BEIRUT: The Israel-Hamas conflict has extended across the intricate geopolitics of the Middle East, with its effects touching regional and potentially international energy markets.

Chevron, the operator of the 285 billion cubic meters Tamar gas field, located 15.5 miles northwest of Gaza, temporarily halted production on October 9, two days after the Hamas attacks, following an order by Israel’s Energy Ministry. This field not only supplies Israel but also delivers gas to Egypt.

The ongoing conflict raises concerns about the stability of energy supply lines and their potential disruption, even though the war primarily stems from political and territorial disputes.

Natural resources near Israel are of immense geopolitical importance due to their potential to shift power dynamics among nations and influence regional alliances. What might be the implications for energy security in the region, especially in Egypt, Jordan, and Lebanon?

A complex interplay of regional dynamics and energy markets

“The most immediate impact is on energy prices, especially in oil and gas markets. This trend tends to intensify as we approach the fall and winter seasons,” said Charbel Skaff, a Lebanese expert in geopolitics and energy markets with a PhD in history and international relations.

Since the onset of hostilities between Israel and Hamas, global oil prices have surged due to speculation about the conflict’s impact on regional energy production. On October 19, the global benchmark price for Brent crude oil increased by 9.2 percent to $92.38 a barrel from October 5, while the US benchmark price for West Texas Intermediate rose by 8.5 percent to $89.31 a barrel.

The rise can be attributed to heightened security concerns and a significant increase in insurance premiums in areas close to these conflict zones. However, starting from November 1, there has been a noticeable market downturn. The global benchmark price for Brent crude oil has dropped to $86.35 per barrel, and there has been an unusual 1.45 percent decrease in the price of the US benchmark, West Texas Intermediate, since October 5.

The Egyptian and Jordanian situation

The Gaza conflict has already impacted the natural gas supply from Israel to Egypt, jeopardizing gas deliveries to Europe. Due to security concerns, Israel scaled back gas shipments to Egypt, leading to the closure of a key offshore field operated by Chevron, the American multinational primarily focused on the oil and gas industry.

For several months, Egypt has faced power shortages, which officials say are due to unusually high temperatures and cost-saving measures amidst the country’s most acute foreign currency crisis in decades, starting in early 2022.

Israel is keen on preserving diplomatic ties with Egypt and ensuring stability in the buffer zone within the Sinai Desert, where thousands of Palestinian refugees are being relocated. However, with Israeli authorities opting to further reduce gas production, the government stated that natural gas imports have dropped from 800 million cubic feet per day (mcf/d) to zero.

The most immediate impact is on energy prices, especially in oil and gas markets. This trend tends to intensify as we approach the fall and winter seasons.

Charbel Skaff, a Lebanese expert in geopolitics and energy markets

The Tamar field, located 15 miles off Israel’s southern coast, is a major source, providing 70 percent of Israel’s electricity generation needs, as noted by a prominent US energy firm.

Egypt depends on Israeli gas imports from the Tamar and Leviathan fields in the Mediterranean Sea. This gas is vital for Egypt’s domestic energy needs and for supporting its exports from two liquefaction plants. Extended disruptions could lead to reduced Israeli gas exports to neighboring countries like Egypt and Jordan, further pressuring the already tight global gas market.

Jordan, a key figure in Middle Eastern energy, exports some of its gas to both Egypt and Israel. A significant portion of this gas is processed in Egypt before reaching European and Asian markets. As per Reuters, Chevron currently supplies gas via a pipeline network crossing Jordan, influencing the region’s energy dynamics.

Lebanon: A key area at risk

In Lebanon, the involvement of Hizbollah, recognized by the US as a terrorist organization, presents significant challenges to the nation’s economic and geopolitical outlook. However, experts concur that the recent maritime border talks between Beirut and Tel Aviv could only have occurred with the consensus of all involved nations.

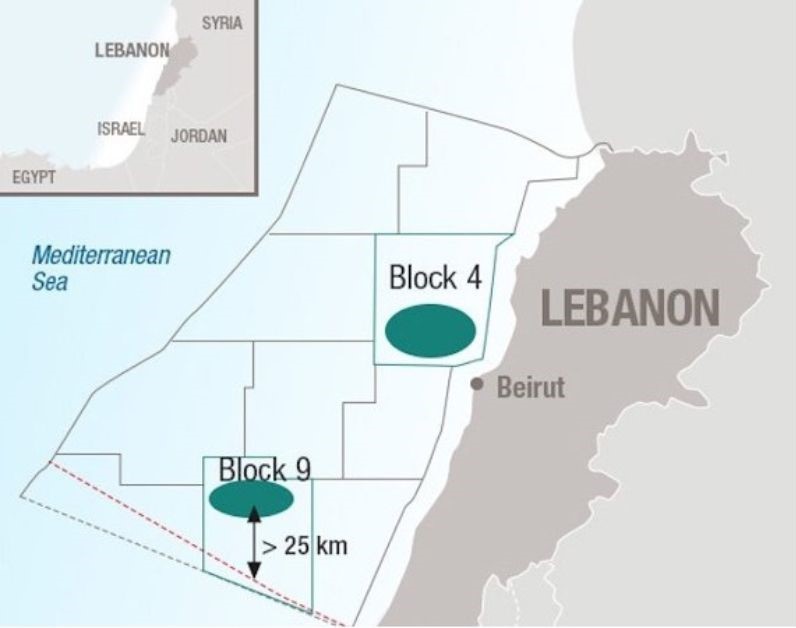

“Major companies like TotalEnergies, Eni, and QatarEnergy continue their operations in Lebanon, especially in Block 9, and aim to explore Blocks 8 and 10. While the initial drilling in Block 9 was unproductive, it doesn’t indicate the entire block lacks gas. It remains uncertain if these companies will continue their exploration efforts,” said Skaff.

The recent revelation on October 14 about the lack of commercial gas reserves in Lebanon’s Block 9 might escalate political tensions between the two countries.

Before the conflict, Lebanese officials were optimistic about the revival of the nation’s tourism sector as an economic lifeline. However, the conflict’s potential to extend into Lebanon is concerning. Minor skirmishes have already occurred between Hizbollah militants, who support Hamas, and Israeli troops along the southern border. Foreign embassies are urging their nationals to leave, and several airlines have suspended flights to the country.

Is the regional energy corridor project in jeopardy?

Following the G20 Summit in New Delhi, leaders from India, the United States, the UAE, Saudi Arabia, and the European Commission introduced an ambitious initiative named the India-Middle East-Europe Economic Corridor (IMEEC).

Preliminary details indicate that IMEEC will link India (either from Mumbai or Mundra) to the UAE’s ports in Jebel Ali or Fujairah. This connection will include a land route with rail transport from Fujairah to Israel’s Haifa port on the Mediterranean coast. Part of this railway is under development, while the remainder, stretching from the Saudi-UAE border to the Al Haditha border crossing with Jordan, is already functional.

While the IMEEC project may offer an alternative to China’s “Belt and Road” initiative in West Asia, it underscores the increasing desire to tap into the region’s resources and enhance global supply and trade links. The collaboration seeks to spur new gas projects, create a major regional hub, and foster confidence within the region.

However, when Arab countries like Saudi Arabia declared they were pausing their plans to normalize ties with Israel due to the ongoing conflict with Hamas, it signaled that the region’s foreign policy dynamics might be experiencing another major shift.

A precarious future ahead

On a larger scale, Iran’s involvement could have profound implications for global gas distribution. These include increased security concerns for liquefied natural gas (LNG) vessels passing through the Strait of Hormuz daily and the safety of international gas pipelines in the area.

In case the conflict between Israel and Arab nations escalates further, proposed Israeli gas projects with Egypt, Jordan, and Lebanon might face challenges. A wider conflict would also raise concerns about the safety and dependability of the infrastructure connecting North African gas suppliers to European markets, adding further uncertainty to an already tight gas market.

The outcome of the current situation on local, regional, and global gas and oil markets hinges on its duration. Achieving peace in the region is crucial, not just for the well-being of its people but also for maintaining global economic stability and energy security.