Billionaire Elon Musk announced on Monday the buyout of Twitter for approximately $44 billion with shares valued at $54.20, a takeover bid that the Riyadh-based Kingdom Holding Company’s (KHC) Chairman Prince Alwaleed bin Talal recently rejected.

“Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” Musk said in a statement.

“I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans,” he added.

The world’s richest person had announced his takeover bid on April 14, calling it his “best and final offer”.

Last week, Prince Alwaleed rejected Elon Musk’s bid to acquire Twitter Inc for $54.20 per share, stating that the deal did not “come close to the intrinsic value” of the popular social media platform.

In a tweet, Prince Alwaleed said: “I don’t believe that the proposed offer by @elon musk ($54.20) comes close to the intrinsic value of @Twitter given its growth prospects.”

He added: “Being one of the largest and long-term shareholders of Twitter, @Kingdom_KHC and I reject this offer.”

According to the Bloomberg Billionaires Index, Prince Alwaleed is the wealthiest individual in Saudi Arabia, with a $16.5-billion fortune.

Majority of his net worth comes from his 95 percent ownership of KHC. He hasn’t tweeted thereafter.

Musk’s offer price of $54.20 per share represented a 38 percent premium on the closing price of Twitter’s stock on April 1.

KHC implemented a new strategy in recent years with the objective seemingly being more on building Saudi Arabian-based assets, Devesh Mamtani, Chief Market Strategist at Seven Capitals, told TRENDS.

The investment holding company, listed on the Saudi Exchange or Tadawul, has exited or reduced stakes in prominent US-listed companies such as McDonald’s, Walt Disney, Ford, Amazon, and Apple.

“The aim is to use its international asset management expertise to make durable companies in the Middle East,” explained Mamtani.

“With these targets in mind, the holding company has already built up positions in healthcare, hospitality, education, media, and entertainment inside the country itself,” he added.

“This is in line with the Vision 2030 strategy of the Saudi government. And this makes a lot of business sense,” Mamtani said.

Kingdom Holding originally invested $300 million in Twitter for about 3 percent in December 2011.

In October 2015, Prince Alwaleed and his company raised their ownership in Twitter to about 5.2 percent, bringing the market value of their ownership to more than SAR3.75 billion ($1 billion).

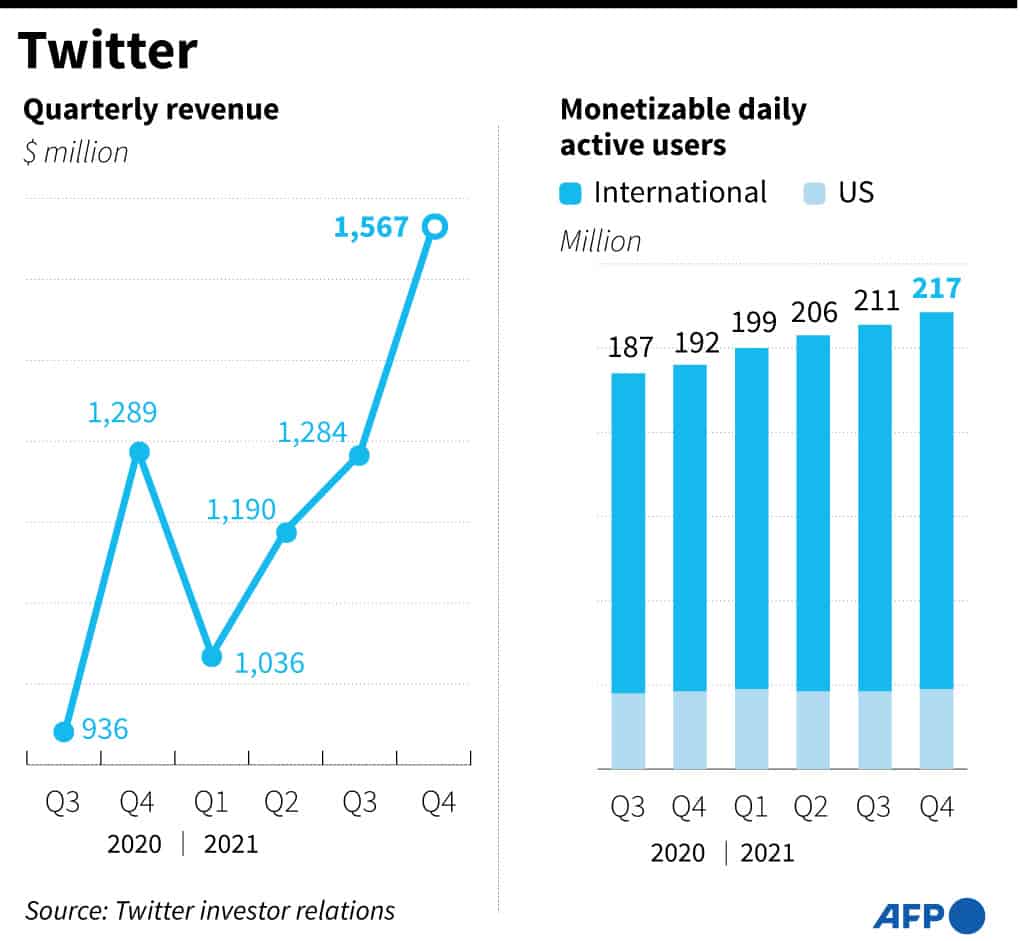

Twitter has a long, tortured history of considering selling itself, the ongoing consequence of its cultural relevancy outweighing its financial performance, said Mohammed Shaheen, CEO of Seven Capitals.

Earlier this month, Musk, who currently has a 9.2 percent stake in Twitter, rejected the offer to be part of the company’s board.

He is the company’s second-largest shareholder, owning 73.5 million shares of common stock in his personal capacity.

Musk and former Twitter Chief Executive Jack Dorsey are the only individuals among the top 10 shareholders in the company. The rest of the spots are taken by financial institutions.

On April 8, Vanguard Group disclosed owning 82.4 million shares of Twitter, or 10.3 percent of the company, according to the most recent publicly available filings with the U.S. Securities and Exchange Commission.

Funds held by Vanguard recently upped their stake in the social media platform, making it the largest shareholder in Twitter.

In November 2017, Prince Alwaleed, who owns stakes Lyft, Citigroup, and News Corp, was arrested and held in the luxury Ritz-Carlton hotel along with at least 10 other princes, four ministers, and tens of former ministers as part of a major crackdown on corruption in the country.

He was released in January 2018 after he made an undisclosed financial settlement with the Saudi government two months after being held captive.

Twitter takeover timeline:

- January 31 to March 14: Elon Musk accumulates 5% in Twitter.

- March 24 onwards: Musk slams Twitter in a series of tweets.

- March 26: He tweets, “New platform needed?”

- April 4: Musk says he has bought 9.2 percent shares of Twitter.

- April 5: Speculations are rife that he will become a board member.

- April 9: Musk asks, “Is Twitter dying?”

- April 10: He declines to be part of the Twitter board.

- April 14: Musk offers to buy the whole company for $43 billion.

- April 14: Prince Alwaleed rejected Musk’s offer through a Twitter post.

- April 15: Twitter adopts a “poison-pill” approach to stave off takeover.

- April 18: Musk tweets Elvis Presley song “Love me tender”.

- April 24: The Twitter board holds discussions with Musk.

- April 25: Deal for Elon Musk to buy Twitter for $44 billion is sealed.

(With inputs from news agencies)