RIYADH, SAUDI ARABIA — Even as the picture is not too rosy when it comes to investment flow into the startups in Middle East and North Africa (MENA), the region in general has been trying to empower local startups.

Startups in MENA had raised $173 million across 51 deals until September end, marking a 54 per cent month-on month-drop in investment value and an almost 50 per cent drop when compared to the same period last year.

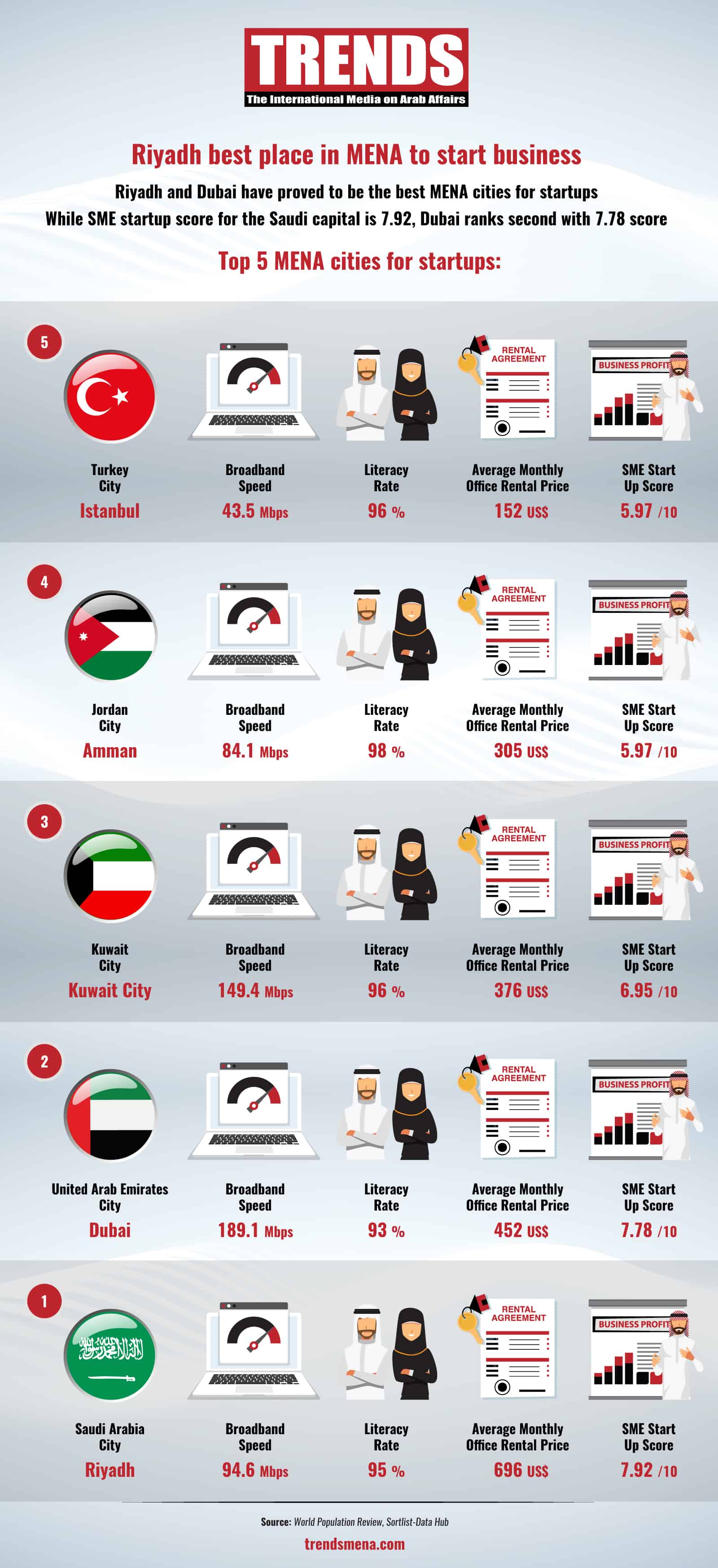

Despite the continued decline in investments this year, Riyadh, Dubai and Kuwait have emerged as the top three cities in MENA which offers all the ingredients that are required to make startups successful, according to a report by Sortlist, a Belgium digital consultancy.

Success rates, average office rental costs, power prices, the most qualified population, and broadband speed were some of the parameters studied to determine the best MENA cities for starting a business.

Riyadh surpassed all other MENA cities in terms of startup activity. It has a higher literacy rate (95 percent) than most others and faster average broadband speed (94.64 Mbps). Riyadh is also among MENA’s happiest cities, with a happiness rating of 6.49/10.

Dubai’s average internet download speed of 189.07 Mbps makes it the second-fastest internet quality in the region, the Sortlist report highlighted.

In the early phases of a company’s development, having access to fast internet is highly beneficial because it facilitates hybrid work and communication with clients and staff in other countries, it added.

Placed third, Kuwait boasts an impressive 96 percent literacy rate and a pitiful 2.5 pence per kilowatt-hour (p/kWh) for power. This, together with the country’s respectable average Internet speed of 149.37 Mbps, makes Kuwait seem like a great place to start a business.

Finishing off amongst the top 10 were Amman, Istanbul, Manama, Casablanca, Cairo, Baghdad and Beirut.

MENA startups raised US$ 173 million

A total of 51 acquisitions totaling US$173 million were completed by MENA startups this year, despite the continuing drop in investment levels. The value of investments has dropped by 54 percent month-over-month and over 50 percent year-over-year.

A report released by Wamda, an entrepreneurship platform in the region, has stated that MENA investors still feel the repercussions of the worldwide economic crisis, which has led to higher prices and a decline in IT stocks.

Among the 20 companies that succeeded in raising capital abroad, the United States was the most active investor (involved in 11 deals), followed closely by the United Kingdom (seven deals).

Egyptian investors, meanwhile, were the most active in the region, taking part in 14 agreements, followed by investors from the UAE, who were involved in 11 transactions.

Regional investors are still bullish on the financial technology industry, as evidenced by the fact that fintech startups accounted for a quarter of all deals last month. However, health technology startups, particularly those working in mental health and medical technology, came in second, with eight deals.

Significant Startups

Investcorp of Bahrain sponsored a US$100 million pre-IPO funding round for Saudi Arabia’s TruKKer, a truck aggregator. Since its inception, the company has raised over US$320 million, including a Series B investment of US$ 96 million.

The overall amount raised by the businesses in May was just under US$73 million, which indicates a sustained decrease in venture investment despite TruKKer’s US$100 million round.

A total of 12 startups in the United Arab Emirates raised just under US$ 27 million; Jordan moved up to third place thanks to US$ 18.5 million raised by liwwa in loans and equity before its Series B round.