Washington, United States– Shopping online at Temu, Laurie Silva paid just $1.25 for earrings and $15 for a cardigan — she is among millions of US consumers the Chinese platform is wooing with low-cost bargains and a dizzying array of products.

Temu topped US app download rankings in early April, a spot it held since January, but its rapid rise comes as platforms with links to China face growing scrutiny and when a ban on youth favorite TikTok appears increasingly inevitable.

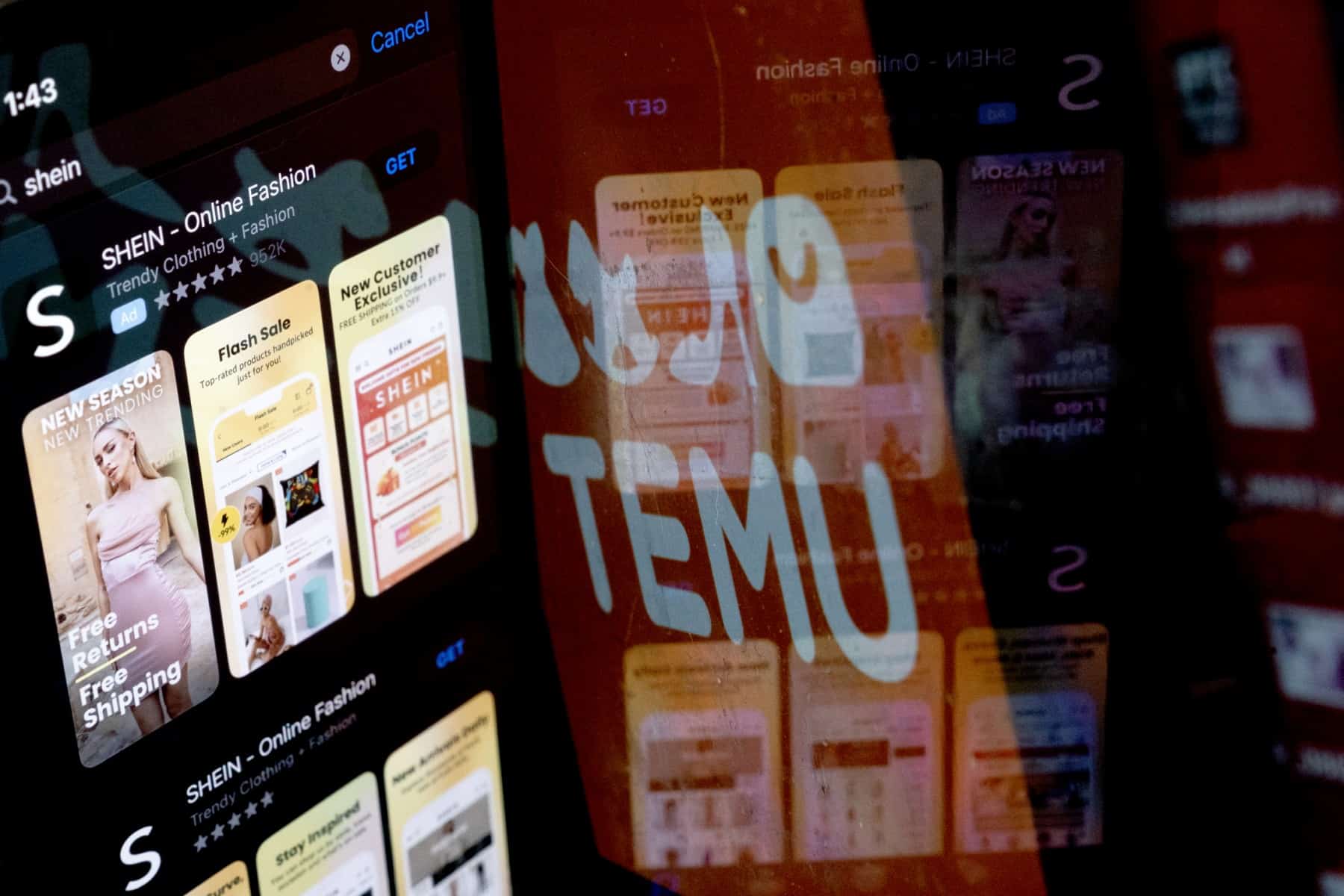

According to Sensor Tower data, some of the most popular platforms downloaded in the US currently have Chinese roots, including TikTok, video-editor CapCut and fashion upstart Shein.

Temu is positioned as an Amazon-like superstore, selling everything from make-up to homeware and electronics, and its quiet launch last September marked Chinese e-commerce giant Pinduoduo’s first foray into the US market.

Based out of a Boston office block, Temu’s out-of-the-blue success makes it the second Chinese-made shopping app — after Gen Z darling Shein — to make a splash in America in recent years.

“I’ve seen so many things in their catalog… offered on Amazon and other online retailers for much more,” Silva, a 65-year-old in California, told AFP.

She has placed around 20 orders on Temu, buying craft supplies, jewelry and gifts.

Another customer, 38-year-old Stephanie Wolfe, said she first bought items like eyeliner and jewelry to test the service in January.

“It got here so quick, I couldn’t believe it,” she said. “Once I realized it was legit, I just started ordering more.”

Fueling the frenzy were Temu’s commercial spots during the Super Bowl in February that asked more than 100 million US viewers to “shop like a billionaire.”

“I was like: ‘Oh that’s what I use!’ Since then I’ve noticed it’s gaining more traction,” said Wolfe.

According to Sensor Tower, Temu has had 33 million US downloads since its launch, with user numbers surging on the month of the Super Bowl, the most-watched TV event in the US.

China connections

The rise of Shein and Temu comes as leading US fashion companies seek to reduce their exposure to China with worries intensifying over growing US-China tensions, said Sheng Lu, a professor of fashion and apparel studies at the University of Delaware.

Both brands primarily source their products from China and Temu mostly ships its goods directly from there as well, he added, contrasting this against Amazon’s US-based distribution centers.

This allows Temu to tap China’s strengths in producing apparel in greater varieties with greater flexibility — all while qualifying for US waivers on import duties for lower value shipments, Lu said.

A recent notice for Shein suppliers in China seen by AFP requires turnaround times of just seven to 18 days on factory orders.

For Shein in particular, artificial intelligence and big data play a “critical role” in its expansion and success, Lu said.

“Shein has utilized data collected from its apps and other social media channels to gain insights into consumers’ shopping habits and lifestyles, enabling the company to offer in-demand items,” he added.

Fast fashion scrutiny

But the ascent of Chinese apps have been accompanied by scrutiny that Temu may too have to grapple with.

In 2021, non-governmental group Public Eye found that some workers behind Shein’s breakneck production toil for 11 to 13 hours a day.

It has also come under fire for generating fast fashion waste and apologized for products like a swastika necklace in 2020.

“Additionally, similar to the case of TikTok, Shein and Temu’s rapid expansion in the US has resulted in the collection of vast amounts of personal data from American consumers,” said Lu of the University of Delaware.

TikTok faces a potential US ban amid allegations that its data haul amounts to a national security threat and that its algorithm poses a danger to mental health.

So far, Temu and Shein have avoided the fate of TikTok, whose CEO faced a brutal hearing in US Congress last month, with unanimous accusations by lawmakers that the social media app was a threat to America.

Georgia Institute of Technology professor Milton Mueller downplayed the danger of shared data, arguing that that “the nationality of the company is a very crude and nationalistic criterion” in assessing security threats.

A research paper co-authored by Mueller released in January concluded that “data collected by TikTok can only be of espionage value if it comes from users who are intimately connected to national security functions and use the app in ways that expose sensitive information.”

“These risks arise from the use of any social media app,” the paper said.

Meanwhile, the vast majority of US consumers shrug off security concerns.

But Wolfe said she uses virtual private networks and makes payments through PayPal for added layers of security.

“Because I’m taking precautions, I’m not worried,” she said.