- RIYADH, SAUDI ARABIA – The Saudi Ports Authority (Mawani) attained its highest improvement in the UNCTAD's Liner Shipping Connectivity Index...

This development aligns with the objectives of the National Transport and Logistics Strategy (NTLS).

This achievement adds to the recent major records, including a score of 77.66 during Q3.

- Slowing demand growth and rising US crude production will make it more difficult for OPEC+ to continue to prop up...

The Paris-based IEA, which advises oil-consuming nations, noted that prices had fallen by around $25 per barrel since September highs.

Efficiency improvements and a booming electric vehicle fleet have also been lowering oil demand, it added.

- Sharjah, UAE--The board of directors of the Arab Union for International Exhibitions Conferences (AUIEC), operating under the Council of Arab...

AUIEC plan for next year focuses on attracting new memberships in order to expand its network and active participation in union members' activities and events

The union is set to organise prominent events like the Arab Industries Exhibition in the UAE and Iraq and the Conference of the Exhibition Industry in the Arab World

- Tesla's Autopilot program has spurred numerous government investigations as well as media exposes focusing on misuse or vulnerabilities. The system...

The recall affects models across Tesla's portfolio and will be addressed by an "over-the-air software remedy" typically performed remotely

The recall covers 2.03 million Tesla vehicles and includes Models S, X, Y and 3. Authorities in Canada said they were recalling 193,000 vehicles there

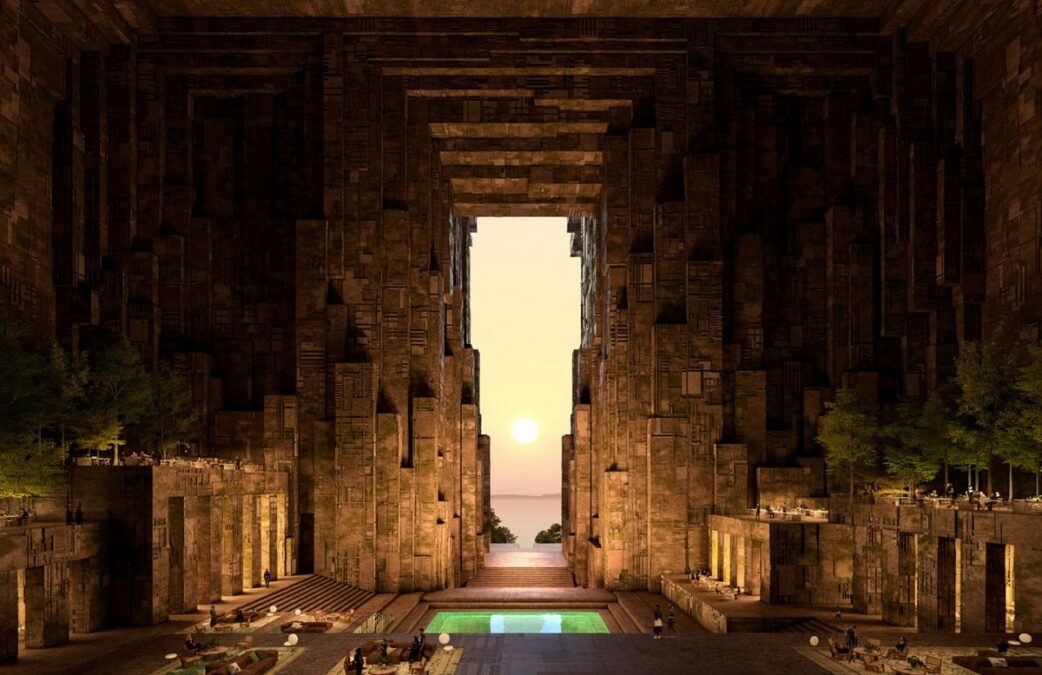

- NEOM, Saudi Arabia - Saudi Arabia's $500 billion mega project, has introduced Utamo, a new art and entertainment destination set...

Described by NEOM as "an innovative and multipurpose event and performance space," Utamo features VIP lounges and signature restaurants

NEOM envisions Utamo as a venue where "reality and the digital realm converge," aiming to redefine entertainment benchmarks

- The IMF said the debt relief will facilitate access to additional financial resources that will help it strengthen economy, reduce...

Its external debt has fallen from 64% of GDP in 2018 to less than six percent of GDP by the end of 2023

The IMF said that Somalia has implemented a poverty reduction strategy for at least a year

- The agreement will bolster cross-border ETF cooperation.

ADX is looking to enhance ties with with leading global financial institutions, including the recent agreement with the New York Stock Exchange

The agreement between the two bourses is set to provide a robust platform for financial growth and connectivity between the UAE and China

- The company deals in risk management infrastructure for digital assets.

Silicon Valley venture capital firm Lightspeed Venture Partners led the round with participation from Mubadala Capital

Andalusia Labs is a collection of leading technology solutions addressing the security challenges prevalent in the blockchain industry

- Reeling from a calamitous drop in advertisement revenues and public trust, news media organizations are reworking strategies to create "niche"...

Many believe news media outlets have been distracted from their role to safeguard space for informed debate on public issues

Several well trusted media outlets with deep pockets are battling against thinning revenues and being forced to think differently

flydubai 2025 profit $591m

Total revenue increases by 6% to $3.7bn

BYD logs record EV sales in 2025

It sold 2.26m EVs vs Tesla's 1.22 by Sept end.

Google to invest $6.4bn

The investment is its biggest-ever in Germany.

Pfizer poised to buy Metsera

The pharma giant improved its offer to $10bn.

Ozempic maker lowers outlook

The company posted tepid Q3 results.