DUBAI, UAE — For the governments of the Gulf Cooperation Council (GCC), achieving self-sufficiency is crucial for transforming their countries into export-based industrial economies. Bolstering local industries is also vital to increasing domestic demand within these economies.

To achieve this, regional leaders have crafted sector strategies to spur economic growth. They’ve ramped up government spending to stimulate industrial and commercial activities and have launched local content development programs to foster skill and capacity growth in GCC companies.

However, successful localization hinges on transparent demand data and forecasting. Having access to precise demand data can mitigate risks for investors and offer clearer insights for their business plans. Transparency in demand also amplifies the broader investment appetite.

Moreover, governments can embrace centralized demand planning to fortify their industrial stance and enhance their trade balance. This approach places the public sector—and its collaboration with the private sector—at the forefront of industrial transformation.

Three barriers to local content development

The shift to a more localized economy isn’t always seamless. State-owned entities (SOEs)—the primary industrial demand drivers in GCC economies—employ varied practices to craft the demand forecasts that bolster localization. This leads to three main challenges:

Categorization. Numerous SOEs have devised or adopted their categorization systems for materials and services expenditure. This hampers efforts to consolidate and predict demand at a national level. Systems like the Harmonized System (HS), the North American Industry Classification System, the Standard Industrial Classification, the United Nations Standard Products and Services Code (UNSPSC), and unique SOE taxonomies differ in category breadth and granularity.

Visibility. Due to confidentiality and competitive factors, SOEs typically don’t publish detailed forecast demand based on specifications or categories. Instead, they release information at a broader level, often with inconsistent time intervals and methodologies. The limited accuracy and granularity of these forecasts can significantly hinder comprehensive visibility for private sector investors.

Technical Standards. Different SOEs adopt varied technical standards for identical goods and services. Some have even crafted their standards. This introduces complexity for the private sector, which then faces additional compliance requirements.

These challenges currently diminish the GCC’s overall potential buying power and might deter potential market entrants.

How to Boost Localization and Propel the GCC Industrial Revolution

GCC economies can surmount the aforementioned challenges by initiating:

- Common Data Categorization: Establishing a shared taxonomy for identical goods and services categories. This taxonomy could be linked to external codification systems (e.g., HS or UNSPSC codes), facilitating demand comparison and aggregation.

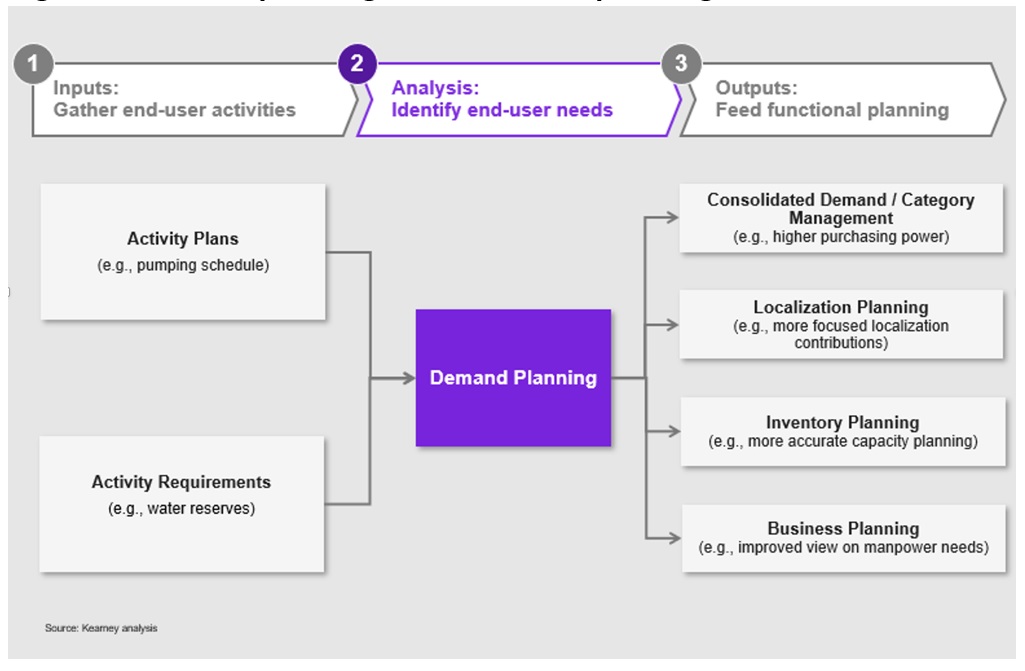

- Consolidated Demand Planning: Enhancing visibility of requirements across all entities, bolstering market confidence, and enticing investors. Demand forecasting can start at a detailed level and then be aggregated nationally using common categorization systems.

Consolidated demand planning can also amplify purchasing power and offer enhanced visibility for investors eyeing localization opportunities.

Figure 1: Demand planning is central to all planning activities.

Industrial Demand Planning in Practice

GCC governments can attain more effective demand planning by mandating a common harmonized data structure and forecasts based on volatility metrics. This would align localization strategies with the visions of GCC governments, such as unlocking non-oil sectors in Saudi Arabia, diversifying industries in Qatar, and boosting the non-oil GDP impact in the United Arab Emirates.

Digital technologies, including Artificial Intelligence (AI) and Machine Learning (ML), are pivotal for refining demand planning. Adopting these technologies can aid SOEs in transitioning to advanced algorithms for enhanced accuracy and intricate data handling. This empowers SOEs to leverage top-tier methodologies, including probabilistic assessment and demand modeling, supporting multi-scenario planning. It also aids in crafting user-friendly dashboards tailored to the needs of various stakeholders.

Figure 2: Forecasting and demand planning entities from other leading economies.

The Benefits of Centralized Demand Planning

Six tangible benefits arise from a unified data structure and consolidated demand planning:

- Accelerated Localization: Enhanced demand visibility helps SOEs focus their localization efforts on key categories, providing the private sector with a clearer understanding of government priorities.

- Category Management: Consistent category delineation offers opportunities for consolidation, contingency development, and improved procurement performance, potentially leading to cost savings.

- Improved Data Accuracy and Transparency: Forecasting and validating demand models using various scenarios improves robustness and risk mitigation.

- Enhanced Trust: Increasing the reliability of SOE data fosters greater trust between market players.

- Increased Supplier Visibility: Effective production and capacity planning for suppliers boosts visibility of local content contributions and fair competition.

- Greater Control and Risk Management: Enhanced control of planning dimensions reduces costs and improves risk management.

As GCC countries aim to reshape their economies by fortifying local industries, governments and SOEs have a golden opportunity to attract the necessary investment to develop local industrial capabilities. In this scenario, centralized demand planning is indispensable.

Mehdi Kanso is a Partner at Kearney. Co-authors are Marcos Mayo, Gael Rouilloux and Igor Hulak.

The opinions expressed are those of the authors and may not reflect the editorial policy or an official position held by TRENDS.