DUBAI, UAE — Global supply chain constraints, escalating inflation, political instability, and an impending recession are posing significant economic challenges. However, investments in IT and digital transformation are expected to remain robust globally and in the region.

IT spending in the GCC is projected to reach US$ 35.3 billion in 2023, marking an increase of US$ 1.4 billion from 2022. “Even as inflation continues to undermine consumer purchasing power and reduce device spending, enterprise IT expenditures are anticipated to remain robust,” Jyoti Lalchandani, Group Vice President and Regional Managing Director for the META region at IDC, told TRENDS.

Rising IT prices

According to the GCC CIO DX survey results, the most significant factor affecting IT purchasers is the surge in IT prices due to inflation or currency changes (28 percent). This is followed by COVID variants/recession (1 percent), geopolitical tensions (4 percent), disruptions in the IT supply chain (25 percent), and staffing or labor shortages (23 percent).

Throughout the pandemic, the GCC countries have demonstrated resilience as most businesses have increased technology spending to navigate COVID-19-related challenges. Lalchandani said, “The pandemic revealed that digital transformation efforts improve an organization’s resilience against market disruptions. Given its importance to future success”.

Digital transformation investments

Moreover, global digital transformation spending is projected to reach US$ 3.4 trillion in 2026, with a five-year compound annual growth rate (CAGR) of 16.3 percent, as per the International Data Corporation (IDC) Worldwide Digital Transformation Spending Guide.

The IDC report indicates that overall spending in the Middle East, Turkiye, and Africa (META) region will total US$ 233.8 billion, encompassing spending by businesses, governments, and consumers.

“As part of the ongoing digital transformation, META governments and businesses will continue to invest. However, consumers may reduce spending this year, particularly on devices such as PCs and phones, if high inflation persists and a global slowdown occurs,” said Lalchandani.

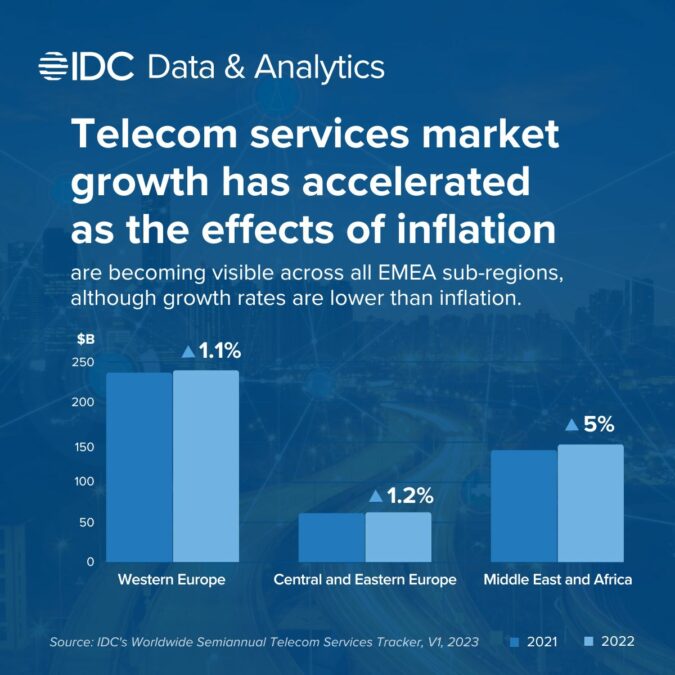

Concurrently, spending on telecom services and IT is projected to rise to US$ 133.9 billion and US$ 99.9 billion, respectively. This increase is due to organizations accelerating their digital engagements, products, and services, predominantly fueled by faster deployment of digital technology, according to Lalchandani.

Across the region, new offers and solutions are readily available, showing that an increasing number of companies are turning to the digital realm as a source of resilience and innovation. Improvements in customer experience, engagement, and journey will broadly drive stable growth in digital transformation.

Efforts to digitally transform the region are ongoing, leading to improvements in efficiency, productivity, and adaptability in businesses. As a result, investing in technology will surpass all other priorities in key industries, including retail (e-Commerce, CX), government (e-services), telecommunications, banking, finance, and others.

Even as inflation continues to undermine consumer purchasing power and reduce device spending, enterprise IT expenditures are anticipated to remain robust.

Jyoti Lalchandani, Group Vice President and Regional Managing Director for the META region at IDC

The IDC predicts that the Middle East, Turkey, and Africa will spend US$ 44 billion on AI, big data, and RPA between 2021 and 2026.

However, several obstacles, such as a skills deficit, limited availability of training data for AI models, and a lack of understanding of business use cases, are seen as keeping AI adoption in silos.

These challenges exist despite the projected 29 percent CAGR for AI spending in the META region between 2021 and 2026. Additionally, 40 percent of businesses still struggle with managing data lineage, even with vast data resources.

Need for improvements

Lalchandani said the most prominent businesses in the GCC have achieved a level of digital transformation maturity that parallels their global counterparts, transitioning quickly from the early stages of digital transformation to managing actual “digital businesses.”

While cloud usage is still in its nascent stages in the region, it is expected to evolve as hyper-scalers increase their local investments and cloud ecosystems develop.

In comparison to Europe and the US, the adoption of advanced technologies such as AI and blockchain is crucial in the GCC. Interestingly, this adoption is potentially faster than in other regions and is often spearheaded by the public sector, said Lalchandani.

In the face of the ongoing global pandemic and the potential of a worldwide recession, attracting talent and resources is challenging, and the “depth of skills” in the GCC is lower than in other regions.

GCC’s Chief Information Officers (CIOs) are investing in developing tech capabilities in critical areas such as security, automation, data, and cloud, Lalchandani pointed out.

These include security and resilience excellence, process automation excellence, data and cloud excellence, application modernization capabilities, connectivity excellence, infrastructure transformation capabilities, and software engineering and innovation capabilities, as highlighted in the accompanying graph. This continued investment shows a strong commitment to overcoming challenges and leveraging digital transformation for future success.