Riyadh, Saudi Arabia — The financial landscape of Saudi Arabia is witnessing a substantial shift as most adults in the nation experience an increase in their wealth, with the majority falling within the range of $10,000-$100,000, a report said.

This growth trend highlights a promising trajectory of social and economic development in the kingdom, according to a joint report by UBS and Credit Suisse, titled Global Wealth Report 2023.

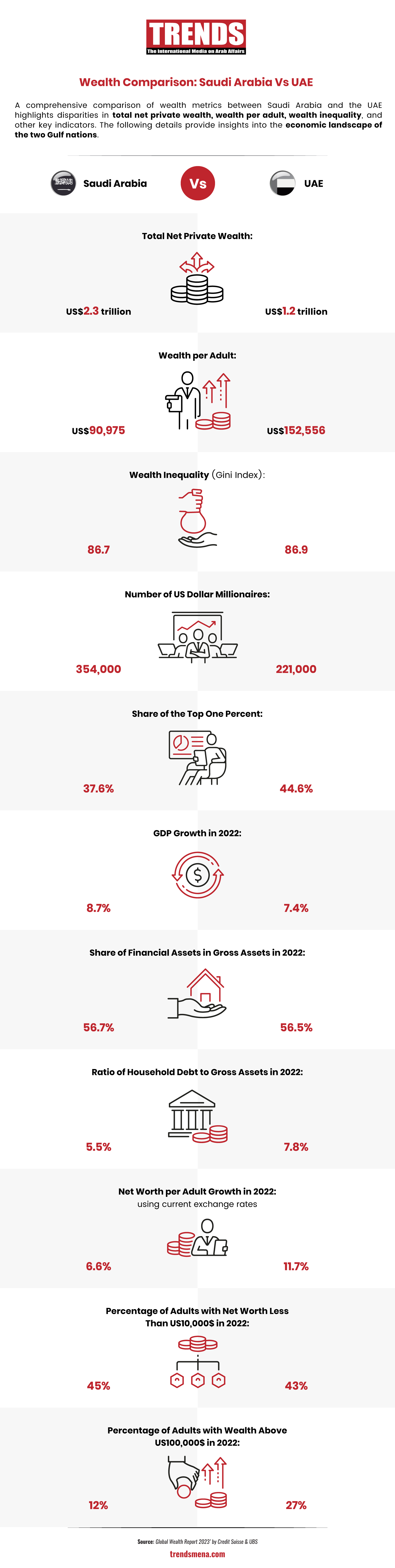

The net worth per adult in Saudi Arabia surged by an impressive 8.6 percent in 2021, followed by a 6.6 percent increase in 2022, both measured in US dollars.

A somewhat similar trend was witnessed in the United Arab Emirates (UAE), where per capita wealth exhibited growth rates of 18.7 percent and 20.6 percent in 2021, using current and smoothed exchange rates respectively.

However, the UAE experienced a slightly more modest increase of 11.7 percent in 2022 at current exchange rates, with smoothing rates impacting the growth at 4.1 percent.

The report sheds light on the distribution of wealth among adults in both Saudi Arabia and the UAE. In 2022, approximately 45 percent of Saudi adults had a net worth of less than $10,000, while the corresponding figure for the UAE stood at 43 percent.

In 2022, 45 percent of adults in Saudi Arabia had a net worth of less than $10,000, against 43 percent of adults in the UAE. Compared to the UAE, Saudi Arabia had more adults with wealth between $10,000 and $100,000.

The number of persons with wealth above $100,000 in Saudi Arabia (12 percent) was lower than in the UAE (27 percent).

Furthermore, the Gini coefficient for wealth inequality in 2022 was 86.7 in Saudi Arabia and 86.9 in the UAE, placing both nations among the highest in global wealth inequality rankings.

The top percentile of wealth distribution painted an equally striking picture. In Saudi Arabia, the top 1 percent accounted for 37.6 percent of the population’s share, while in the UAE, this group comprised 44.6 percent. These figures place both countries at the forefront of global wealth disparity.

The report acknowledges that wealth inequality has slightly narrowed compared to historical levels but emphasizes the need for more comprehensive research to pinpoint underlying causes.

The wealth is heading to China

The economic trajectory in the Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, reveals a significant pivot towards China.

Amid concerns about the future of their security partnership with the US, these oil-rich nations are bolstering ties with China, reflecting a shift in economic exchanges.

Seven months after President Xi Jinping participated in the first Chinese-Gulf summit in Riyadh, economic exchanges between China and the two largest economies in the GCC, Saudi Arabia and the UAE, accelerated, largely bypassing crude oil purchases from the region Beijing has dominated for years.

The value of acquisitions and investments by GCC companies in China this year rose more than 1,000 percent year-on-year to $5.3 billion, according to data compiled by Bloomberg. This shows that this year is on its way to becoming the most in terms of the value of similar deals ever.

Overcoming COVID-19 challenge

In the face of the COVID-19 pandemic, Saudi Arabia and the UAE emerged as resilient economies, successfully navigating the challenges and displaying rapid recovery compared to many global counterparts.

Both countries demonstrated remarkable adaptability and resilience, with their economies showing signs of robustness and diversification beyond oil reliance. The report indicates that the pandemic initially impacted both nations, leading to a contraction in GDP in 2020.

However, by 2021, the tide had turned, with both Saudi Arabia and the UAE registering growth rates of 3.9 percent. The positive momentum continued into 2022, with Saudi Arabia’s GDP expanding by 8.7 percent and the UAE’s by 7.4 percent.

While the IMF projects a slightly slower growth rate for 2023, both nations have proven their capacity to weather unprecedented challenges.

With the current global economic challenges, the two countries have shown strong resilience while, at the same time, they are diversifying their economies so it doesn’t depend on oil and are following the latest trends in the green economy as well.

Government Debts reverses recent gains

A sobering trend in government finances, however, marked a reversal of recent gains. As private consumption declined by 6.3 percent in Saudi Arabia in 2020, savings experienced a marginal uptick. This pattern reversed with a surge of 14.2 percent in 2021 and 2022, contributing to increased government spending. Consequently, public debt in Saudi Arabia escalated from 21.6 percent of GDP in 2019 to 31 percent in 2020, and in the UAE, it rose from 26.8 percent to 41.1 percent.

By 2022, a recovery was evident, with gross government debt receding to 22.6 percent of GDP in Saudi Arabia and 30 percent in the UAE.

The total household wealth in Saudi Arabia reached $2.3 trillion at the end of 2022, outstripping the UAE’s $1.2 trillion. However, adjusting for population size, wealth per adult in the UAE stood 68 percent higher than in Saudi Arabia, reflecting a gradual convergence over time. The report highlighted that earlier in the century, the wealth gap between the two nations was much wider.

The composition of financial assets in gross assets remained stable until 2022 in both countries. Financial assets constituted 56.7 percent of gross investments in Saudi Arabia and 56.5 percent in the UAE, revealing a consistent trend. Household debt, by international standards, remained low, with a marginal shift from 2021. In 2022, household debt accounted for 5.5 percent of gross assets in Saudi Arabia and 7.8 percent in the UAE.

As Saudi Arabia and the UAE navigate evolving economic landscapes, the “Global Wealth Report 2023” underscores their achievements, challenges, and their ongoing commitment to sustainable growth and diversification.