The Arab oil and gas producers are likely to close the gap that could arise from the disruption of oil flows from Russia, according to the Institute of International Finance (IIF).

As Russian military forces entered parts of Ukraine, which the United States and most of Western Europe termed as invasion, the Brent crude oil futures rose to US$104.84 on Thursday.

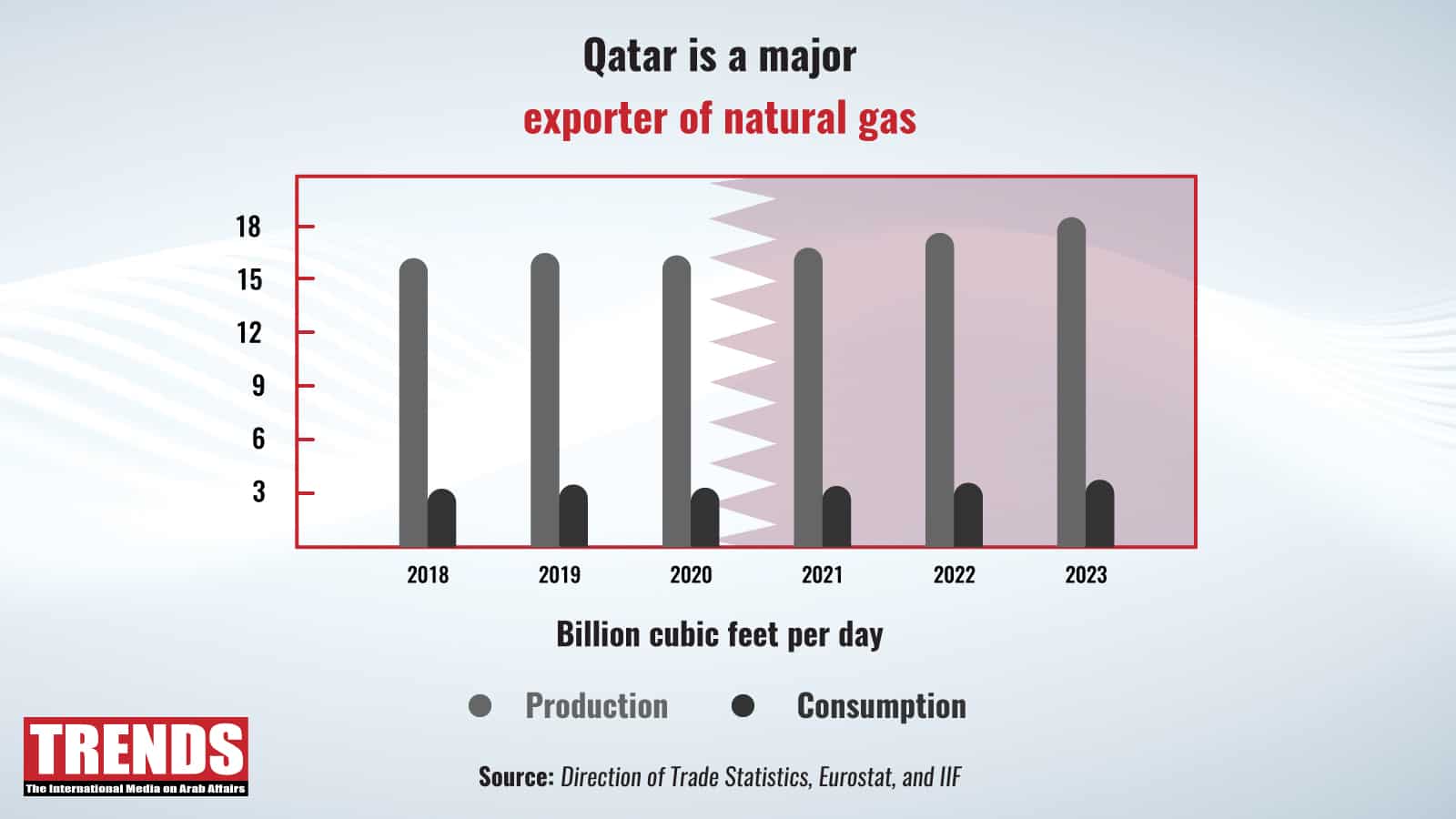

While the brent oil prices surged to US$100 per barrel for the first time in eight years, the Washington DC-based IIF said in a report shared with TRENDS that Saudi Arabia, the UAE, Qatar, Iraq, and Iran (subject to nuclear deal) are capable of meeting the European fuel demand.

Stable prices again

It was the first time since 2014 that oil prices broke beyond the $100 barrier, reaching $104 as Russia stepped up its intervention in the Ukraine situation.

Oil prices have stabilized after US officials said that penalties against Russia, one of the world’s top oil producers, are unlikely to follow an escalation in the conflict between Russia and Ukraine.

Brent crude’s price stayed stable at US$ 96.84 per barrel, while West Texas Intermediate crude futures gained 19 cents to $92.10 per barrel, its highest level since November 2011.

On the other hand, some members of OPEC said this week that there is no reason for the organization and its allies, OPEC+, to increase production more than agreed, given that the conclusion of any possible agreement between oil-producing Iran and world powers regarding Iran’s nuclear program will lead to an increase in supplies.

Enlarging the oil and gas Circle

Energy suppliers from the US, Qatar, Canada, Saudi Arabia, the UAE, Iraq, and Iran can be sought out by Europe in response to Russia’s strategy of disrupting natural gas, and crude oil flows for political advantage (if a new JCPOA deal is reached).

Half of Russia’s crude oil and petroleum products exports to Europe in 2021 were targeted for the European market. International Finance Institute estimates that Saudi Arabia’s crude oil spare capacity is close to Russia’s crude oil imports, at over three mbd when combined with the UAE and Iraq. So, in a few months, Iran could sell another 1.2 million barrels of oil, with more than half of that going to Europe.

If sanctions are eased, Iran will export an additional 1.2 million barrels of oil within a few months. Most of Iran’s crude oil exports, 0.8 mbd, currently go to China. Before the sanctions, Europe accounted for 20 percent of Iran’s total oil and gas exports.

It is possible to diversify away from Russian gas in the medium run. However, it will be difficult for Europe to locate gas suppliers other than Russia in the foreseeable future. Therefore, Europe must invest in energy infrastructure and strengthen ties with its neighbors, notably the Middle East and North Africa (MENA) countries that export oil and gas.

In addition, according to a survey, the vast oil and gas reserves in Saudi Arabia, Iran, Iraq, and the United Arab Emirates would open up new business prospects.

Russia vs. Europe

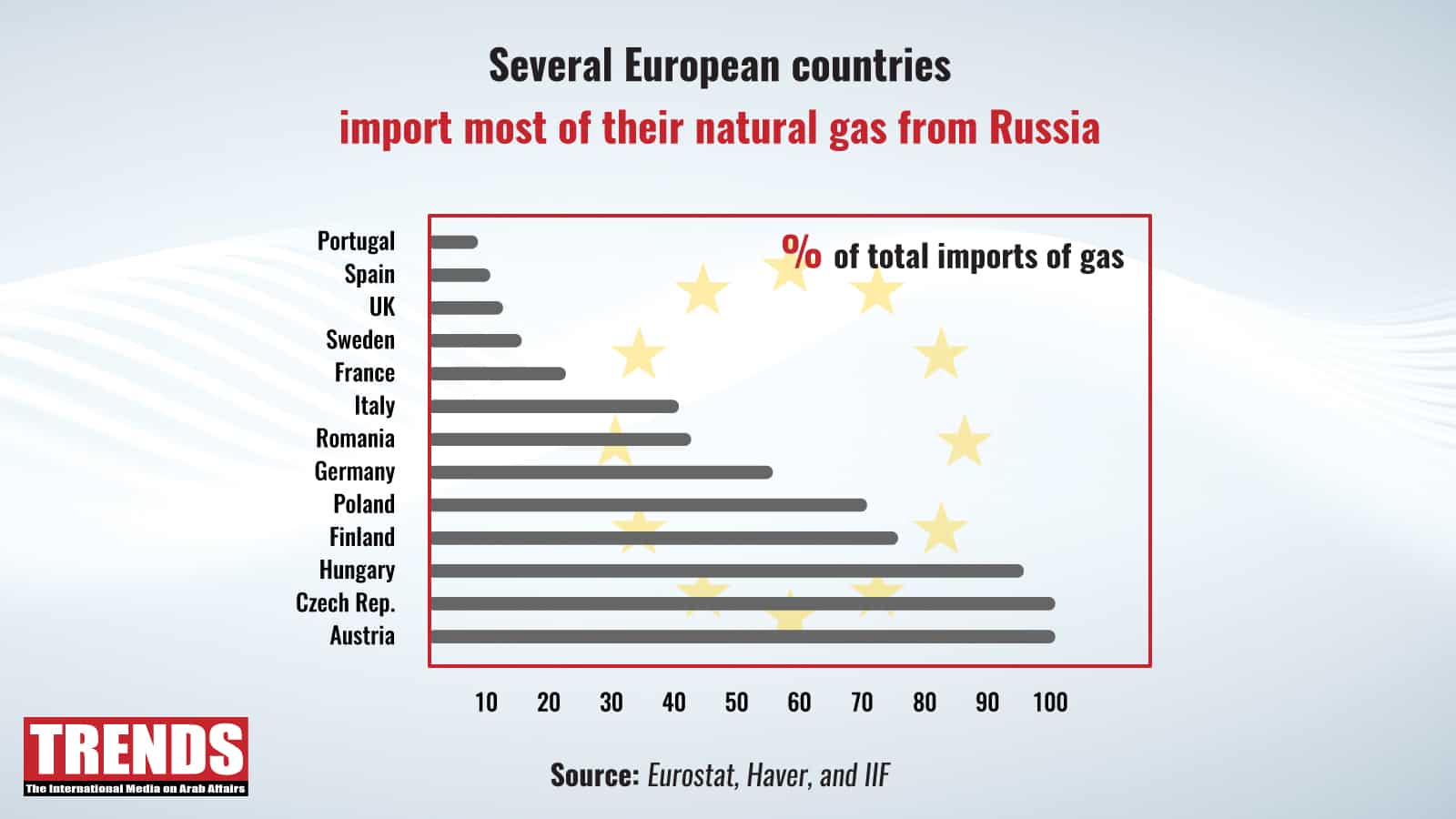

- Only Europe purchases roughly 35 percent of its natural gas from Russia, which is the second-largest oil producer in the world, mainly selling to European refineries.

- According to Eurostat and the International Institute of Finance (IIF), almost one-third of the gas and one-quarter of the crude oil used in Europe in 2021 was imported from Russia.

- Energy research firm Rystad Energy estimates that a war between Russia and Ukraine may put up to 155 billion cubic meters (bcm) per year of gas supplies to Europe in danger, which amounts to 30 percent of Europe’s annual gas demand if that happens.

- If Russia’s energy imports are cut off, Europe’s gas reserves may last for two months. According to Rystad Energy, the amount of gas in storage has dropped to 45 bcm, 30 percent below the average for 2016-2020. High gas costs in 2021 and a lack of supply are two factors contributing to the low storage.

Sanctions on Russia

In response to Russia’s decision to send soldiers into Ukraine, the West has slapped further sanctions and threatened more if Moscow continues its path.

- European Union

The European Union has imposed sanctions on Russia, including 351 parliamentarians and 27 individuals and entities.

- The United States

American President Joe Biden signed an executive order on Monday that stipulated that any institution in Russia’s financial services sector is a target for further sanctions.

More than 80 percent of Russia’s daily foreign exchange transactions and half its trade are conducted in US dollars.

Washington sanctioned two of Russia’s state-owned banks – VEB and Promsvyazbank – and blocked it from trading its debt on US and European markets. The two Russian banks are considered close to the Kremlin and Russia’s military, with more than US$ 80 bn in assets.

- The United Kingdom

On Tuesday, the UK announced sanctions against five Russian banks and three Russian billionaires: Gennady Timchenko, Boris Rotenberg, and Igor Rotenberg.

While the banks are: Rossiya Bank, IS Bank, General Bank, Promsvyazbank, and the Black Sea Bank.

Foreign Secretary Liz Truss said that the UK would also stop Russia from selling sovereign debt in London.

– Germany

German Chancellor Olaf Scholz announced the halting of certifying the Nord Stream 2 gas pipeline from Russia – a lucrative deal long sought by Moscow but criticized by the US for increasing Europe’s reliance on Russian energy.

It should be noted that Russian state-owned gas giant Gazprom owns the US$ 11.6 bn projects.