The Depositors Association and League in Lebanon on Sunday demonstrated against the government’s plan to convert deposits into Lebanese pounds.

The demonstration, held outside the headquarters of the Association of Banks in Beirut, was also against an associated decision to compensate depositors in the local currency.

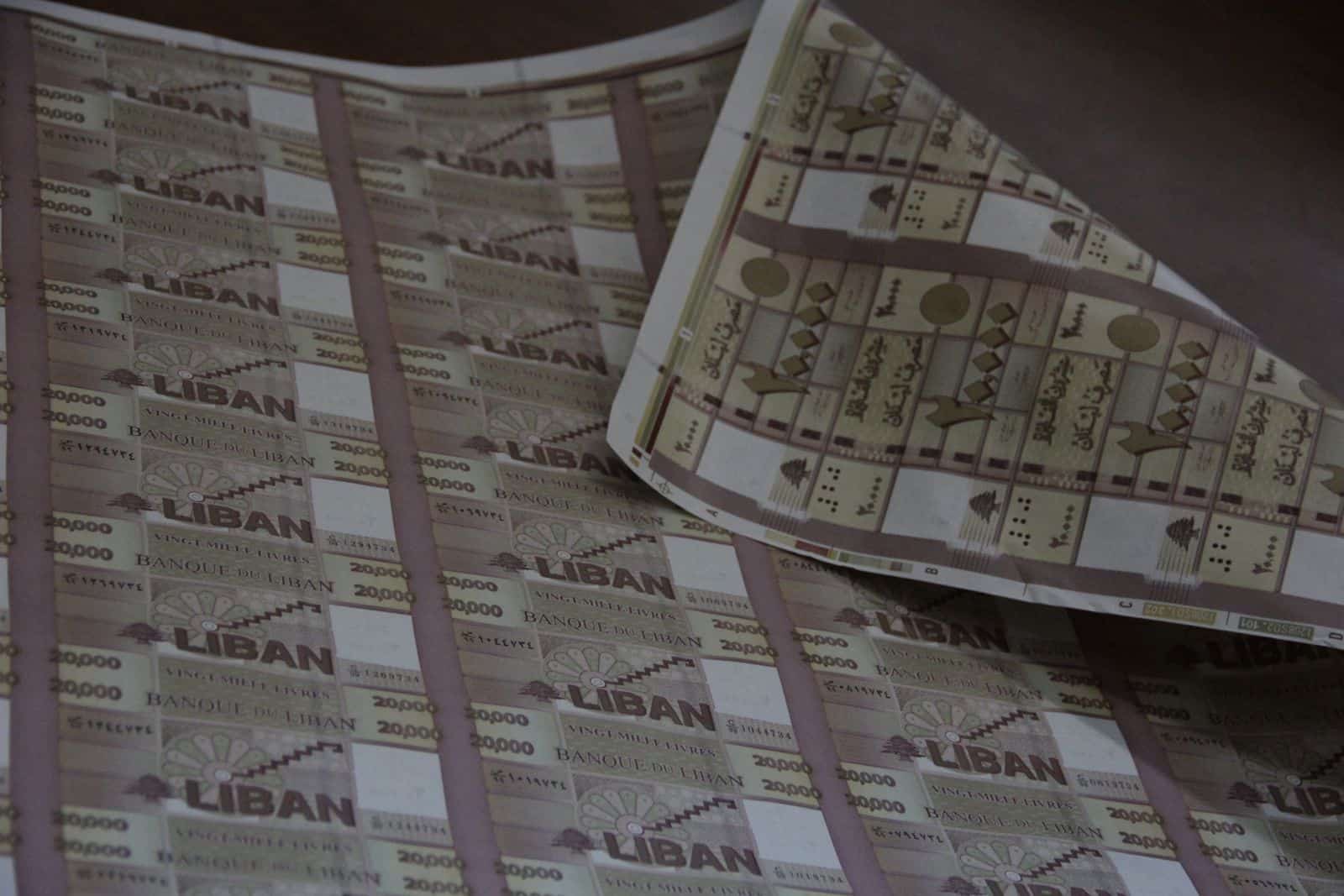

The Lebanese pound has lost more than 95 percent of its buying power due to its devaluation against the dollar, even as the country undergoes an economic crisis that the World Bank has said is on a par with wartime hardships.

The current midmarket rates indicate that a US dollar is worth more than LBP1,500, while the black-market rate is more than LBP23,000 to the dollar, which is a 15-fold difference.

Thus, converting these deposits from dollars to Lebanese pounds could massively erode their value.

This comes amid allegations that the billions of dollars are missing from the Lebanese central bank.

Sunday’s demonstration by the depositors also headed to the Government Serail and then to the Banque du Liban, where a joint statement was read, reported Lebanon’s official National News Agency.

Demand from depositors

The depositors said in their statement that that they refuse to allow more losses to be inflicted upon them and to bear the consequences of the ruling system’s deals, waste, corruption, and carelessness.

“We will not allow them to deceive the people and annihilate the lively and productive classes…,” they said in the statement.

“Today we are here, depositors whose small and medium deposits are threatened with extinction; workers, laborers and self-employed people who have lost their purchasing power and their incomes are threatened by evaporation; syndicates and unionists who are threatened of losing their savings, funds and rights,” they added.

“This is our message to society as a whole, with all its components, especially unions and professional associations, to every citizen affected by the policies of this system, and every citizen aspiring to establish a social justice system on the ruins of the banking and rentier system,” said the depositors.

Our message is that everyone who hears us joins this decisive confrontation, join in order to protect what is left, in order to defend savings and deposits and in order to restore rights, all rights!” the depositors’ statement underlined.