DUBAI, UAE — Memories of the Global Financial Crisis have resurfaced in recent weeks as financial markets experience the worst banking sector turmoil since 2008.

The collapse of Silicon Valley Bank and troubles at Credit Suisse sparked turbulent trading activity, particularly in the bond market. As a result, US bond yields have tumbled, the future US rate trajectory has been adjusted sharply, and there is safe-haven demand for Japanese yen and gold.

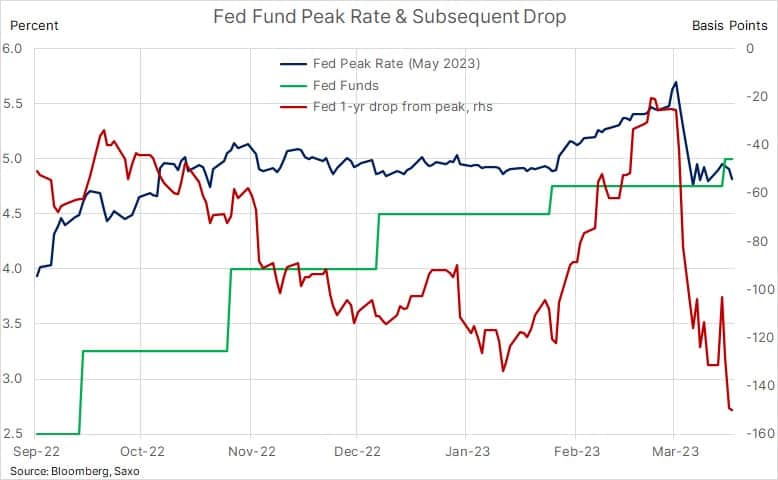

It remains uncertain whether the US Federal Reserve will focus on financial stability and abandon its fight against inflation. Following this week’s rate hike to 5 percent, the market now anticipates a 150-basis point rate cut before May next year. The most inverted front end of the US yield curve since 2001 signals an imminent rate cut, highlighting the pain inflicted not only on banks as liquidity tightens but also on consumers facing higher borrowing costs and the real estate sector grappling with growing pains.

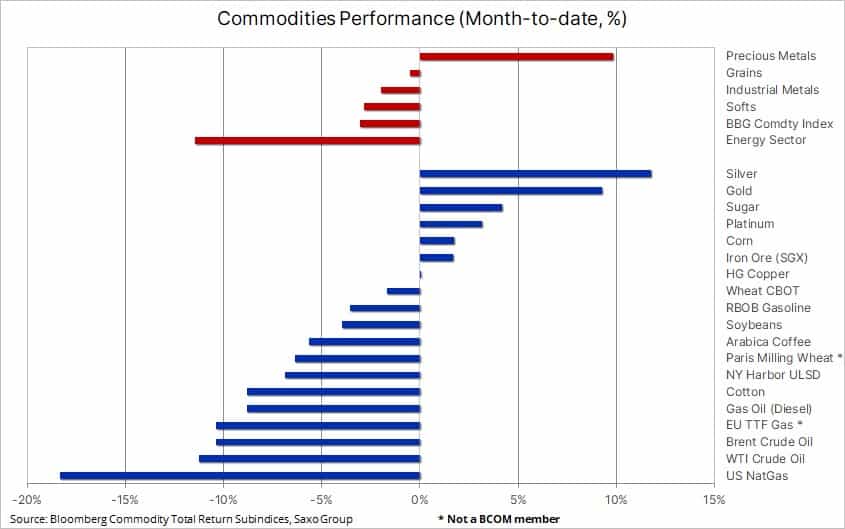

This month, the commodity market’s reactions to these developments have varied. Precious metals have rallied due to collapsing yields and safe-haven demand, while the energy sector has declined on growth and demand concerns. The strength of the moves, both up and down, has been influenced by the size of positions held by speculators.

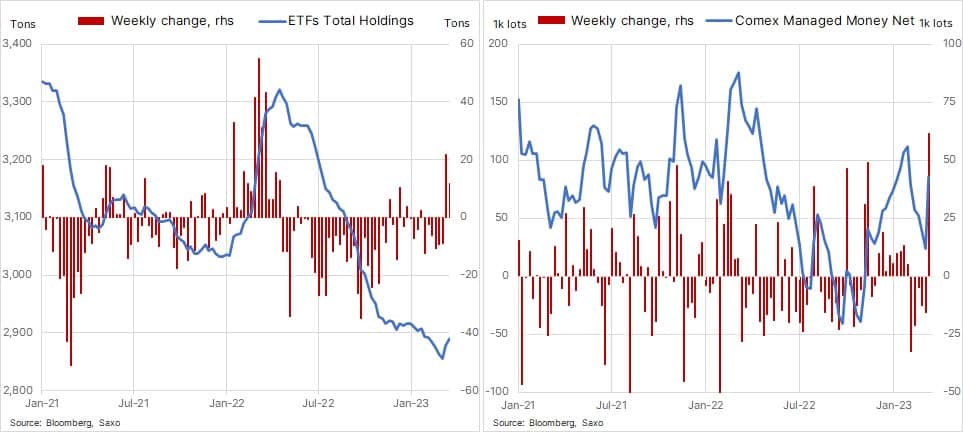

Gold and silver have benefited from a 3.5 percent drop in the dollar and a 110 basis point collapse in the two-year US government bond yield. The outlook for these precious metals remains positive, supported by falling yields and safe-haven demand driven by concerns in the banking and real estate sectors.

Copper is attempting a breakout, driven by lower stockpiles and demand from China. Trafigura and other major mining companies forecast that copper will surge to a record high this year as China’s rebound continues to deplete already low stockpiles.

Crude oil has been challenged by the continued loss of risk appetite. The banking crisis has particularly impacted the energy sector, with WTI and Brent crude oil down by over 10 percent and natural gas down nearly 20 percent. The market’s focus on financial stability may offset underlying strength in demand from China and a potentially weaker dollar supporting the growth outlook in emerging market economies.

Natural gas prices remain under pressure as the storage shoulder season approaches. Henry Hub natural gas in the US has fallen to a 30-month low near $2 per MMBtu, down about 80 percent from the $10 peak last August.

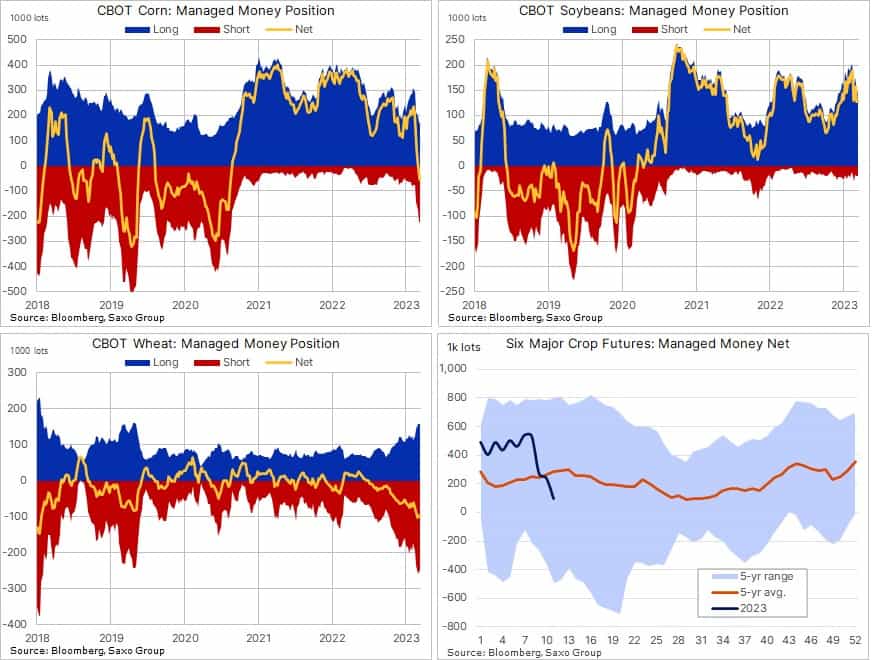

There has been a dramatic shift in hedge funds’ sentiment toward the grain sector, with the combined net positions in US grain and oilseed futures and options at their lowest since August 2020.

Ole S Hansen is the Head of Commodity Strategy at Saxo Bank.

The opinions expressed are those of the author and may not reflect the editorial policy or an official position held by TRENDS.