ABU DHABI, UAE — OSN+, one of the Arabian Gulf’s premier streaming platforms for premium content, and Anghami Inc., the leading music and entertainment streaming platform in the Middle East and North Africa, have announced a deal that will combine their businesses.

The merger, a first of its kind in the region, will bring together two local home-grown brands to offer consumers an unparalleled digital aggregation of the finest and most up-to-date premium movies, TV shows, music, podcasts, and more, all while delivering a rich and seamless user experience.

With a cash investment of up to $50 million from the OSN Group in Anghami, this partnership will consolidate over 120 million registered users, boasting more than 2.5 million paying subscribers and generating over $100 million in revenue at the time of closing. This move will transform Anghami into one of the region’s largest streaming platforms, as stated in a press release.

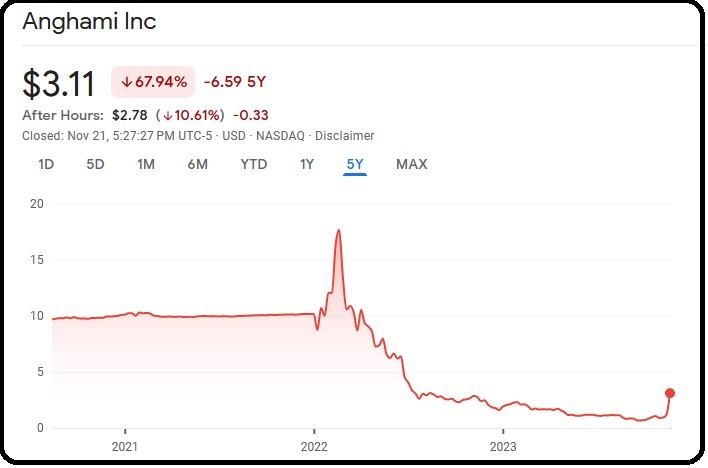

The OSN Group will invest in the Nasdaq-listed Anghami at a valuation of $3.65 per share, which is 3.9 times the stock’s average price for the past month. The valuation of Anghami surprised market pundits who track Wall Street trading. Although Anghami’s share price peaked at $17.70 on February 25, 2022, over the past 12 months, it has mostly remained below $3.00, except for a brief breach of the $3 threshold on Tuesday. The figure below illustrates the volatility of Anghami’s stock.

Anghami boasts a catalog of over 100 million songs, including exclusives from artists such as Amr Diab, the all-time best-selling Middle Eastern artist. In contrast, OSN+ offers more than 18,000 hours of video content and maintains exclusive partnerships with premium international studios like HBO, NBC Universal, Paramount, as well as leading Arabic and Turkish studios.

However, this merger might remind readers of Parrondo’s Paradox in game theory. Created by Spanish physicist Juan Manuel Rodríguez Parrondo and taught in strategy classes to MBA students, it states that “a combination of losing strategies becomes a winning strategy.”

Both OSN and Anghami find themselves in challenging financial positions.

When we examine the financials of OSN+’s parent firm, Kuwait Projects Company (KIPCO), which is an investment holding company, it becomes evident that OSN+ has been facing financial difficulties for some time.

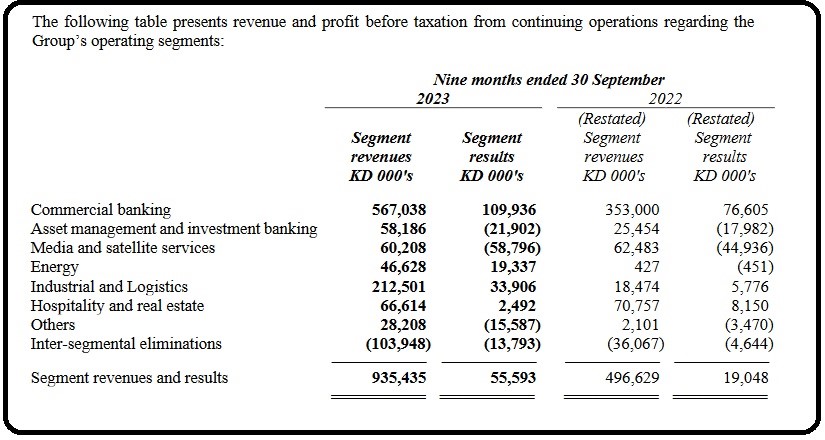

A quick analysis of KIPCO’s results for the first nine months of 2023, ending on September 30, 2023, paints a grim picture, particularly for the group’s media business.

Joining forces with OSN+ is a significant step in Anghami’s journey to revolutionize entertainment in the Arab World.

Elie Habib, co-founder of Anghami and set to be the CEO of the combined business

Overall, KIPCO is a profitable conglomerate. On November 13, KIPCO reported a net profit of $37.9 million for the first nine months of 2023, marking a 95 percent increase from the $19.4 million reported for the same period in 2022.

However, the story takes a different turn when we focus on the media business, namely OSN+. KIPCO’s recent financial statement reveals that its media and digital network services generated $194.15 million in income during 9M 2023, while expenses for the same period amounted to $222.06 million, compared to an income of $201.8 million and expenses of $223.35 million in 9M 2022. When expenses surpass income, it sends a clear signal that cost-cutting measures are necessary.

According to the statement, the assets of KIPCO’s media and digital satellite services totaled $662.02 million at the end of 2022, with liabilities amounting to $515.87 million. In the 9M 2023 period, the assets for the same business vertical reached $667.01 million, while liabilities decreased to $497.47 million.

The screenshot below, taken from KIPCO’s recent financial statement, illustrates that in the 9M 2022 period, the media division generated $202.78 million in revenue, but suffered losses of $145.82 million before taxes. Similarly, in 9M 2023, the revenue of the media and digital satellite services unit amounted to $195.38 million, with losses reaching $190.80 million before taxes.

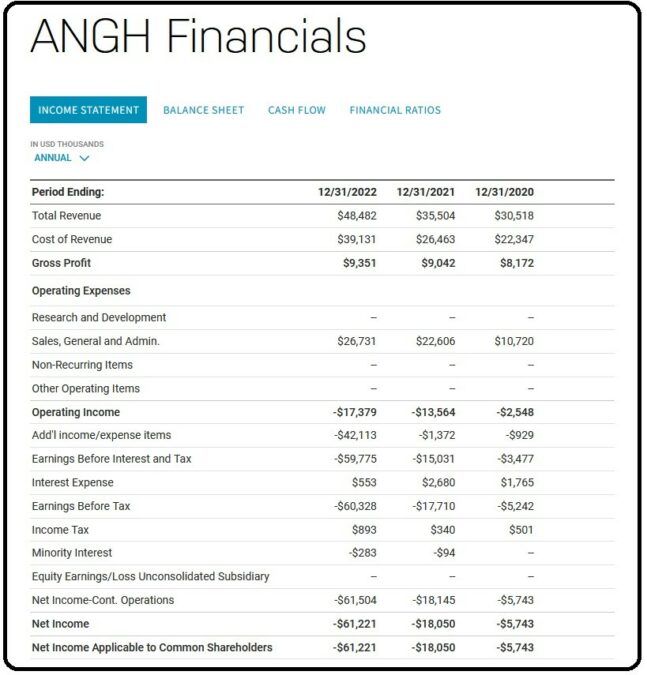

Speaking of Anghami’s financial performance, the results have been less than stellar. The company had a market capitalization of $80.88 million when the Nasdaq New York trading closed on Tuesday.

According to the recent income statement posted on the Nasdaq website, Anghami reported a net income of -$5.74 million in 2020, followed by -$18.05 million in 2021, and by the end of 2022, it had reached -$61.22 million. Please review the screenshot below for details.

In a press statement released during its annual results in May 2023, Anghami mentioned an increase in revenues, but there was no mention of profit, as there simply wasn’t any. Despite facing currency-related challenges in Egypt and Lebanon, Anghami did manage to achieve unaudited revenue of $10.2 million in Q1 2023, representing a six percent increase compared to Q1 2022. Additionally, the audited total revenue for 2022 was $48.5 million, marking a 37 percent increase compared to 2021.

The success of this OSN+ and Anghami merger remains to be seen, whether it will be a runaway success like Disney and Pixar or a disaster like AOL and Time Warner.

Returning to the merger news, the new platform will be dedicated to offering the best product and content experience in the region. Recognizing the strength of both brands, the platform will leverage Anghami’s robust tech stack and extensive music catalog, combined with OSN+’s library of premium video content, to deliver a unique digital streaming experience. This experience will be characterized by AI-driven hyper-personalization, prioritizing recommendations based on user preferences.

Elie Habib, co-founder of Anghami and set to be the CEO of the combined business, stated, “Joining forces with OSN+ is a significant step in Anghami’s journey to revolutionize entertainment in the Arab World. We’re bringing together technology, music, and video to build a comprehensive media ecosystem. It’s an opportunity to deepen our connection with our users and create something they will truly love.”

Joe Kawkabani, CEO of OSN Group, expressed, “This marks a significant milestone in OSN’s journey as we continue to expand our streaming business. The fusion of OSN+ content with Anghami’s technology allows us to provide the best entertainment in one place for our customers, ensuring that we constantly adapt to meet their needs.”

At A Glance * OSN+ and Anghami have announced a groundbreaking merger, uniting two prominent Middle Eastern entertainment platforms. * The merger aims to create an unmatched digital aggregation of premium movies, TV shows, music, podcasts, and more. * OSN Group invests up to $50 million in Anghami, resulting in over 120 million registered users and $100 million in revenue. * Anghami's valuation at $3.65 per share surprises market analysts, reflecting its potential. * Anghami boasts a catalog of 100 million songs, while OSN+ offers 18,000 hours of exclusive video content. * Both companies faced financial challenges, prompting the merger for sustainability. * OSN Group to hold a majority stake in Anghami after the merger. * SRMG Ventures' $5 million investment in Anghami to enhance growth in the rapidly expanding music and audio sector. * MENA music and audio industry projected to grow at a CAGR of 11 percent, surpassing the global market. * Declining profits and mounting debts in the industry may drive further consolidation and mergers.

Kawkabani further said, “As two locally rooted entities with an unparalleled understanding of the local market, we are confident that this new offering will revolutionize the regional streaming landscape.”

Anghami plans to maintain the listing of its ordinary shares on the Nasdaq Stock Market following the completion of the transaction. The transaction is expected to conclude in the first quarter of 2024, pending customary closing conditions and regulatory approvals.

After the transaction is finalized, OSN Group will hold a majority stake in Anghami Inc. The final amount of OSN Group’s cash investment in Anghami and the precise number of Anghami securities to be issued in a private placement to OSN Group are subject to adjustment in accordance with the terms of the definitive transaction agreement, as mentioned in the release.

In addition to its stake in Anghami, OSN will continue to operate its linear TV business, OSNtv, with Joe Kawkabani serving as Group CEO.

In August of this year, SRMG Ventures, the venture capital arm of the Saudi Research and Media Group (SRMG), announced a $5 million investment in Anghami. SRMG Ventures is expected to enhance Anghami’s growth trajectory through its extensive media reach, content library, and portfolio of leading assets in audio/podcasts. This investment will enable Anghami to capture a larger share of the rapidly growing sector, which is projected to reach $700 million by 2026, as stated in SRMG’s announcement.

The statement from SRMG also highlighted that SRMG Ventures’ investment in Anghami reflects the Ventures’ unique and prominent position in the promising music and audio segment of the media industry.

“The MENA music and audio industry is projected to grow at a CAGR of 11 percent, surpassing the global market’s growth rate. This rapid expansion, accentuated by the increasing prominence of Arab stars and local talent, along with the strategic presence of international labels including Warner, Universal, and Sony, solidifies MENA’s role as a key player in the global music landscape,” the statement highlighted.

Jomana R. Al-Rashid, CEO of SRMG, emphasized in August, “Audio consumption is rapidly increasing in the MENA region. In 2022 alone, the audio market size witnessed a 35 percent growth. The combination of this demand and the commercial opportunities it presents positions digital audio and media as a top investment priority for SRMG Ventures.”

The landscape for companies offering similar services worldwide varies. Another GCC media group, the Middle East Broadcasting Corporation (MBC), has faced challenges related to rising debts, expenses, and declining profits.

MBC announced on Tuesday that it received approval to go public with an IPO on the Saudi Arabia Tadawul stock market. MBC plans to offer 10 percent of its share capital on the exchange.

Public data reveals a decline in MBC group’s profits in recent years. In 2018, the company’s profit was $100 million, which decreased to $50 million in 2019, $30 million in 2020, and further dropped to $10 million in 2021. However, there was some improvement in revenues in 2022, which reached $930 million.

On the international front, companies like Disney+ and StarzPlay operate in a similar segment as OSN+ in the region, competing with heavyweights such as Netflix and Amazon Prime. In Q2 2023, StarzPlay reported revenues of $338.4 million with a subscriber base of 25.4 million, and in Q1 2023, revenues amounted to $322.8 million, with a profit of $79.2 million.

On the other side, Disney+ reported 150.2 million subscribers in Q4 FY 2023, with its revenue reaching $8.4 billion for the full fiscal year 2023.

Global OTTA firm Spotify, which is similar to the Arab world’s Anghami, reported revenue of $13.64 billion for the twelve months ending on September 30, 2023, marking a 12.01 percent year-over-year increase. The music streaming service also noted a return to profitability, reporting an operating income of $34.87 million for Q3 2023.

While the presence of various OTTTV and OTTA platforms provides customers with a wide array of choices, the trend of declining revenues and profits, coupled with mounting debts and expenses, may drive major players toward consolidation and mergers in the coming years. Whether this consolidation will lead to winners or losers, only the future will reveal.