-

Offer price range has been set at AED 2.55 to AED 3.05 per share

-

The IPO will continue till 6 Jul 2021 for individuals and other investors in the UAE

UAE’s state investor Mubadala’s statellite company Yahsat on Sunday announced the initial public offering, setting an indicative price range that shows it could raise up to 2.976 billion dirham ($810 million) in the IPO.

The IPO will continue till 6 Jul 2021 for individuals and other investors in the UAE and until 8 Jul 2021 for qualified institutional and other investors, a statement on the company’s webiste said.

The offer price range has been set at AED 2.55 to AED 3.05 per share and the final offer price for the shares is expected to be announced on 9 July 2021.

This will be the first major IPO of a company on the Abu Dhabi bourse since Abu Dhabi National Oil Co was listed in 2017.

Media report said Yahsat plans to sell a minimum of 731.9 million shares to a maximum of 975.9 million shares, indicating it may raise at least 2.23 billion dirhams to a maximum of 2.976 billion dirhams.

Mubadala will remain a majority shareholder following the offering of at least 30% and up to 40% of Yahsat’s issued share capital, all of which is currently held by Mamoura Diversified Global Holding PJSC, a wholly-owned subsidiary of Mubadala Investment Company PJSC.

The statement said the shares are likely to be admitted to trading on the Abu Dhabi Securities Exchange on 14 July 2021, subject to market conditions and obtaining relevant regulatory approvals.

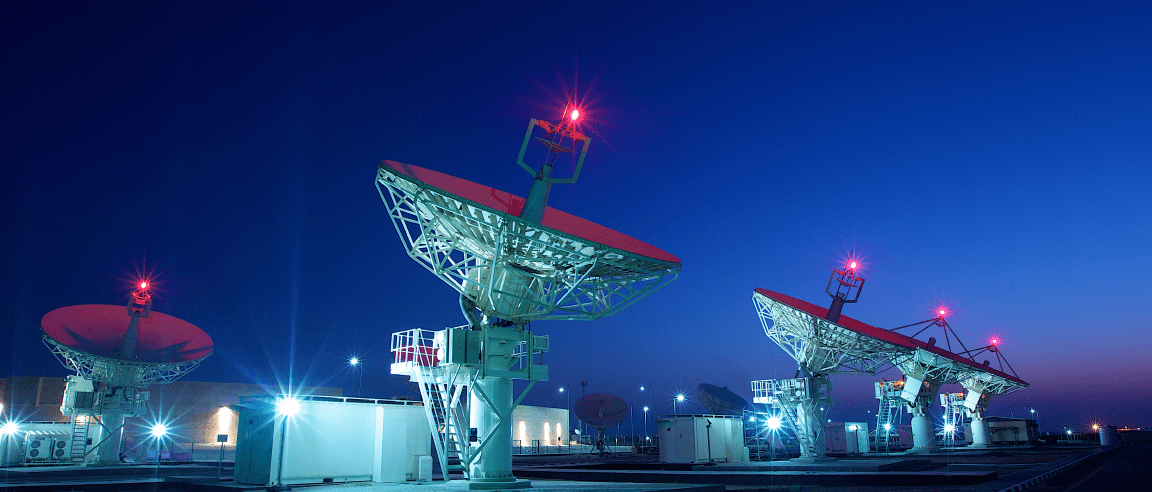

Established in 2007, Yahsat is one of the largest providers of satellite communications services in the world in terms of annual revenues, Mubadala has said. It said the company has operations in more than 150 countries. It also owns satellite phone operator Thuraya.

Ali Al Hashemi, CEO Yahsat, said the company’s track record and prospects of the space industry in Abu Dhabi and the UAE “provides a compelling proposition” for potential investors.