US central bankers remain committed to raising interest rates further to quell rising prices, but agreed it would be appropriate to slow the pace of the hikes “at some point,” the Federal Reserve said Wednesday.

The central bank has raised the benchmark borrowing rate four times this year, including two massive three-quarter-point increases in June and July as it tries to cool demand to lower prices that have surged at the fastest pace in more than 40 years.

The aggressive moves took on more urgency after US annual inflation spiked to 9.1 percent in June.

In the minutes of the July policy meeting, which produced a second massive rate increase of 75 basis points, Fed officials said it will take some time to bring “unacceptably high” inflation back down near the two percent goal.

Policymakers are trying to tread a narrow path and avoid pushing the world’s largest economy into recession, and many officials at the meeting cautioned that there is a “risk” the Fed could go too far.

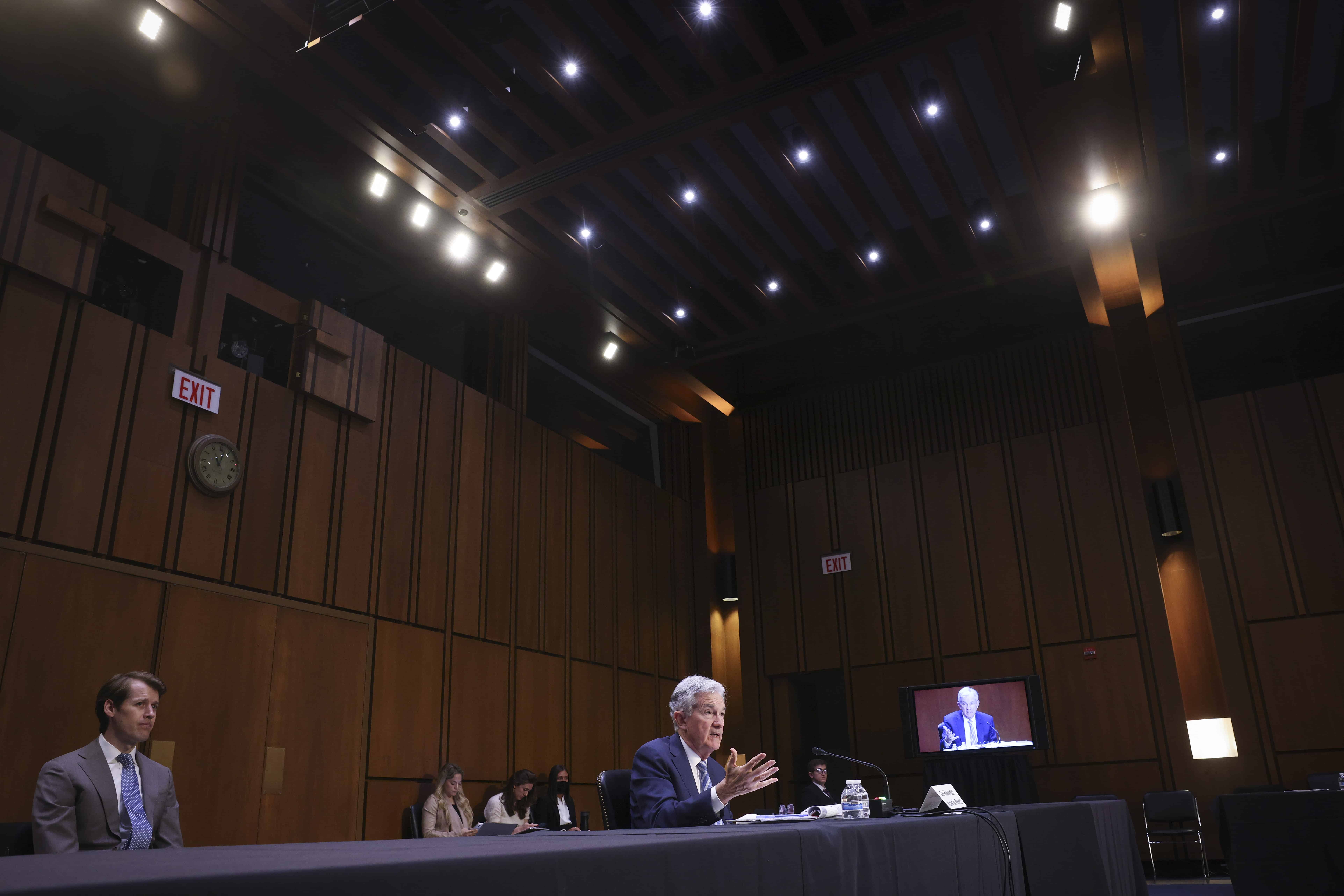

Since the last Fed meeting, financial markets have been cheered by hopes that a slowing economy will allow the central bank to dial back or even halt the rate hikes, especially after comments from Fed Chair Jerome Powell, who signaled that the rapid increases eventually would give way to more normal steps.

But Fed officials have tried to dispel some of that excess optimism, stressing in recent speeches that the central bank is committed to pursuing its battle on inflation — a message echoed in the minutes.

And economists see no suggestion of a pivot from the Fed’s policy-setting Federal Open Market Committee (FOMC) any time soon.

After the benchmark rate was slashed to zero at the start of the coronavirus pandemic, it now sits in a range of 2.25 to 2.5 percent.

“Even if the FOMC decides to scale back its rate hike to 50bps on September 21, we look for another 125bps increase in the fed funds rate by year-end,” said Kathy Bostjancic of Oxford Economics.

And the central bankers said even when the rates hit a “sufficiently restrictive level,” they may keep them there for some time to ensure that inflation falls.