DUBAI, UAE — As the world’s largest cryptocurrency trading platform, Binance, grapples with allegations of wash trading, the global crypto market is in a state of flux. The potential fallout from these allegations is particularly significant for the Middle East, a region that has witnessed a surge in cryptocurrency interest and activity.

Wash trading, a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace, is at the heart of the allegations against Binance. The Wall Street Journal (WSJ) first brought these allegations to light, which were later substantiated by charges filed by the U.S. Securities and Exchange Commission (SEC).

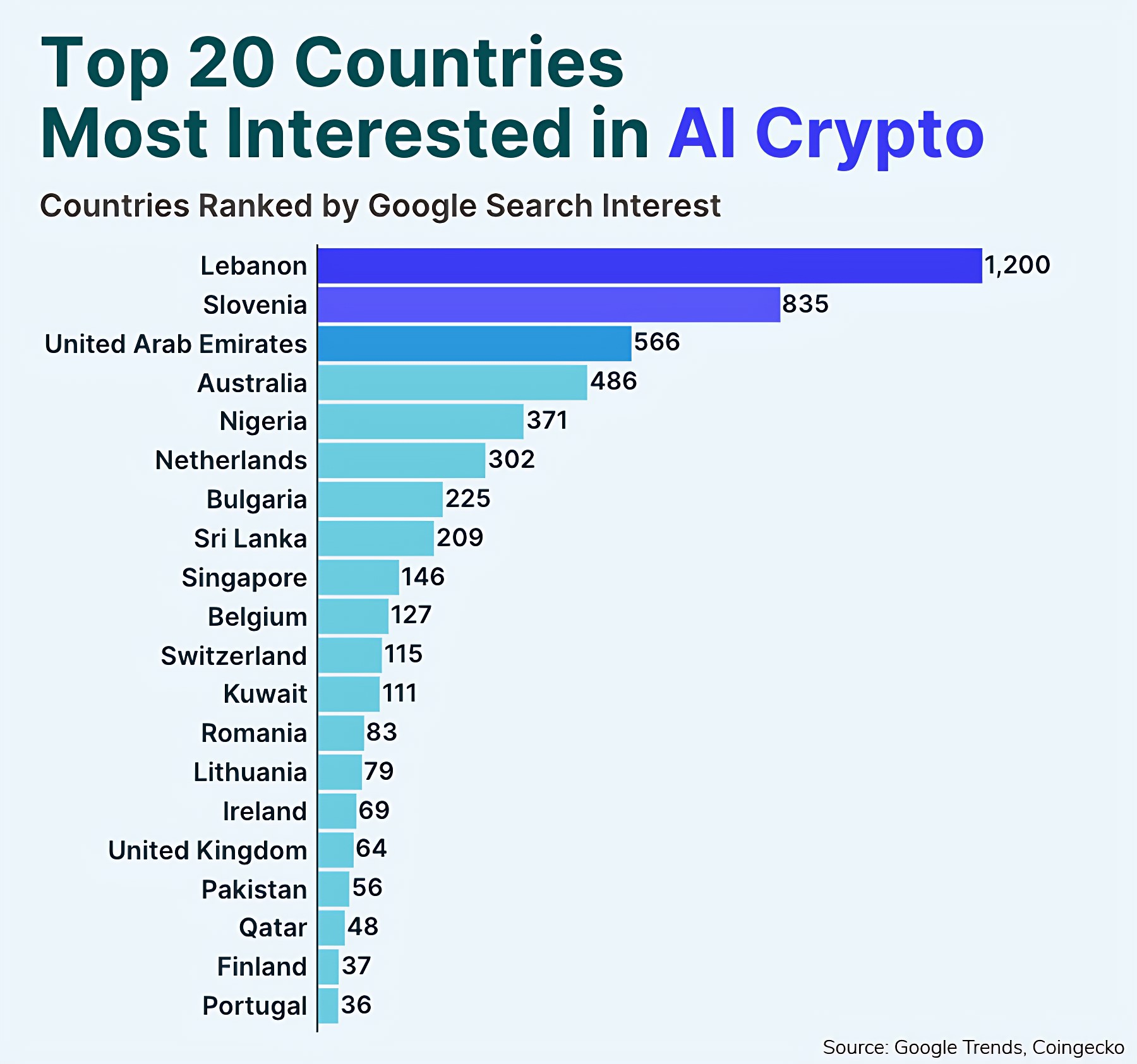

The Middle East, particularly countries like Lebanon and the UAE, have seen a surge in interest in cryptocurrencies, especially AI cryptocurrencies. Amidst economic hardships, residents are turning to crypto investment as an alternative means of making ends meet.

However, the rise of cryptocurrency has also seen an increase in illicit activities. The allegations against Binance could potentially lead to increased regulatory scrutiny in the region.

Interestingly, Rudy Shoushany, founder and CEO of the digital transformation talk show DxTalks, suggests that if the accusations against Binance are true, the platform might face trial in the US but not in other countries where this law is not applicable.

Shoushany added, “It is not easy to detect wash trading; it starts with suspicion, and then an investigation is requested to track all the information, transactions, and account holders.”

Proving wash trading in crypto is particularly challenging because the industry is still 50 percent unregulated, making the detection of wash trading almost impossible.

“There are still ways to track, monitor, and block wash trading, but these are new technologies and are still under testing. In contrast, many different behaviors and levels of sophistication in tracing wash trading are challenging to detect,” said Shoushany.

Crypto activities in the region

The Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority recently granted cryptocurrency firm Rain permission to offer brokerage and custody services to residents. Meanwhile, Kuwait’s Capital Markets Authority issued a new circular to clamp down on crypto activities in the country.

Cryptocurrency exchange Bitget is set to expand its operations to the Middle East, with plans to hire up to 60 new staff members in the region. The allegations against Binance, therefore, come at a critical juncture for the Middle East’s crypto market. They underscore the need for robust regulatory frameworks to ensure transparency and protect investors.

The recent lawsuits against the world’s top two crypto exchanges, Binance and Coinbase, by the US financial regulator have sent shockwaves through the global crypto industry. Amid this escalating crackdown, the Middle East is emerging as a potential beneficiary and a new frontier for the crypto industry.

Coinbase’s CEO visited the UAE, signaling that it could become a strategic hub for the US company. This move could boost the UAE’s push to become a global leader in the cryptoeconomy.

Zurich-based private bank Julius Baer is looking to expand its crypto services in the Middle East. The bank’s Middle East subsidiary, JBME, is seeking a digital assets license from the Dubai Financial Services Authority (DFSA) to offer custody services for cryptocurrencies like Bitcoin and Ether in the region.

The MENA region has seen a staggering increase in crypto adoption, with users obtaining a total of $566 billion worth of crypto between July 2021 and June 2022, a 48% increase compared to the previous year.

Several MENA countries, including the UAE, Saudi Arabia, and Iran, are making significant …

The Binance case highlights the need for vigilance in the crypto market. How is the Middle East balancing opportunity with oversight? Find out in our in-depth report. Click here