New Delhi, India – Indian software giant Infosys on Thursday cut the upper end of its revenue growth guidance for the financial year ending in March, as a client spending slowdown clashed with a seasonally weak quarter.

Infosys, India’s second-largest software services exporter, earns more than 80 percent of its revenue from Western markets.

It reported a decline in profit for the October-December quarter, and revised its revenue growth guidance to 1.5-2.0 percent in constant currency terms, changed from its previous estimate of 1.0-2.5 percent.

Part of the $245-billion IT sector, Infosys, like local rival TCS, benefited from a digital services boom after the Covid pandemic.

But it has since struggled as Western customers cut back on tech spending amid higher inflation and fears of a recession.

A big employer of India’s engineering graduates, the company upset markets last quarter after it said it would halt campus hiring in an effort to cut costs.

The Bengaluru-headquartered firm said net profit fell 7.29 percent year-on-year in the three months to December, to hit 61.06 billion rupees ($735 million).

The company’s revenue moved up just 1.31 percent year-on-year, to 388.21 billion rupees from 383.18 billion rupees reported in the same quarter last year.

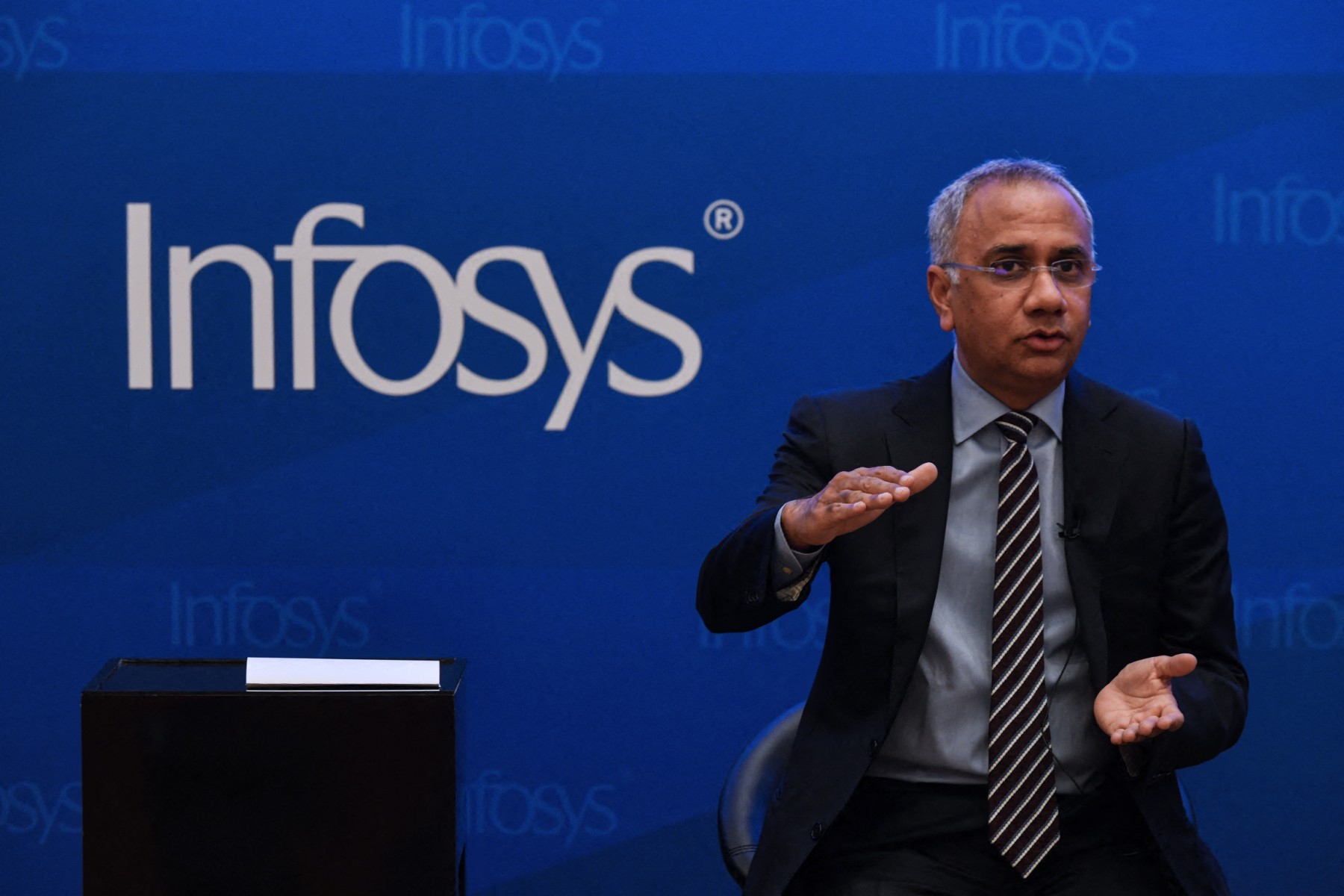

“We’ve tightened our revenue growth guidance,” CEO Salil Parekh told reporters.

“In effect, the higher end has come lower and the lower end has gone up a bit. We see the outlook, in essence, is quite similar.”

Figures were mostly in line with analyst estimates. While the December quarter is seen as seasonally weak, analysts had predicted a fiercer winter chill.

“At this stage we’ve not seen any different behavior from clients,” Parekh added. “Typically, Q3 is a quarter with large furloughs and other end of year holidays — that we’ve seen continue.”

Employee attrition — a key metric for IT companies — declined to 12.9 percent, from 14.6 percent in the previous quarter. But the firm’s total employee count declined by 6,101 staffers in the quarter under review.

Operating margins at the company contracted slightly to 20.5 percent, in part due to higher salary costs.

Shares in Infosys ended down 1.7 percent at the close of trading in Mumbai on Thursday ahead of the earnings announcement.