French investment fund manager Amethis has bought a minority stake in Tarjama, the UAE-based firm, selling Arabic language translation software.

The investment, for an undisclosed amount, will fund growth “across the region’s main markets”, said Tarjama in a statement.

Paris-based Amethis is investing through its Amethis MENA Fund II, which raised $101 million in July, to target majority and minority stakes in fast-growing small and medium-sized firms in such countries as Morocco, Egypt, Tunisia, and Jordan.

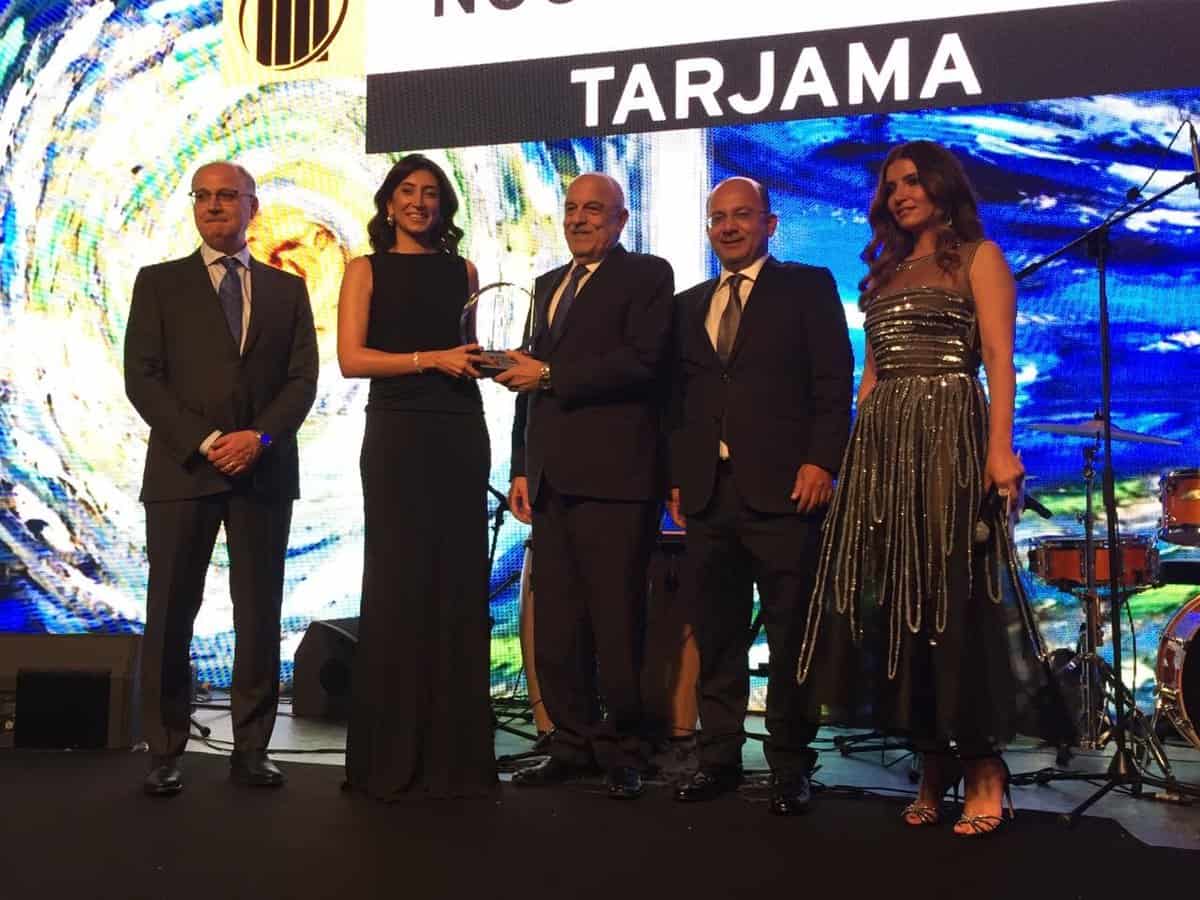

Tarjama CEO Nour Al Hassan said: “This investment by Amethis creates an exceptional opportunity for us to build up our technological capabilities and securely position Tarjama as the leader in language AI across the region.”