Dubai, UAE – DP World Limited handled 79 million TEU (twenty-foot equivalent units) across its global portfolio of container terminals in 2022, with gross container volumes increasing by 1.4 percent year-on-year on a reported basis and up 2.8 percent on a like-for-like basis.

On a 4Q2022 basis, DP World handled 19.5 million TEU, up 2.4 percent on a like-for-like basis.

2022 gross volume growth was broad-based, with Asia Pacific, Middle East & Africa, Australia, and Americas regions all delivering like-for-like growth.

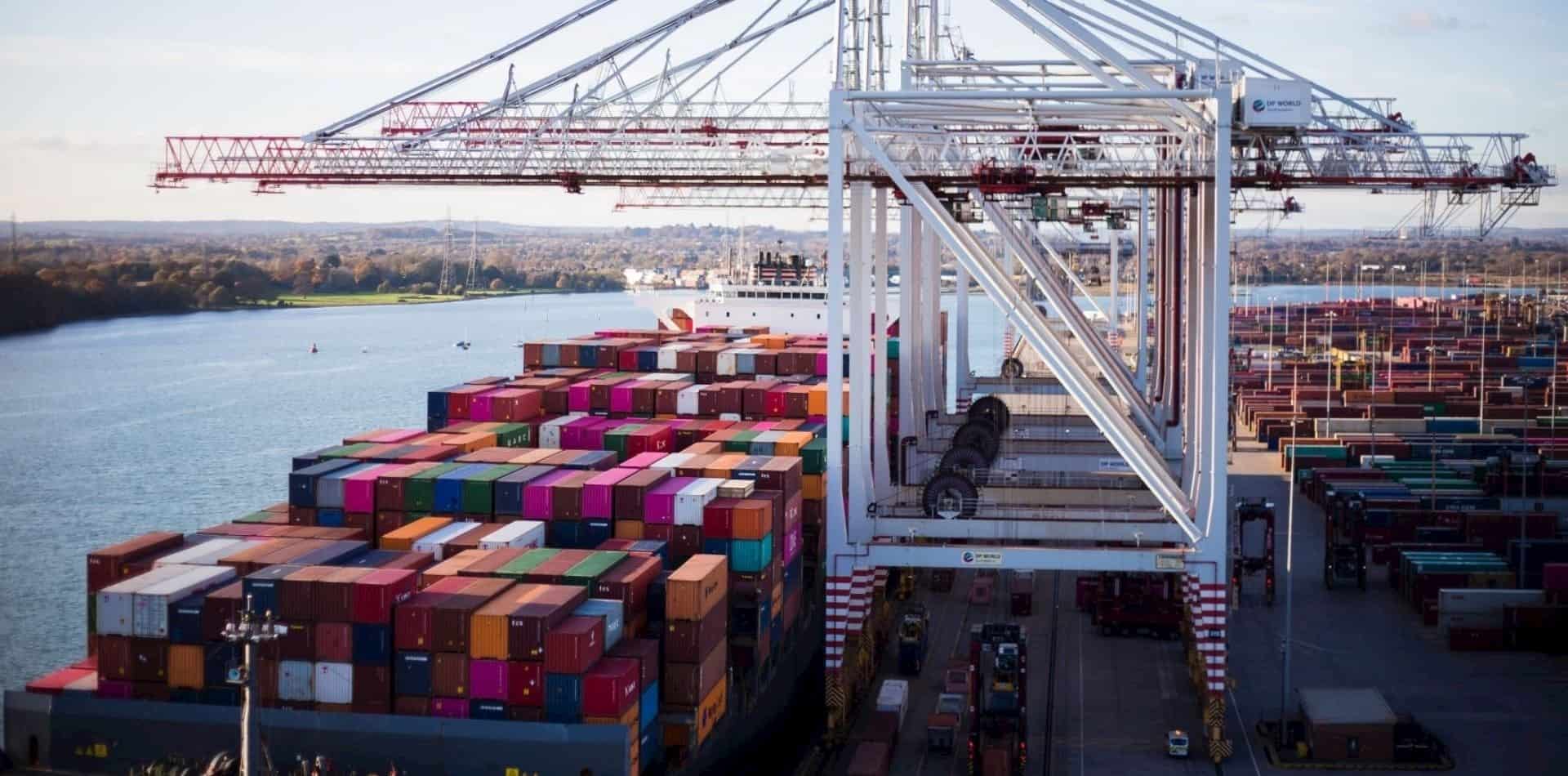

At an asset level, Jebel Ali (UAE), Jeddah (Saudi Arabia), Angola (Angola), Sokhna (Egypt), London Gateway (UK), Constanta (Romania), Caucedo (Dominican Republic), Posorja (Ecuador), DP World Santos (Brazil) and its ports in Australia (Brisbane, Sydney, Fremantle and Melbourne) delivered a solid performance.

Jebel Ali has handled 14.0 million TEU in 2022, up 1.7 percent year-on-year.

“At a consolidated level, our terminals handled 46.1 million TEU during 2022, increasing 1.5 percent on a reported basis and up 0.7 percent year-on-year on a like-for-like basis,” Group Chairman and Chief Executive Officer Sultan Ahmed Bin Sulayem said..

“We are delighted to report another solid volume performance with like-for-like growth of 2.8 percent in 2022, which is once again ahead of the industry forecast of a marginal decline of -0.5 percent,” he added.

The company’s growth, Bin Sulayem said, was driven by Asia Pacific, the Americas and Australia region.

Jebel Ali’s high-margin origin and destination cargo grew by 8.6 percent, with overall volume growth steady at 1.7 percent for the year, the top executive said.

“As expected, growth rates moderated in the final quarter of 2022 due to the more challenging economic environment. Looking ahead to 2023, we expect our portfolio to continue to deliver growth, but the outlook remains somewhat uncertain due to rising inflation, higher interest rates and geopolitical uncertainty,” Bin Sulayem noted.