New York, United States– Lawyers handling the bankruptcy of FTX, the cryptocurrency giant co-founded by Sam Bankman-Fried, said Wednesday they had recovered $5 billion in assets in their efforts to salvage funds from the failed firm.

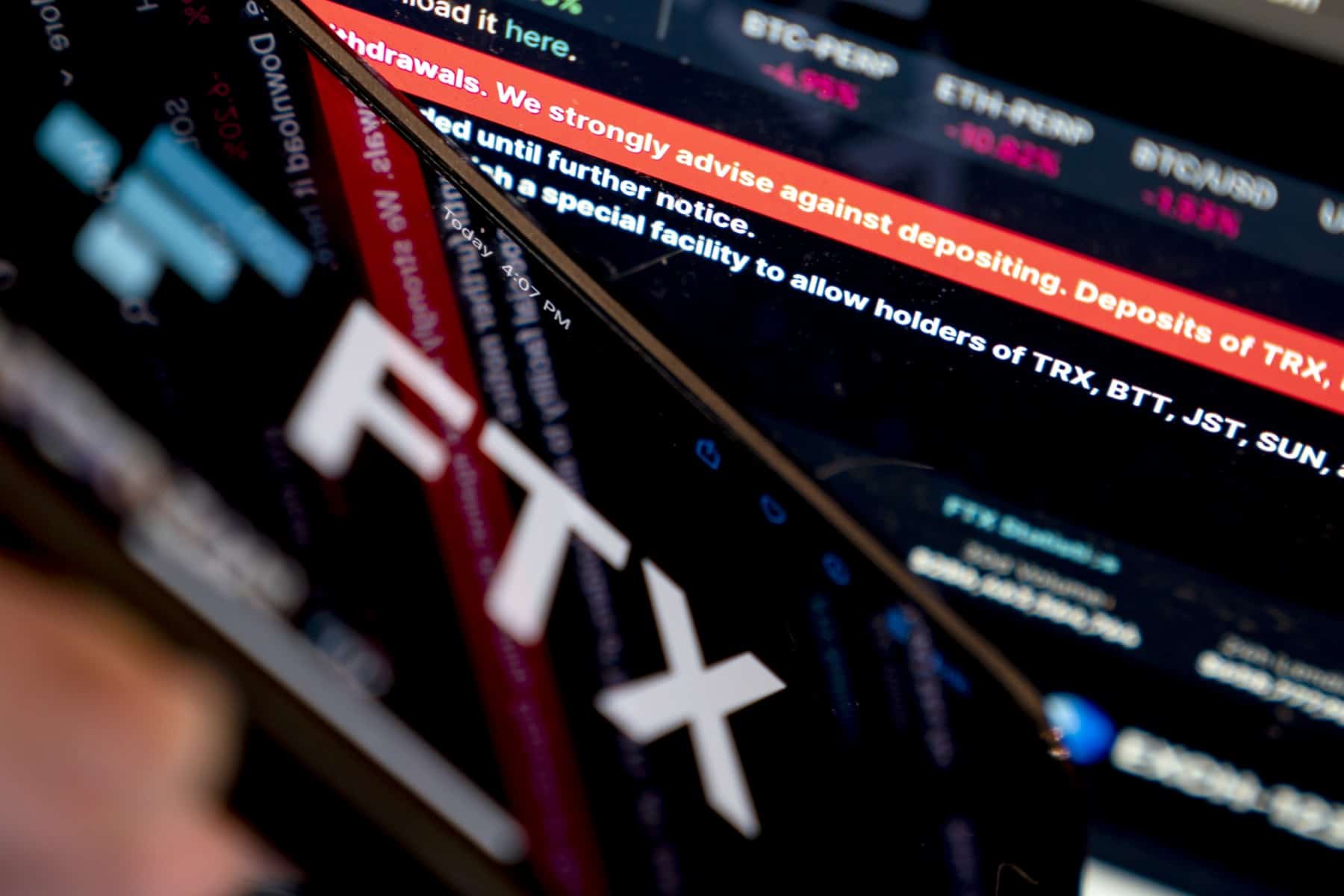

FTX, once the world’s highest profile crypto exchange, collapsed spectacularly in November leaving nine million customers in the lurch and seeing co-founder Bankman-Fried indicted for fraud by US prosecutors.

The downfall of FTX and Bankman-Fried’s arrest and extradition from the Bahamas sent a shockwave through the crypto industry after a decade of extraordinary growth on the back of bitcoin and other digital currencies.

“We have located over $5 billion of cash, liquid cryptocurrency, and liquid investments securities,” FTX lawyer Andrew Dietderich told a Delaware bankruptcy court.

He also said that the company was “well underway” on plans to sell other investments that had a book value of $4.6 billion.

The lawyer said it was too soon to say how much was needed to compensate customers that saw their deposits vanish overnight.

“We know that all this has led to a shortfall in value to repay customers and creditors. The amount of the shortfall is not yet clear,” Dietderich told the court.

FTX and its sister trading house Alameda Research went bankrupt in November, dissolving a virtual trading business that at one point had been valued by the market at $32 billion.

The United States has charged Bankman-Fried with conspiracy, wire fraud, money laundering and election finance violations.

FTX’s lawyer told the court the 30-year-old cheated investors by creating a back channel that siphoned away customer deposits at FTX towards Alameda, creating a secret credit line worth $65 billion.

Bankman-Fried is out on bail and living at his parent’s home in California after he pleaded not guilty at a Manhattan Federal court on January 3.