New York, United States– US stocks rallied Wednesday, with the Nasdaq jumping three percent, after Federal Reserve Chair Jerome Powell said the central bank could moderate its stance on interest rate hikes as soon as December.

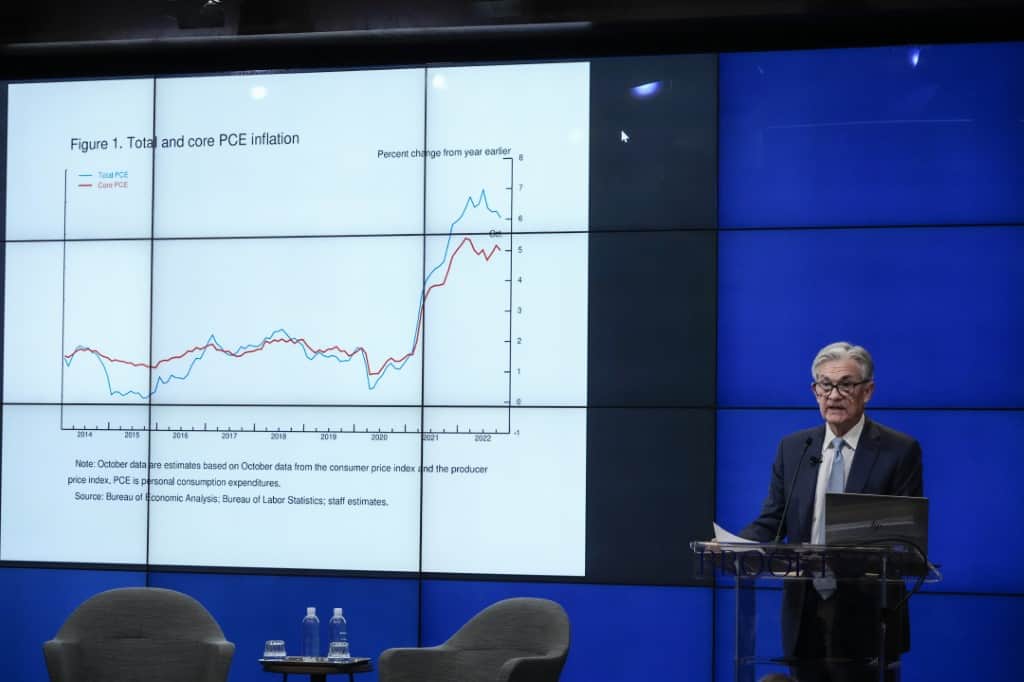

“The time for moderating the pace of rate increases may come as soon as the December meeting” of Fed policymakers, Powell said in a speech at the Brookings Institution, a think tank.

He added that the full effects of the bank’s moves are yet to be felt, but also warned that policy will likely have to remain tight “for some time” to restore price stability.

Major indices had been near flat prior to the Powell event, but then took off once his remarks were reported.

Stocks have risen over the last month, in part on expectations that the Fed would soon pivot on monetary policy. Powell’s appearance had been viewed as a potential risk to equities if he had adopted a more hawkish tone.

Earlier, government data showed the United States economy grew at 2.9 percent in the third quarter, annualized, better than the 2.6 percent figure in the prior estimate.

But payroll firm ADP said private employers added just 127,000 jobs in November, much less than analysts expected and well below the level in October.