DP World has completed all formalities for the 100 percent acquisition of Imperial Logistics Limited (Imperial). The transaction will come into effect on March 14, 2022.

“We are excited about concluding this transaction, which will be value-enhancing for our people, clients and other key stakeholders who will benefit from DP World’s leading technology, capabilities, global networks, scale and key trade-lane volumes, while enabling us to build on our ‘Gateway to Africa’ strategy and growth ambitions,” said Imperial’s Group CEO, Mohammed Akoojee.

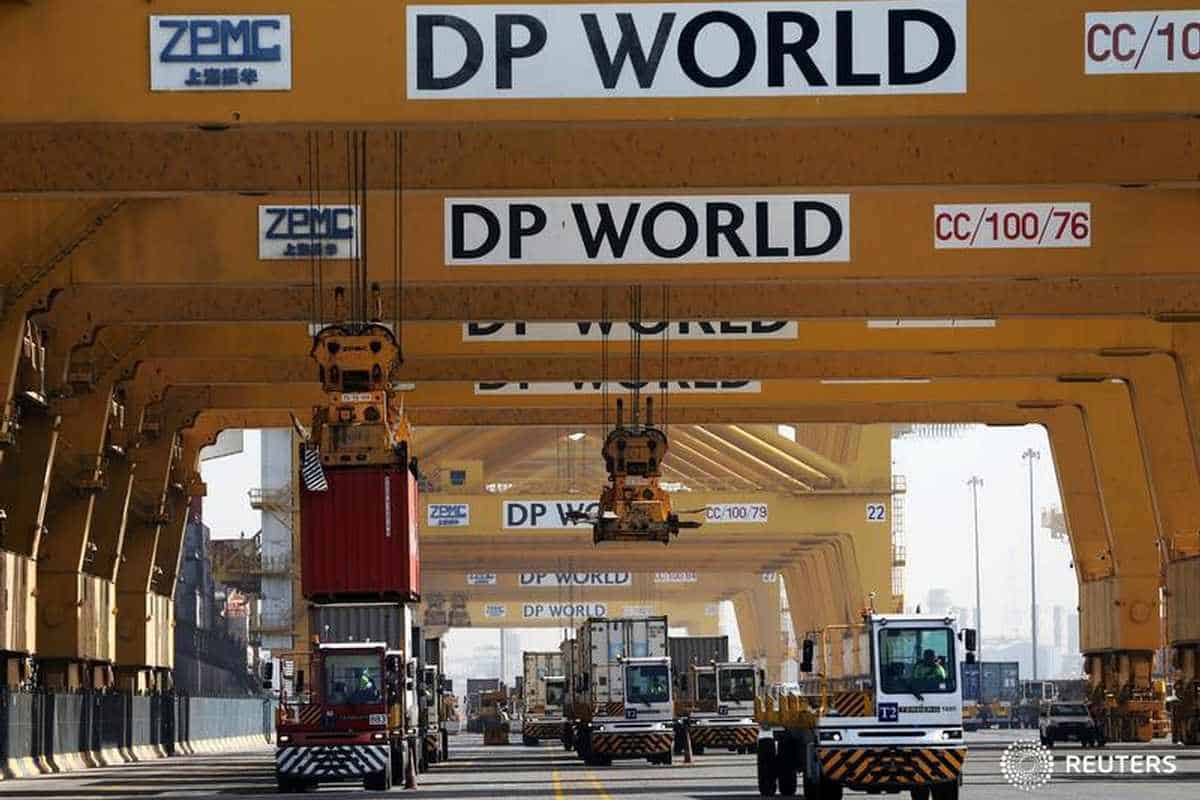

DP World and its subsidiaries employ over 71,000 people across its worldwide operations. The acquisition is expected to also add significant strategic value to DP World given Imperial’s footprint and strong market access and logistics solutions capability.

Imperial’s business strongly complements DP World’s existing footprint in Africa and Europe and will allow DP World to deliver a fully integrated end-to-end solution across a wider market.

“We are excited to conclude our acquisition of Imperial, which has a significant presence in Africa,” Sultan Ahmed Bin Sulayem, Group Chairman and CEO of DP World, said. “Imperial’s capabilities in market access and logistics and its extensive African and European footprint will complement and enhance our growth aspirations”.

As a consequence of this transaction, the Delisting of the Imperial’s Ordinary Shares from the Main Board of the securities exchange operated by the JSE will be implemented on March 15, 2022.