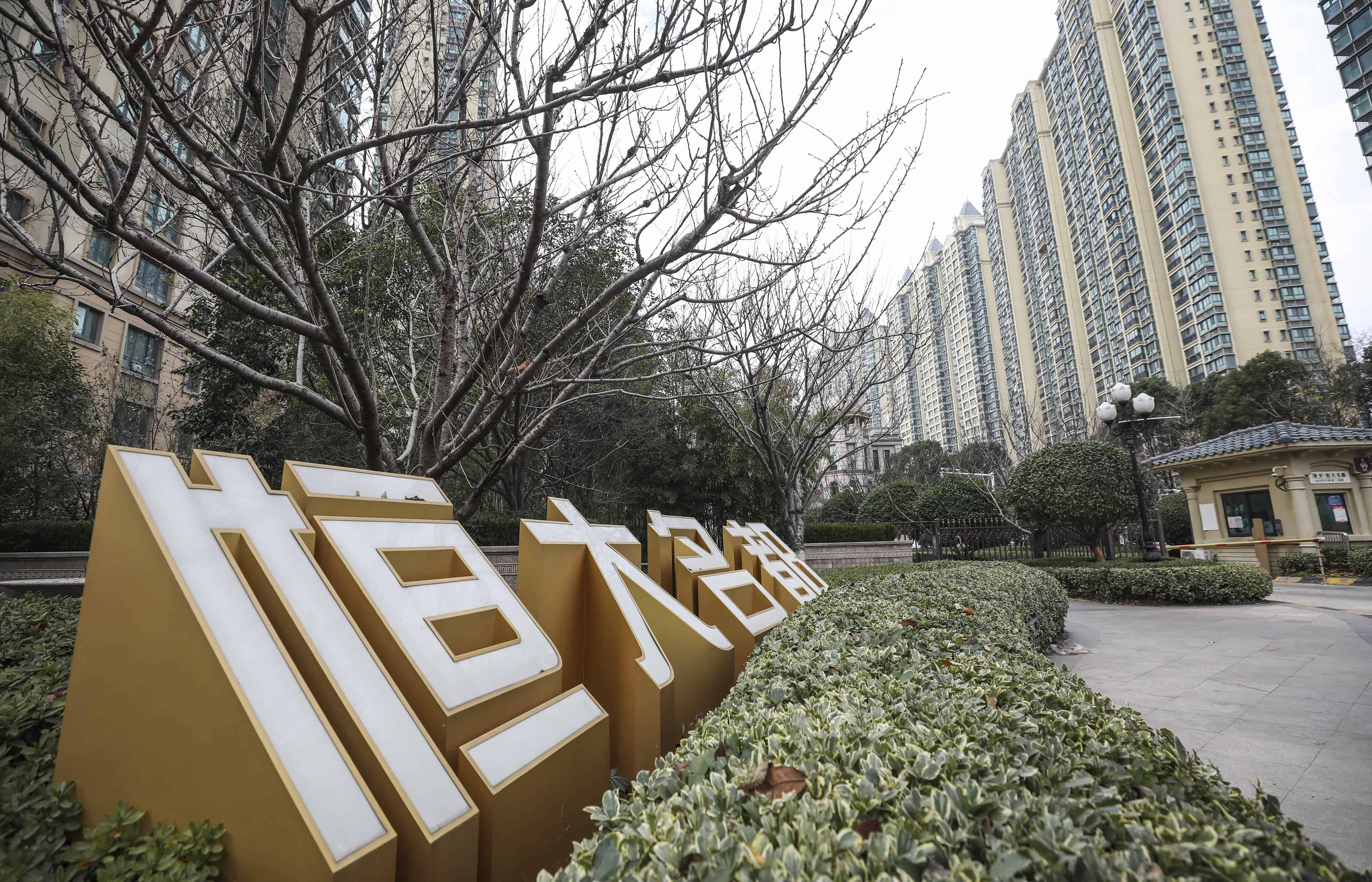

Beijing, China–China Evergrande has pledged to repay its debt this year, as the property giant faces a restructuring following Beijing’s crackdown on excessive borrowing and rampant speculation in the real estate sector.

In an email seen by AFP, chairman Hui Ka Yan told staff that “2023 is a key year for Evergrande to fulfill its corporate responsibility and do everything in its power to ensure the delivery of construction projects”.

Also read: Evergrande to sell stake

“As long as everyone at Evergrande pulls together, never gives up, (and) works hard… we will certainly be able to complete the tasks of guaranteeing deliveries, repaying all kinds of debts, and resolving risks,” Hui wrote.

The company last year resumed work on 732 construction sites and delivered 301,000 residential units to homebuyers, the message said.

Employees “endured huge physical and mental stress, and overcame countless difficulties to realize the impossible”, Hui wrote.

Evergrande has rushed to offload assets in recent months and has been involved in restructuring talks after racking up some $300 billion in liabilities.

Also read: Debt-ridden Evergrande urges investor ‘caution’ as audit result delayed

The company has come to embody a broader crisis in China’s property sector, which accounts for around a quarter of the country’s gross domestic product.

Major developers including Evergrande have failed to complete housing projects, triggering protests and mortgage boycotts from homebuyers.

And smaller firms have defaulted on loans or had problems raising cash since the government brought in stricter lending curbs in 2020.

In November, an official document showed Evergrande had sold land earmarked for its headquarters in the southern tech hub of Shenzhen for $1 billion.

That same month, China’s banking regulator and central bank issued new measures to promote the “stable and healthy development” of the real estate industry.

They include credit support for indebted developers, financial support to ensure projects are completed and assistance for deferred-payment loans for homebuyers.