its own effort to jump-start a high-tech industry that includes sending astronauts to the International Space Station. The country is not limiting its potential to space program alone. It too is making a broader push to kick start an industrial sector, and in this regard it has established the Jebel Ali Free Zone in Dubai and the Khalifa Industrial Zone in Abu Dhabi, with a focus on sectors like aerospace, pharmaceuticals, and renewable energy. It anticipates a substantial contribution from industrial manufacturing to its GDP in the coming years.

Across the length and breadth of the Middle East, countries are attempting to diversify their economies away from oil and build a manufacturing base to achieve high economic growth. But is it even possible to economically sustain the industrial sector in the Middle East in times of high inflation, low growth, and risk-averse investors?

According to Javier Carinena, principal at Kearney Middle East & Africa, the GCC’s industrial manufacturing has organically grown to cater to key demand drivers, state-owned enterprises and large conglomerates. “These entities are pivotal in exploiting and commercializing natural resources and fuel demand for industrial machinery and equipment,” he said.

“However, dedicated efforts are underway to attract investments in new, high-growth industries. The focus is shifting towards manufacturing aircraft, strategic electronic components, and electric vehicles, bringing new technologies to the forefront,” he added.

Carinena stresses on the critical role manufacturing plays in transforming economies into sophisticated entities. The GCC nations, he believes, work collaboratively rather than in isolation. This united front enables them to consolidate demand, attract global manufacturers, and achieve regional synergies.

He argues setting up state-owned enterprises, conglomerates, and partnerships with global leaders. Well-established businesses like ACWA POWER, Alkhorayeff Group, Alokoizay, NAFFCO, SMEET, and Sohar are in strategic positions for international collaboration.

According to him, the GCC has successfully attracted investment in sectors like oil and gas-related equipment and building materials. But there has been a limited flow of investment in industries like aerospace or automotive manufacturing. The sector also is handicapped by a host of problems: limited demand for certain products, competition from neighboring nations, and the lack of global talent.

Be that as it may, Carinena sees an upside to the Middle East’s manufacturing sector. It can generate up to 15 million jobs in the next decade. “These direct jobs will trigger other 3.0 to 5.3 million indirect jobs within the businesses providing services or raw materials to the GCC manufacturers, and 2.2 to 5.7 million induced jobs thanks to the additional spend from the disposable income (e.g., food, travel, housing) of those employees working in the manufacturing facilities that are expected to be established in the GCC. This represents 7.9 to 15.4 million jobs, i.e., equivalent to the workforce of countries like Morocco, Chile, or Romania today”.

“The excellent quality of the jobs created by manufacturing in GCC is equally vital as highlighting the quantity of employment. An influx of fresh ideas and the transfer of crucial technological know-how into GCC companies will be made possible by the manufacturing sector’s ability to entice top global specialists. Locals in the GCC can get good jobs and advance their careers, becoming key figures in their countries’ modernization processes,” he added.

The Middle East, thanks to these high-quality jobs, can compete with other well-established manufacturing hubs, such as the aerospace hubs of France or the UK or the automotive hubs of Germany or Italy, on know-how, infrastructure, capabilities, and brand. The region can also become a knowledge hub for the chemicals, automotive, and aerospace industries.

Engineering and technical fields are among the primary sectors set to experience a surge in job creation. With an emphasis on industries such as petrochemicals, automotive manufacturing, and aerospace, there is a growing demand for skilled engineers, technicians, and technologists. Engineers specializing in mechanical, chemical, electrical, and industrial engineering will likely find abundant opportunities as the GCC expands its manufacturing capabilities. These professionals will oversee the design, implementation, and maintenance of advanced manufacturing processes and technologies.

Many experts believe growth of industrial manufacturing in the GCC can stimulate demand for logistics and supply-chain-management professionals. Efficient movement of raw materials and finished goods is crucial for the success of manufacturing operations. This will lead to a rise in inventory management, procurement, transportation, and distribution jobs. Supply chain analysts and logistics coordinators will play vital roles in optimizing the flow of materials and products throughout the manufacturing process.

Several analysts feel that expanding manufacturing industries in the Middle East can open up opportunities in research and development (R&D). Companies will seek scientists, researchers, and innovation experts to drive materials, processes, and technology advancements. This focus on innovation is integral to staying competitive in the global market and fostering sustainability in industrial practices.

Between 2019-2022, as many as Nine Arab countries recorded rates exceeding 10 percent in the index of the share of manufacturing industries in GDP, namely Jordan, the Emirates, Bahrain, Tunisia, Saudi Arabia, Sudan, Egypt, Morocco, and Yemen, based on the Arab Economies Competitiveness Report.

According to a report released by the Arab Monetary Fund, Bahrain, Jordan, and Egypt occupied first, second, and third places as the contribution of manufacturing industries to the gross domestic product in Bahrain and Jordan reached about 19.5 percent, 17.3 percent, and 16 percent respectively from 2019 to 2022.

The sector is expected to contribute up to $1trillion annually to the GDP of the region, equivalent to advanced countries like Belgium or Turkey.

In Saudi Arabia, the biggest economy of the Middle East, industrial manufacturing is a cornerstone of the Vision 2030 initiative. The country aims to reduce its dependence on oil revenues and transform into a global industrial powerhouse. Initiatives like the National Industrial Development and Logistics Program (NIDLP) focus on promoting key sectors such as petrochemicals, automotive, and aerospace. The expansion of manufacturing capabilities not only enhances GDP but also creates job opportunities and fosters innovation.

Latest numbers reveal that industrial production in Saudi Arabia declined 11.2 percent on an annual basis last November 2023, affected by a contraction in mining, quarrying, and manufacturing activities. Manufacturing industry activity also recorded an annual decline of 3.3 percent, while electricity and gas supply activity recorded an increase of 38.6 percent compared to the same period in 2022.

But the momentary decline doesn’t seem to perturb many as country after country is laying the groundwork for the transition to manufacturing. Qatar is leveraging its resources to develop a robust industrial sector. The country’s National Vision 2030 emphasizes economic diversification, particularly in the petrochemicals, steel, and manufacturing industries.

Some distance away, Kuwait, too, recognizes the importance of industrial manufacturing in economic development. The Kuwait Vision 2035 plan outlines ambitious goals for the industrial sector, focusing on enhancing competitiveness and sustainability. Establishing the Al-Zour Refinery and developing the Mubarak Al-Kabeer Port underscore Kuwait’s commitment to expanding its industrial capabilities.

Oman too has been actively promoting industrialization through initiatives like the Tanfeedh program. The country’s industrial strategy targets mining, manufacturing, and logistics sectors. By fostering partnerships with international investors and implementing policies that support industrial growth, Oman seeks to enhance its GDP and reduce reliance on oil revenues.

With its strategic location and business-friendly environment, Bahrain is also making strides in industrial manufacturing. The Bahrain Economic Vision 2030 emphasizes diversification through sectors like aluminum, downstream industries, and logistics. The country’s efforts to attract foreign direct investment contribute to expanding its industrial base and, subsequently, its GDP.

At the same time, Carinena advocates for a healthy balance between locally produced and imported goods. While local manufacturing develops knowledge and talent, imports maintain healthy market competition, ensuring innovation and variety.

In this transition, he says AI-powered machines may soon be able to produce almost any product at a lower cost and with better quality than people. “It may become crucial to train a large number of exceptionally skilled workers in all areas of manufacturing.”

“The emergence of Industry 4.0 technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), will also contribute to the demand for IT and cybersecurity professionals. Safeguarding industrial processes from cyber threats and ensuring the seamless integration of digital technologies will be critical for the success and sustainability of manufacturing operations in the GCC,” he adds.

As the Middle East strives for sustainable development, there will be a surge in jobs related to environmental management and sustainability. This includes roles in energy efficiency, waste management, and environmental compliance.

Industrial manufacturing is increasingly expected to align with global sustainability goals, and professionals in this field will be essential for implementing eco-friendly practices within manufacturing processes.

A recent industrial report by Gulf Research Centre (GRC) titled “GCC and Türkiye Industrial Sector Outlook,” said that the GCC countries are taking several steps to promote industrial growth to diversify their industrial sector and move away from the oil and gas sector.

The non-hydrocarbon sector of Bahrain is expected to grow aided by a robust manufacturing sector. Oman is expected to continue its recovery and economic reinforcement over the medium term, supported by various structural reforms. The industrial sector of Qatar is driven by an upsurge in internal consumption, allowing the country to widen its fiscal balance surpluses. A recent bilateral free trade agreement of the UAE with Asian countries supports the progress of its manufacturing sector.

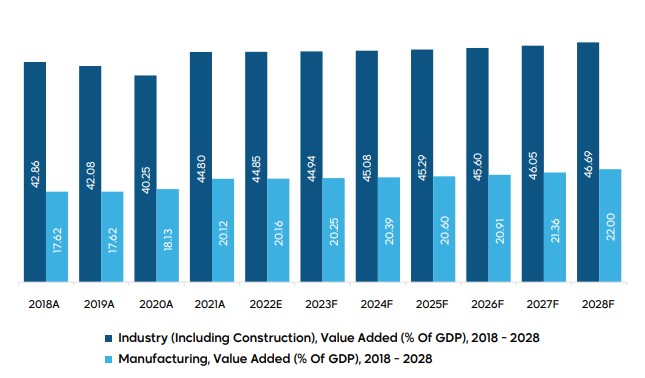

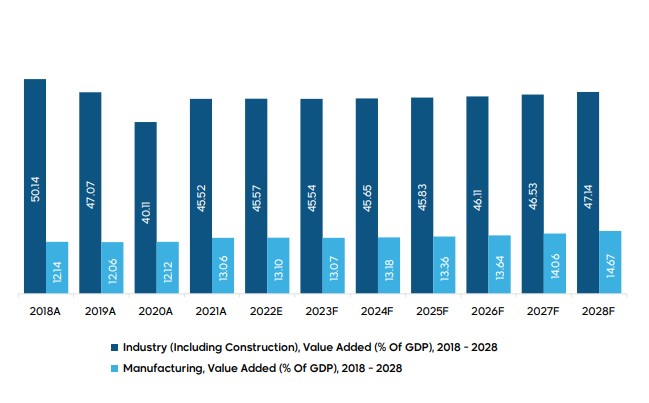

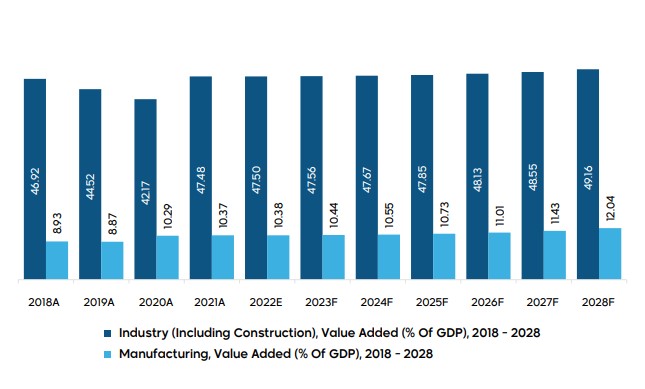

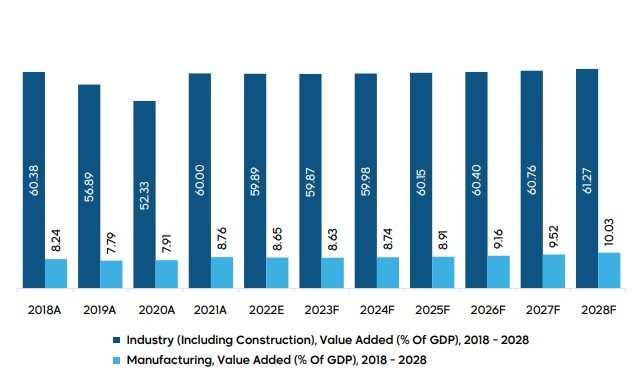

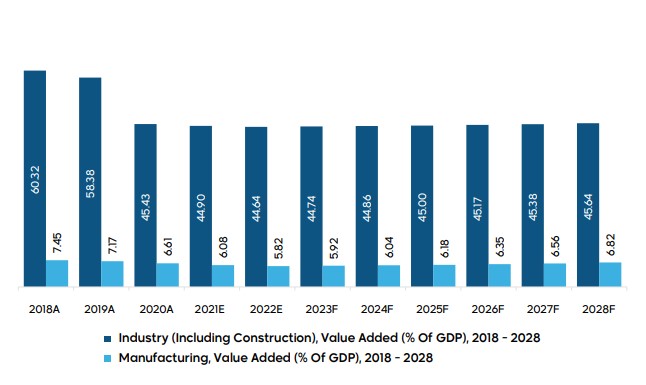

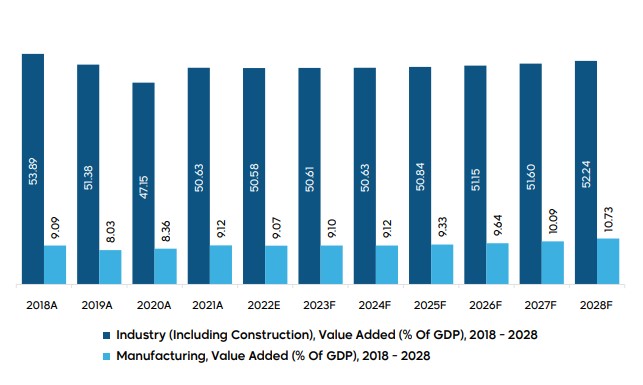

The report put together bar graphs indicating how the industrial sector’s contribution to each country’s GDP is expected to grow over the forecast period of 2018-2028. Promoting the industrial sector has been given utmost importance by GCC nations, as it can allow them to move away from their dependence on the oil and gas sector. Also, this strategy would have a lower impact of price volatility of oil and gas globally, said the GRC report.

Saudi Arabia:

The UAE:

Qatar:

Kuwait:

Oman:

Bahrain: