London, United Kingdom — US semiconductor group Qualcomm announced on Monday the planned acquisition of London-listed chip designer Alphawave for $2.4 billion, as it looks to expand into data centers for artificial intelligence.

The deal makes Alphawave the latest tech company to depart London, joining a growing number of firms exiting Britain’s financial center through mergers or by moving their listings to the US to attract greater investment.

Last week, UK fintech Wise, specializing in international money transfers, said it plans to shift its primary listing from London to New York.

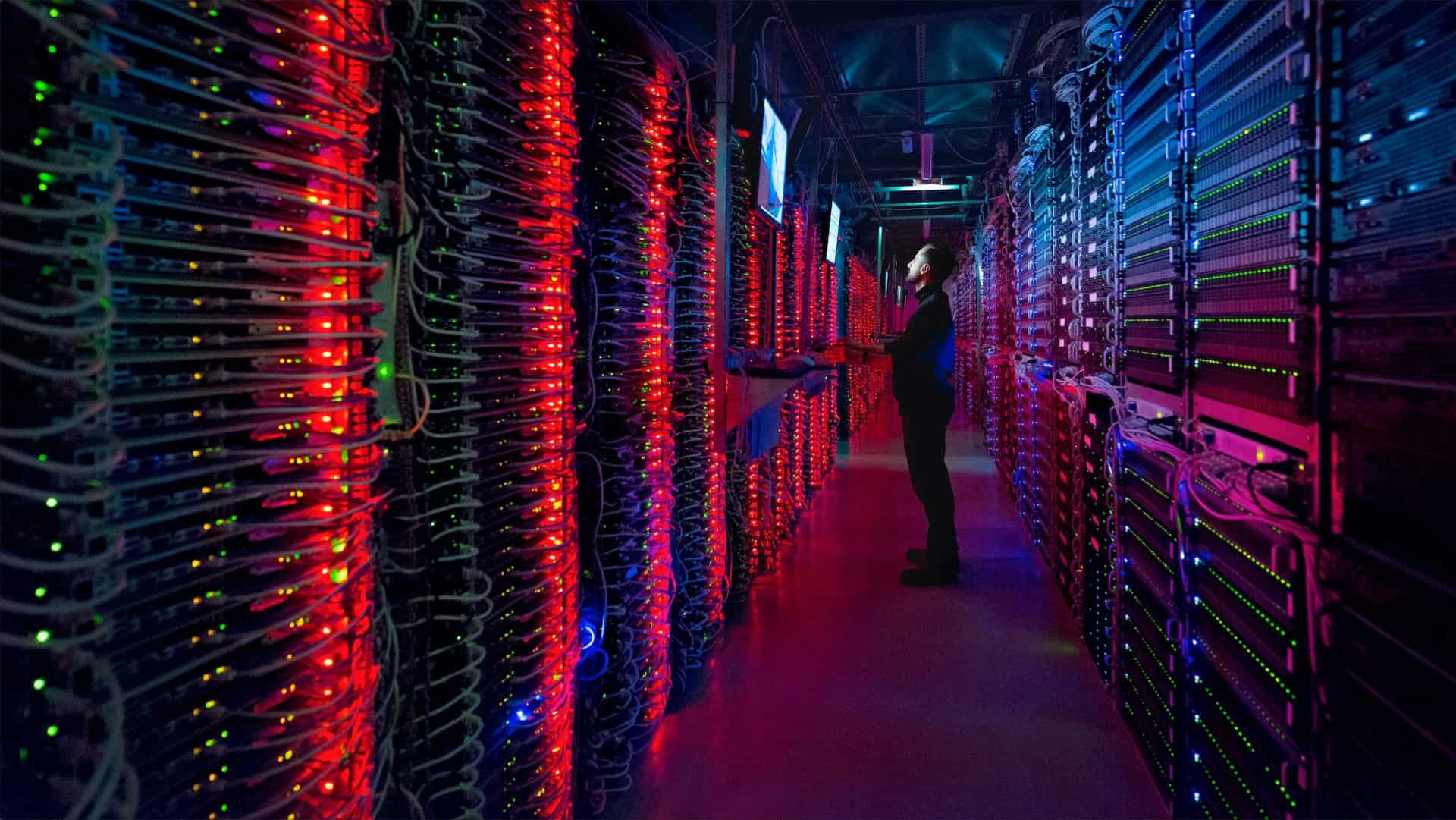

For California-based Qualcomm, the acquisition will help boost its AI infrastructure amid soaring demand for the technology.

“The combined teams share the goal of building advanced technology solutions… across a wide array of high growth areas, including data center infrastructure,” Qualcomm chief executive Cristiano Amon said in a statement.

The deal is expected to close in the first quarter of 2026, subject to regulatory and shareholder approval.

The announcement sent Alphawave’s shares soaring more than 20 percent in London.