The economies of the Arab countries might have been dented by high inflation in the last few years, but many economists are sanguine about high growth the region can look forward to from here onward. Many feel that with the rise in the price of crude oil, the economy of the region might receive a big boost and put it on a path of robust growth.

But what is the current impact of inflation on regional commerce, and what are the forecasts for the next few years?

Energy Prices vs. Trade

Global inflation can affect trade in many ways. First, to the extent that inflation is due to rising energy prices, there could be an initial boost to regional trade as energy exporters enjoy the growth in income, according to Invesco’s Global head of asset allocation, Paul Jackson. However, from the other side, it is well noted that higher energy prices could eventually result in lower demand for energy (especially as real incomes are squeezed in the rest of the world), which will depress GCC export earnings and regional trade.

Nevertheless, suppose higher energy prices do not cause global inflation. In that case, the erosion of real incomes in the GCC and the rest of the world could lead to lower demand for energy, thus reducing export earnings (and probably trade) in the region.

In an interview with TRENDS, Jackson explained that: “In any case, the squeeze on real incomes within the region (because of higher inflation) could depress regional trade flows.”

We should know that there might be a further effect of inflation on regional trade if global central banks’ attempts to control inflation depress global economic activity. But, again, this would probably depress regional trade.

Inflation might not affect regional trade

But there are many who feel that inflation would not impact the regional trade between the GCC countries. Ralf Wiegert, Head of IHS Middle East and Northern Africa economic forecasting team, told TRENDS: “We do not see much of an impact by higher prices at the moment.” However, he added: “The supply chain issues affect container shipments worldwide, including the Gulf region, as the big container companies still adjust to the new environment.”

Trevor Cullinan, Lead Analyst at Sovereign Ratings S&P, sees that Intra-regional Trade is fairly limited, mainly since the oil and gas sectors dominate GCC exports. He explained to TRENDS: “Higher oil prices will support the price of exports, in most cases more than offsetting any increase in the price of imported goods.”

Trade as an economy booster in UAE

According to the Federal Center for Competitiveness’ report titled “Emirates Figures,” non-oil overseas commerce has been a top focus for the UAE government since the state’s founding.

The report revealed that the UAE succeeded over half a century in recording great leaps in its non-oil commodity trade, rising only five years after the founding of the country from $ 3.1bn to $381bn in 2020. This is thanks to the solid international relations that the UAE enjoys with all the world’s governments and its advanced infrastructure of world-class airports and ports and logistical and banking systems capable of providing an ideal response to trade requirements.

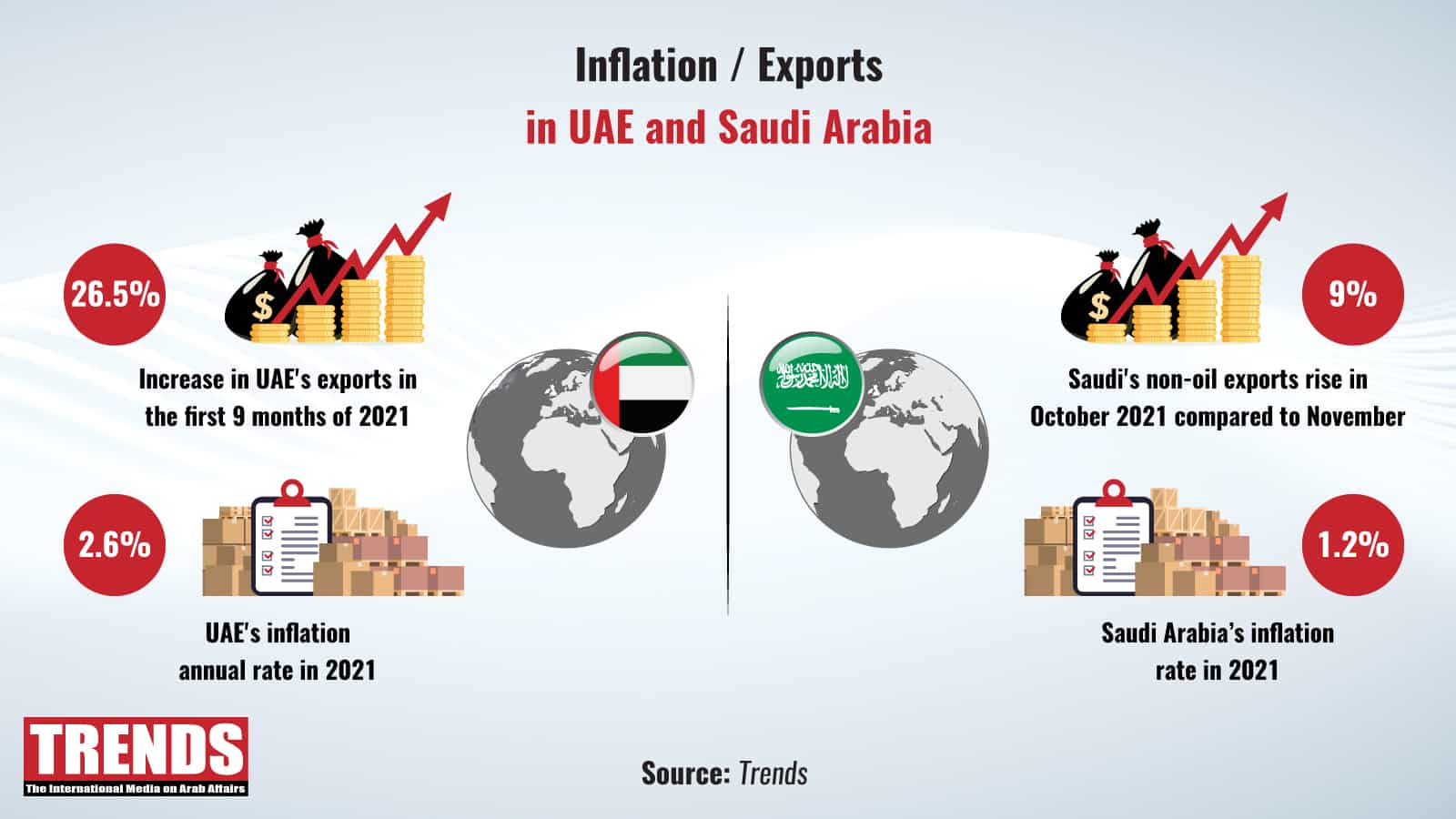

Figures show that, in 1995, the non-oil merchandise foreign trade jumped from $27.3bn to $98.3 bn, a three-and-a-half-fold increase. As a result, foreign trade in non-oil goods in the UAE was worth $288bn in 2015 and is expected to climb to $381bn by 2020. During the first nine months of 2021, the UAE’s exports surpassed $348bn, a 26.5 percent increase.

Saudi Arabia Exports

The percentage of petroleum exports out of total exports increased from 65 percent in November 2020 to 75.8 percent in the parallel month of 2021, while the value of merchandise exports grew by $301m, or 1 percent, compared to October 2021.

According to the results of the Saudi General Authority for Statistics, non-oil exports recorded an increase of 26.1 percent in November 2021 over the same month of the previous year, reaching $ 6.9bn by $5.4bn, while the value of non-oil exports increased by about $560m and by 9 percent compared to last October 2021.