The International Monetary Fund (IMF) has approved the largest general allocation of Special Drawing Rights (SDRs) equivalent to US$650bn in August to boost global liquidity but nearly 55 percent of it will be distributed among developed nations.

The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The new allocation takes the total SDR allocated by the IMF to US$943bn (SDR660.7bn) so far.

A statement from the Fund said that about US$275bn (42.2 percent) will go to emerging markets and developing countries including US$21bn (3.2 percent) to countries in the low-income group. The remaining US$354bn would be distributed among the developed countries.

In the MENA region, there are nearly 20 countries, most of them in the low-income group bracket for various reasons, and they are allocated a little over US$50bn though some of these nations are yet to grapple with the situation arising out of the pandemic.

Since rich nations like those in the GCC region have adequate reserves to fight the pandemic-induced economic slowdown, they can voluntarily channel part of their SDRs to scale up lending for low-income countries through the IMF’s Poverty Reduction and Growth Trust (PRGT).

In a statement, IMF Managing Director Kristalina Georgieva said that the SDR allocation will benefit all members, address the long-term global need for reserves, build confidence, and foster the resilience and stability of the global economy. It will particularly help our most vulnerable countries struggling to cope with the impact of the COVID-19 crisis.

“We will continue to engage actively with our membership to identify viable options for voluntary channelling of SDRs from wealthier to poorer and more vulnerable member countries to support their pandemic recovery and achieve resilient and sustainable growth,” she added.

The IMF member countries can use the SDRs to minimise the damage caused by the economic fall-out of COVID-19. The funds would be credited to IMF member countries in proportion to their existing quotas in the Fund. One SDR is equivalent to US$1.42.

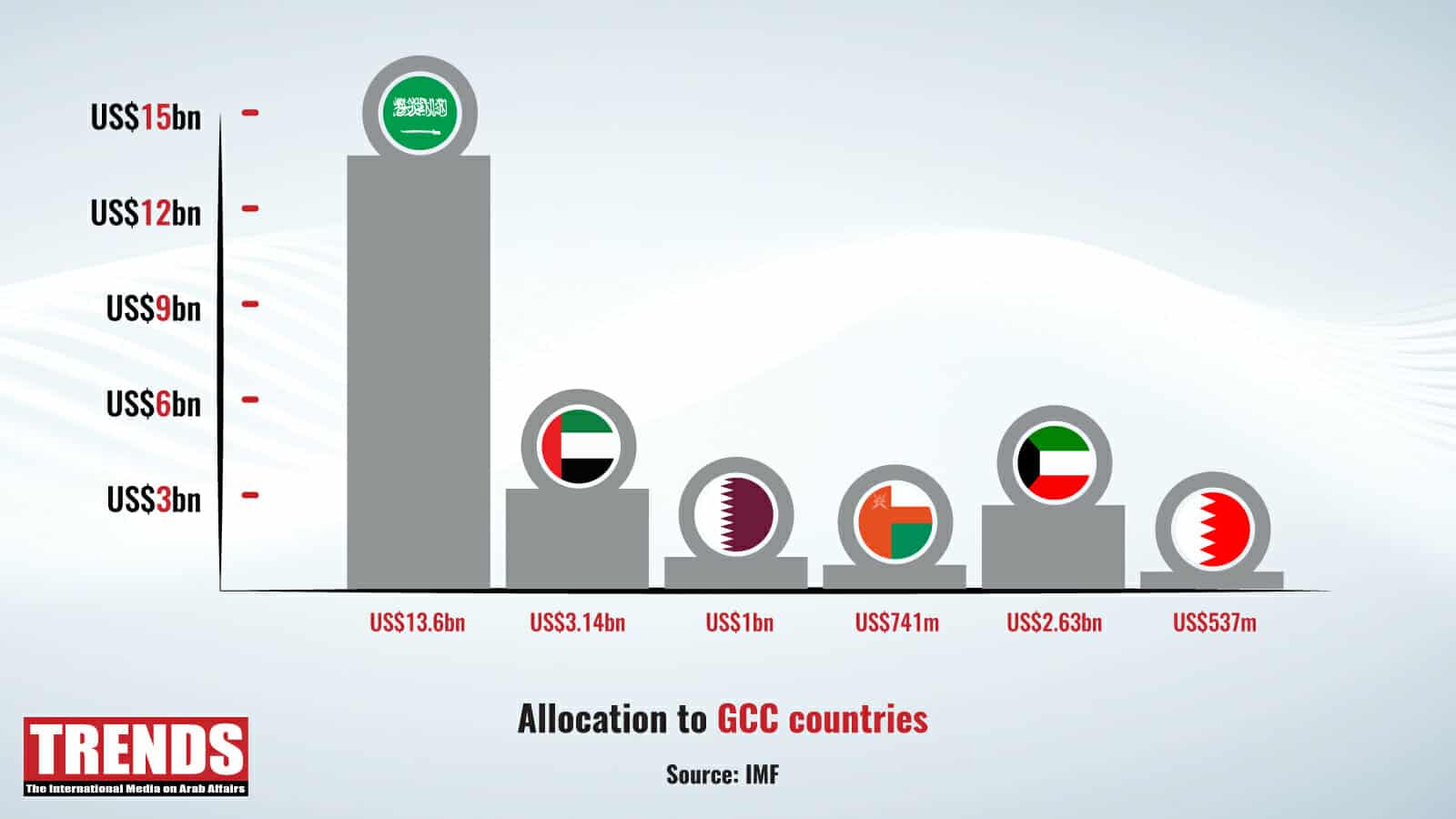

GCC countries were allocated about US$21.66bn with Saudi Arabia receiving US$13.6bn, the UAE (US$3.14bn), Qatar (US$1bn), Oman (US$741m), Kuwait (US$2.63bn) and Bahrain (US$537m).

In the other MENA countries, Iran will get US$4.85bn, Egypt (US$2.77bn), Algeria (US$2.66bn), Morocco (US$1.21bn), Tunisia (US$742m), Lebanon (US$862m), Yemen (US$652m), Iraq (US$2.26bn), Jordan (US$469m), Syria (US$399.5m), Israel (US$2.61bn), Turkey (US$6.34bn), Mauritania (US$175.22m) and Sudan (US$662m).

Breather for poorer economies

The liquidity position in many countries has deteriorated from bad to worse since the outbreak of the Covid-19 pandemic.

Pascaline della Faille, Country and Sector Risk Manager with Credendo, the European Credit Insurance group, told TRENDS that the gross foreign exchange reserves of some MENA countries such as Egypt (-14.6 percent), Algeria (-29.7 percent) and Turkey (-20.1 percent) from end 2019 to July 2021 and Ethiopia (-19.8 percent) and Lebanon (-42.3 percent) decreased sharply between end 2019 and May 2021.

“Higher liquidity buffers would also help countries to withstand a possible tightening of the financial conditions, which could be driven among others by a tightening of the currently very loose monetary policy by a major central bank or higher investor risk aversion,” she said.

For the moment, global financial conditions remain very favourable. As a result, many countries are still able to issue bonds on the international financial markets at very favourable conditions. However, any tightening of the global financial conditions would inevitably dampen access to the financial market, lead to capital outflows from emerging markets and, hence, increase pressure on liquidity, she added.

Struggling economies

Less allocation means the woes of struggling economies such as Lebanon, war-torn countries like Libya, Syria and Yemen and sanctions-hit Iran are far from over.

Lebanon is suffering from alleged economic mismanagement and rampant corruption besides political instability for many years while there is no clarification about Iran’s position as the US government is yet to lift the sanctions.

Syria, Iraq, Yemen and Libya need billions of dollars and the allocations to these are like offering peanuts to the respective governments.

The allocation has boosted Yemen’s foreign exchange reserves by 70 percent. In a brief statement, the Central Bank of Yemen said that the IMF funds were injected into the bank’s account.

“The funds will contribute to strengthening the external reserves of foreign exchange in addition to supporting the national economy and achieving stability in the exchange rates,” the Central Bank said.

For Iran, the government has to find an exchange partner to convert the SDRs into hard currency and with US sanctions still in force, many global banks will be reluctant to deal with Iran. However, China, which is playing an active role in the MENA region, may bail out Iran.

Even Tunisia’s economy is not in the pink of health and is suffering from unrest, shortage of COVID-19 vaccines among others. The government needs at least US$5bn to finance its deficit and loan repayments by the end of the year.