- The agreement between the two will see them both offering services to help set up new businesses in creative economy...

The partnership will aim to double the creative industries’ contribution to Dubai’s GDP to five percent

It will provide creative businesses with special incentives, such as creative activities, logistics, consultation, banking solutions and services

- From optimizing the purchasing ecosystem to driving personalization and developing schemes that help consumers with finance management, retailers must work...

From optimizing the purchasing ecosystem to driving personalization and developing schemes that help consumers with finance management, retailers must work harder

During the pandemic, nearly 40 percent switched brands or retailers, and more than 80 percent developed new shopping habits, says a recent McKinsey study

- Dubai Chamber of Digital Economy, one of three chambers operating under the umbrella of Dubai Chambers, has announced the formation...

The key objectives of the new business group include promoting the digital asset industry in Dubai, boost transparency through market intelligence and data.

The group provides an ideal platform for companies operating in the digital asset sphere to unify their voices, said Omar bin Sultan Al Olama.

- Dubai attracted 7.12 million international overnight visitors between January and June 2022, recording over 183 growth compared to the 2.52...

The number of tourists recorded in H1 2022 was close to the numbers achieved in the first six months of 2019

Western Europe accounted for a significant share of tourist arrivals, comprising 22 percent of total international visitors in H1 2022

- Qatar Central Bank’s (QCB) foreign currency reserves and liquidity increased 2.79 percent to reach QR 211.32 billion ($58bn) in July...

The rise in reserves driven by an increase in the central balances of bonds and foreign treasury bills.

The reserves consist of four categories: foreign securities, balances with foreign banks, gold, and Special Drawing Rights (SDR).

- Online bill payments through National Electronic Payment System in Jordan surged 27 percent in 2021 to JD 9.5 billion ($13.4bn)....

Mobile phone payments increased 107 percent in volume with 25 million transactions.

Payment and electronic money transfer firms issued around 148,000 credit and prepaid cards.

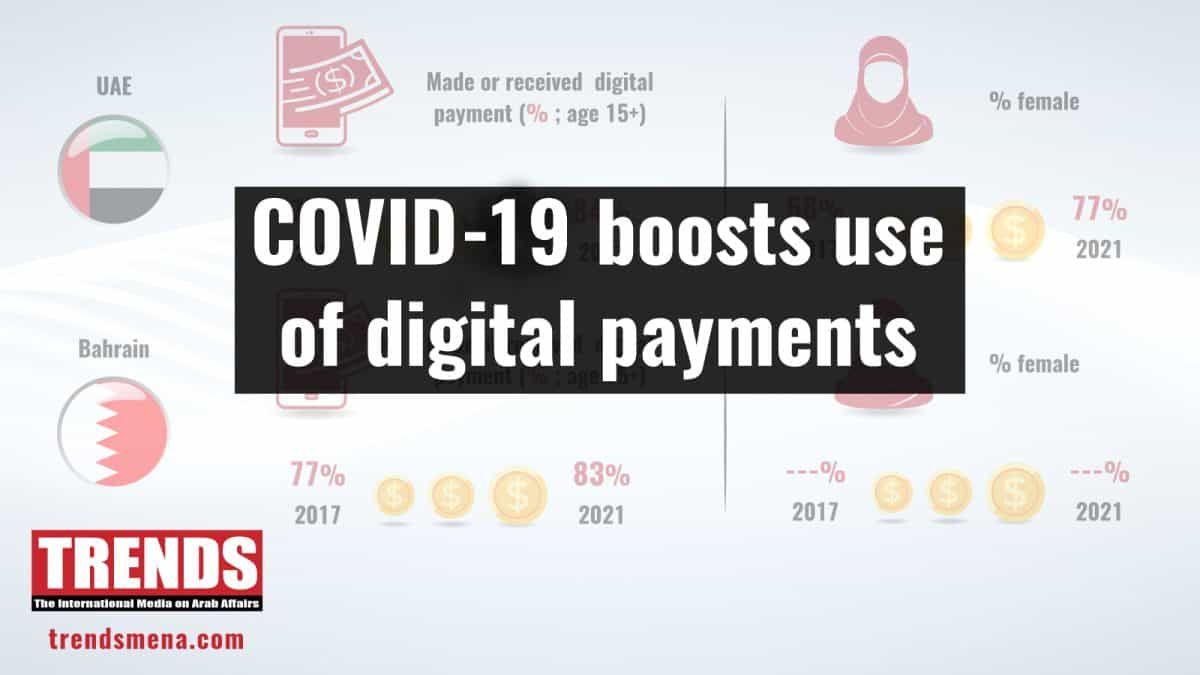

- This expansion created new economic opportunities, narrowing the gender gap in account ownership, and building resilience at the household level...

Two-thirds of adults worldwide now make or receive a digital payment, with the share in developing economies grew from 35% in 2014 to 57% in 2021

The gender gap in account ownership has narrowed, helping women have more privacy, security, and control over their money, latest surveys highlight

- Total assets of the 22 national banks rose to US$816.8 billion (AED 3.023 trillion) in the first five months of...

Total assets of the 22 national banks rose to US$816.8b (AED 3.023 trillion) in the first five months of 2022, up four percent

Assets of national banks accounted for 87.8 percent of gross banking sector's assets of US$937 billion (AED 3.442 trillion)

- Another important and influential trend being witnessed by the banking sector in the region is reduced physical networks and shifting...

Banks in the GCC have proved resilient to the pandemic owing to years of investment in technological capabilities

Online shopping and money transfers are the preferred payment methods for the typical GCC retail customer

BYD logs record EV sales in 2025

It sold 2.26m EVs vs Tesla's 1.22 by Sept end.

Google to invest $6.4bn

The investment is its biggest-ever in Germany.

Pfizer poised to buy Metsera

The pharma giant improved its offer to $10bn.

Ozempic maker lowers outlook

The company posted tepid Q3 results.

Kimberly-Clark to buy Kenvue

The deal is valued at $48.7 billion.