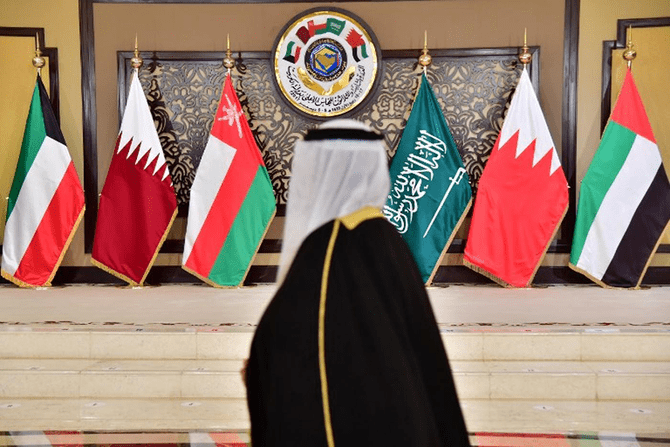

2021 saw the GCC governments grappling with economic challenges posed by the COVID-19 pandemic. The impact of the pandemic was more palpably felt by the region’s major economies like Saudi Arabia and United Arab Emirates. As 2021 comes to an end, here’s looking back at the major economic events that shaped the region.

GCC Economy: Oil and Inflation

Covid-19 Variant Omicron, oil prices, and inflation rates were all factors that directly affected GCC countries in 2021 because of the interdependency of the Gulf economies.

Oil Prices: International oil prices surged by around 36.5 percent and reached a 7-year peak, exceeding US$ 82 a barrel at the end of November 2021, the highest since October 2014. Increased demand from major oil consumers like China, South Korea, India, and the European Union was responsible for the rise.

The International Institute for Finance (IIF) has indicated, in its report “Higher Energy Prices: Winners and Losers Across EMDEs”: that the countries that are net exporters and have considerable terms of trade advantages are the key beneficiaries. These include Saudi Arabia, UAE, Kuwait, Qatar, Oman, Bahrain, Algeria, and Iraq.

Inflation Rate: Inflation rose in most GCC countries. Qatar witnessed the highest inflation rate at 4.28 percent in October 2021.

Kuwait came in second by a 3.36 percent inflation rate in June 2021. In comparison, Oman recorded a 2.45 percent inflation in September 2021, and Saudi Arabia’s consumer price index increased by 0.8 percent. At the same time, inflation rose in the United Arab Emirates for the first time since January 2019, recording 0.55 percent increase.

Notable Announcements

Foreign corporations are eager to invest in the United Arab Emirates, which seeks ways to improve its economy and open up new markets. In light of the new laws, many large companies, including Binance, are considering moving their headquarters to Dubai. At the same time, new agreements for the Red Sea Project are also being signed by Saudi Arabia, which will likely impact the Kingdom’s economy substantially.

Financial Aid: The United Arab Emirates’ central bank has extended several measures of its Targeted Economic Support Scheme (TESS) until June 30 to support the continued recovery of the country’s economy. The bank stated that the extension is to help new lending and financing, as well as prudential relief measures regarding banks’ capital buffers and liquidity and stable funding requirements.

Saudi Arabia Budget: In 2022, Saudi Arabia hopes to produce its first budget surplus in over ten years, thanks to a rise in oil prices that has replenished state finances that the COVID-19 pandemic had decimated.

Riyadh estimates a surplus of US$ 23.99 bn, or 2.5 percent of its GDP, next year – its first surplus since it went into a deficit after oil prices crashed in 2014.

Crypto Free – Zone: In an effort to lure new enterprises to the UAE as regional economic competition heats up, the Dubai World Trade Center (DWTC) will become a crypto zone and a regulator for virtual assets.

New economic sectors are being created in Dubai, one of the seven emirates that make up the United Arab Emirates. The DWTC has developed a specialized zone for virtual assets, including digital purchases, products, operators, and exchanges.

Red Sea Project: Saudi Arabia is witnessing major deals in the Red Sea, which is a joint venture between ACWA Power, SPIC, and TABREED, of which ACWA Power owns a 50 percent stake. Days ago, ACWA Power International announced the financial closing of a major debt facility of US$ 1.33 bn for the Red Sea multi-utility project.

On the other hand, the Red Sea Development Group has concluded deals with nine international hotel brands that will collectively provide more than 1,700 hotel rooms out of a total of 3,000 rooms within the scheme of the first phase of the development of the Red Sea destination.

Major Events

It is no secret to anyone that Saudi Arabia is witnessing a historic transformation in the economic, social, and cultural landscape, in accordance with the ambitious plan of Saudi Vision 2030. Riyadh Season is considered one of the many cultural events happening in the Kingdom, while UAE, at the same time, is focusing on innovation and tourism through its Expo 2020.

Expo 2020: Since its launch in October 2021, Dubai has welcomed millions of visitors and made significant deals with other governments and private companies in several fields such as technology, space and trade.

About US$ 7 bn has been invested by the Emirate of Dubai on the exhibition, aiming for an economic impact of over 1.5 percent of GDP. It has set ambitious and expected income targets of roughly US$ 18.7 bn in the services and event organization sector, US$ 7.3 bn in the construction sector, and US$ 3.1 bn in hospitality.

Riyadh Season: Saudi Arabia is aiming to diversify its economy through more cultural and entertainments events. In this context, the first “Riyadh Season” took place in 2019 and attracted over ten million visitors, offering a diverse range of activities, including shows, auctions, games, wildlife, restaurants and cafes, international brands, concerts, and heritage. Until now, around 2 million visitors attended the “Riyadh Season” in 2021.

Global Economy

Inflation and high oil prices have had an impact on the economics of all countries, but there are other serious challenges threatening the world, including:

Electronic Chips: The semiconductor industry was subjected to two successive shocks: the first was due to the trade war between Washington and Beijing, and the second was due to the economic closure, and some factories stopped completely, and another worked at a capacity of 60 percent, for fear of the virus outbreak.

While the demand for communication and entertainment devices has increased due to people working from home, the global semiconductor supply chain gap has forced major auto and electronics businesses to reduce production.

By the end of 2021, “semiconductors” are predicted to be worth 571 billion dollars, according to a forecast by “Gartner,” a growth of 10.8 percent from 2019.

Debts Worldwide

A record US$ 226 TR in global debt was accrued in 2020, the International Monetary Fund reported, making it the highest one-year increase since World War II. IMF stated that the “Covid-19” pandemic caused global debt to rise by 28 percent in 2020.

Government borrowing accounted for little over half of the US$ 28 TR increase, while the non-financial company and family debt also reached record highs. Low-interest rates, according to the IMF, are to blame for 90 percent of the rise in global debt.

Global Growth: At the same time, IMF cut its global economic growth prediction to 5.9 percent in 2021 in response to the recent breakout of new strains of the Coronavirus.

For affluent countries, supply networks have been disrupted, and for low-income countries, pandemic risks have increased.