Islamic banking refers to financial activities that adhere to Shariah, or Islamic law.

As a result, it is also referred to as Islamic finance or Shariah-compliant finance. It has two fundamental principles.

One of them is the sharing of profit and loss. The other is that Islamic banks are prohibited from the collection and payment of interest by lenders and investors.

This raises the question: How do they make a profit, or even stay in business?

The answer is that Islamic banks make money through equity participation.

This requires a borrower to give the bank a share of their profits, although they pay no interest.

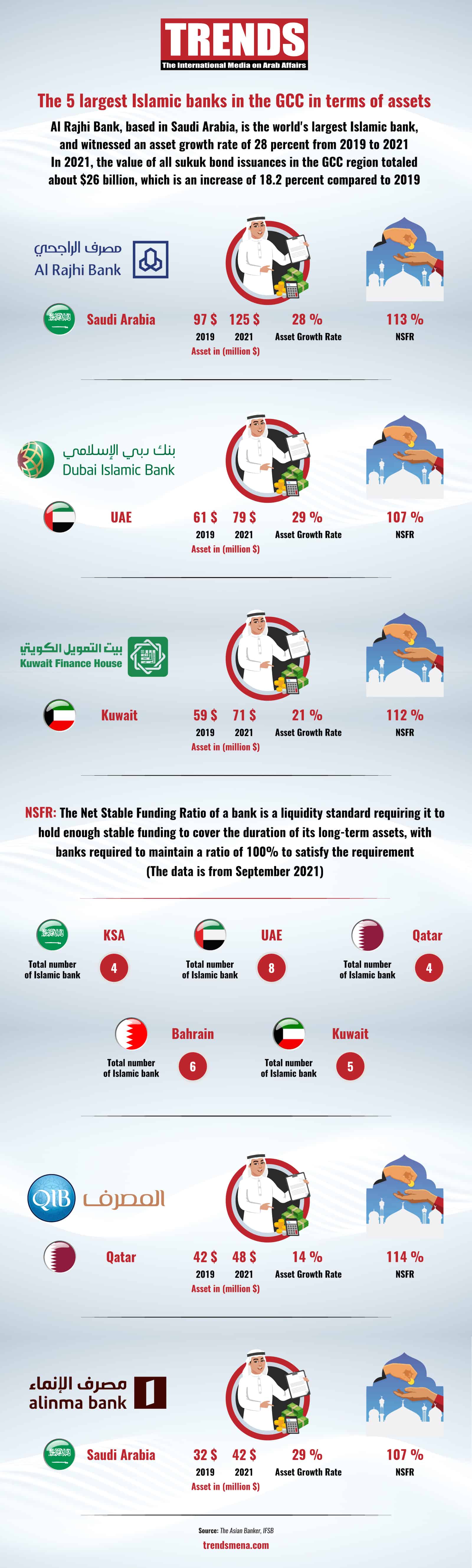

Of recent, Islamic banking has been getting quite a boost from governments and financial institutions in the Gulf Cooperation Council (GCC).

For example, the Saudi Central Bank or SAMA last year launched two programs to augment Islamic banking through research and translation.

They were the Islamic Finance Research Support Program and the Islamic Finance Research Translation Program.

Not two weeks later, the Abu Dhabi Islamic Bank unveiled what it said was the first Islamic digital bank targeting youngsters.

Here’s where the Islamic banking sector is poised in the GCC right now: