Cairo, Egypt – Egypt signed a deal with the International Monetary Fund to increase an initial $3 billion loan package to $8 billion, the two sides said on Wednesday.

The agreement, announced by Egyptian Prime Minister Mostafa Madbouly and the IMF’s mission chief for Egypt, Ivanna Vladkova Hollar, came hours after the country’s central bank hiked interest rates and said it was floating the pound.

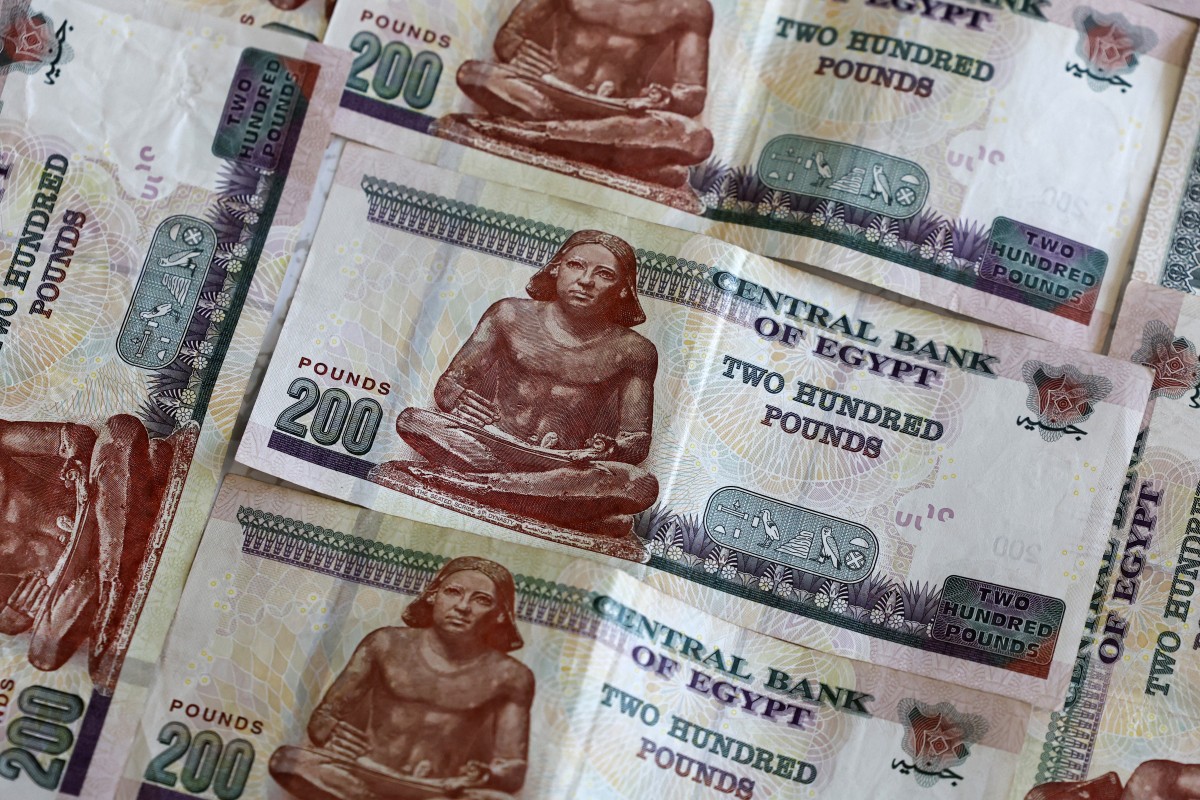

By the time the markets closed on Wednesday, the Egyptian pound was trading at a record low of around 50 pounds to the US dollar, after more than a year of a stabilized official exchange rate of around 30.9 against the greenback.

Hollar welcomed Egypt’s measures as “decisive steps to move to a flexible exchange rate system, starting with unifying the exchange rate between the official and parallel market rates.”

She also said the move would “help increase the supply of foreign currency,” after months of severe shortages that caused a surge in the parallel market rate and raised fears Cairo would be unable to service its massive foreign debt bill.

At a surprise monetary policy meeting Wednesday, the central bank committed to “allowing the exchange rate to be determined by market forces,” saying in a statement that “the unification of the exchange rate is crucial.”

Amid dire foreign currency shortages, the parallel market rate had surged to 70 pounds to the dollar earlier this year, sending consumer prices soaring in the import-dependent country.

Since the most recent economic crisis began in early 2022, Egypt has been buckling under rampant inflation, which reached a record high of nearly 40 percent last August.

In an attempt to rein in inflation, the central bank also raised its key deposit rate by six points on Wednesday, to a record high of 27.25 percent.

The central bank described the move as an attempt to “accelerate the monetary tightening process in order to fast-track the disinflation path and ensure a decline in underlying inflation”.

Egypt has been in talks with the International Monetary Fund over increasing the value of a $3 billion loan facility already agreed with the lender.

A fully flexible exchange rate and a tighter monetary policy were among the conditions attached by the IMF and loan tranches had been repeatedly delayed until the reforms go ahead.

Prior to Wednesday’s announcements, Egypt had already devalued its currency three times in recent years. But it had held back from fully floating the pound, citing concerns for the impact on Egyptians, two-thirds of whom live below or right on the poverty line.

Analysts say Cairo has been emboldened to bite the bullet on exchange rate reform by the announcement late last month of $35 billion in foreign direct investment by the United Arab Emirates.

A first tranche of $15 billion has already been deposited with the balance due by May, Egyptian President Abdel Fattah al-Sisi said.