A glimpse into GCC’s financial evolution

As the winds of change blow, three major forces—regulation, consolidation, and digitization—are shaping the trajectory. These elements intertwine, creating a complex tapestry that defines success.

Tech-driven sustainability focus of banks

Financial institutions in the Gulf region are also focusing on sustainable practices like renewable energy investments, reducing their carbon footprint, and supporting sustainable businesses, say experts,

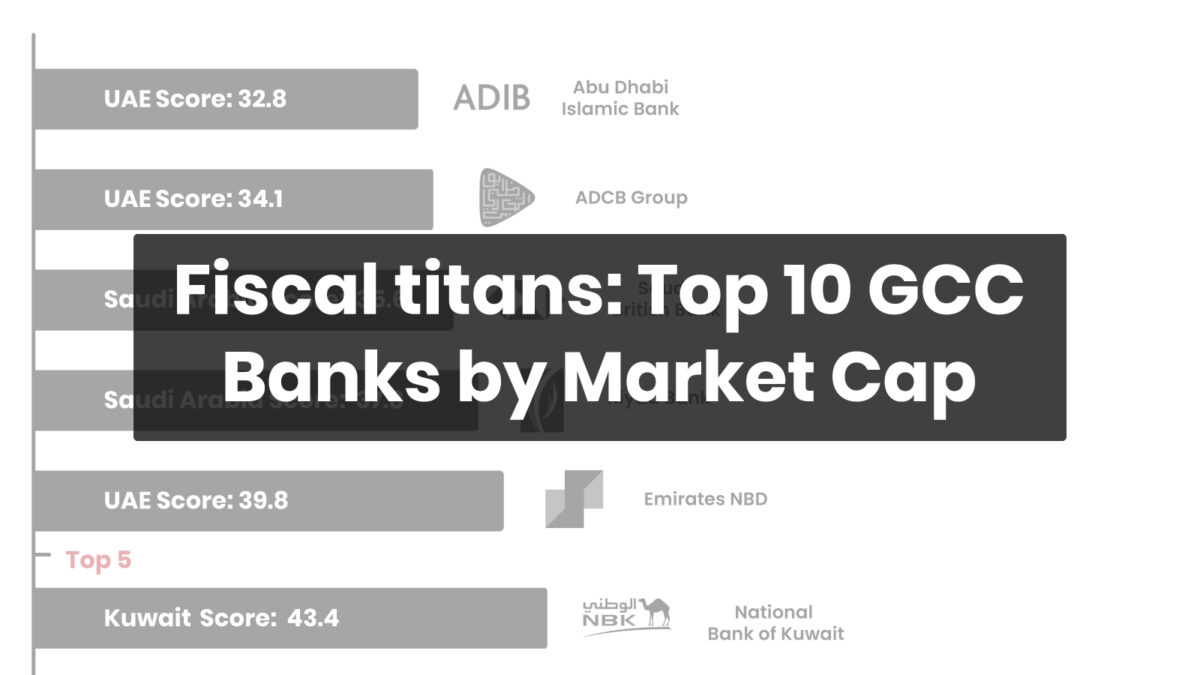

Three UAE lenders among top five GCC banks

Both countries attract a high level of foreign investment, which provides capital for their banking sectors. The UAE is the second-largest FDI recipient in the Middle East, and Saudi Arabia is the largest one in the region.

Crisis hits investments in MENA startups

While the startup ecosystem flourishes in the Middle East and North Africa region, concerns arise over the durability of investments and the ability of banks to sustain SME support amidst a global banking crisis.

GCC banking’s tech shift saves time, money

GCC banks started adopting online and mobile banking, and ATMs, in the 1990s and 2000s. More recently, they’ve integrated advanced technologies like AI, blockchain, and big data, enhancing customer service and fraud detection.

Strong economy, innovation shield GCC banks

GCC banks, which are recognized for their sophistication and maturity, have minimal exposure to the ongoing global crisis due to proactive administrations and robust regulations across the region, they add.

Rate rise boosts Gulf banks amid crisis

Despite global economic challenges such as the crisis, inflation, and high interest rates, the GCC banking sector has shown impressive growth and adaptability. Utilizing technology and responding to evolving market dynamics, it continues to thrive. According to Elham Mahfouz, CEO of the Commercial Bank of Kuwait, the region’s banks remain robust and resilient, unaffected by…

GCC digital banking targets $2trn with cloud services

GCC authorities, however, acknowledge the accompanying challenges and are developing regulations to enhance digital banking experiences. A key requirement is that Cloud Service Providers must reside in their service regions, overcoming which could significantly expand regional financial services and mark a new phase in GCC’s financial evolution.

Gulf banks witness continued growth in lending activities

The first quarter of 2023 experienced a surge in credit demand, except for a slight dip in Qatar. The latest reports suggested a record $1.87 trillion in GCC gross loans, a robust 3.2 percent quarterly increase, while net loans rose by a slightly smaller 2.8 percent due to higher provisions in Q4 2022.