The UAE and Saudi bourses are likely to remain range-bound at the current levels for the remainder of 2022 as the factors that led to the rally since the start of the year, including oil price and banking sector growth, have started pulling back or have peaked, Junaid Ansari, Head of Investment Strategy & Research, Kamco Invest, told TRENDS.

Factors such as oil price and its benefits to oil importers have already reflected on the economic prospects of Saudi Arabia and Abu Dhabi, with further upside to oil prices seems limited, he stated.

“However, there is generally a lag in the transfer of oil wealth to the investment in the non-oil sectors, which will support growth in the private sector in the months and years ahead. This provides a very strong support to the markets in general,” said Ansari.

Furthermore, higher interest rates are expected to benefit banks in the region that account for the second-biggest sector in the region by market cap.

“With lending remaining elevated, this will translate into higher dividends,” he added.

In its latest report, Kamco Invest said that stock exchanges in the Gulf Cooperation Council recorded their second biggest monthly decline in almost six years, as investors booked profits on elevated valuations.

MSCI GCC Index, which captures the performance of indexes across the region, fell 7.5 percent in May. Nonetheless, the GCC aggregate index remained in the green zone regarding year-to-date (YTD) performance, up 12 percent, with gains for all the seven benchmarks.

Elsewhere, Dubai posted the biggest drop of 10 percent, followed by Bahrain and Kuwait with declines of over 6 percent. Saudi Arabia’s Tadawul dropped 5.9 percent in May.

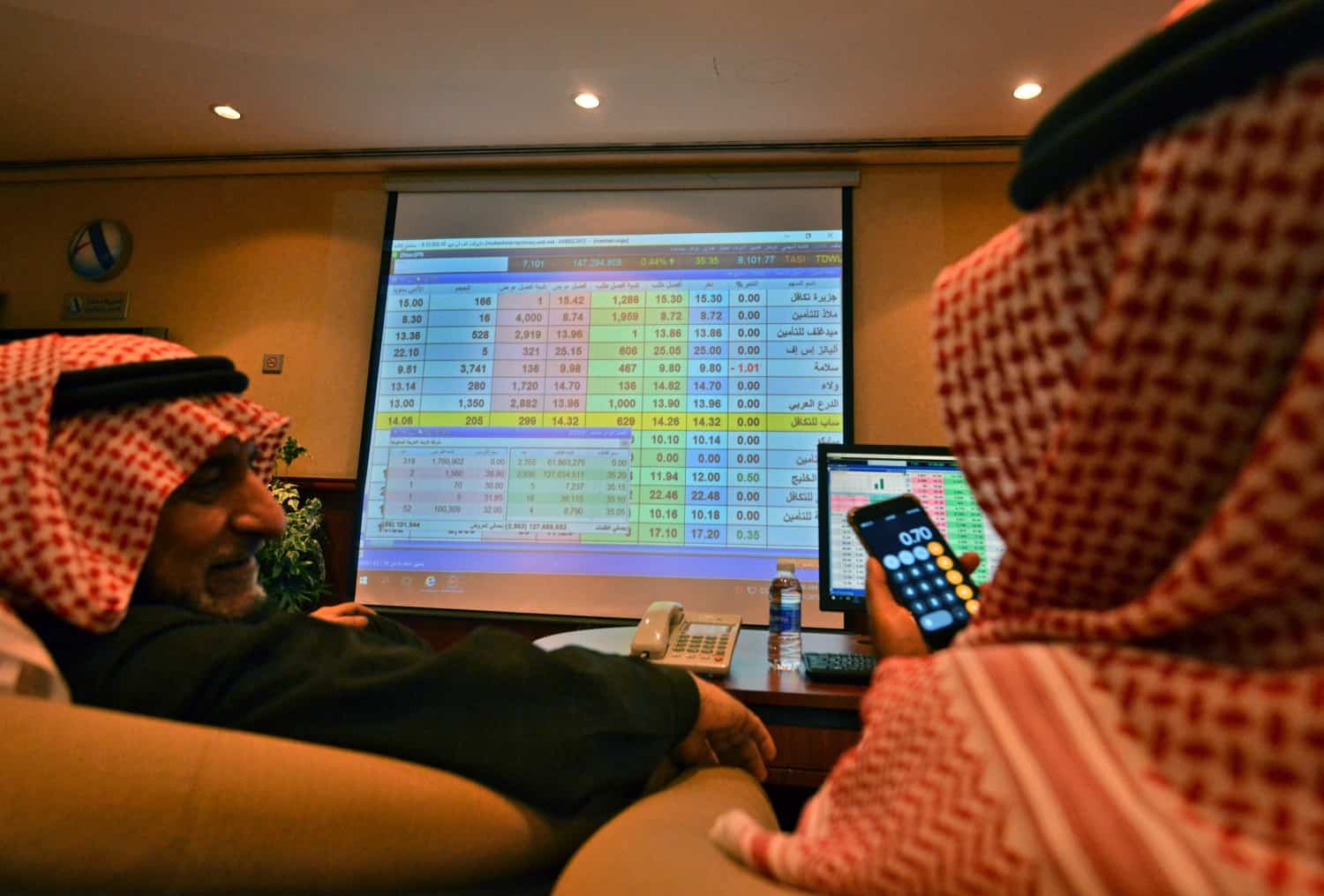

In a recent report, Jadwa Investment said that local investors succumbed to risk-off sentiment seen around the world during May, as Tadawul All Share Index (TASI) declined six percent month-on-month, the first monthly decline since November last year.

The selloff was in line with most global and regional markets. Despite this, TASI was still up 13 percent year to date.

“We remain confident that the combination of elevated oil prices together with a pipeline of initial public offerings will be supportive of further yearly gains,” the brokerage noted.

According to Kamco’s Ansari, emerging markets tend to attract a bigger share of capital flows when advanced markets are seeing a decline. The GCC region has witnessed this phenomenon since this year started.

The analyst noted that earnings quality and regulatory developments are seeing significant improvement in the region, which has attracted inflows.

The key downside risk will be the volatility in oil prices, and if there is a higher-than-expected decline, then markets may feel the heat, he said.

“Risks such as COVID-19 would have a global impact, especially with adequate vaccine access across the globe, but the threat of a looming food scarcity would pose renewed unexpected risks. This situation gets exacerbated with the excessive dependence of GCC countries on food imports, although better fiscal position may offset the impact.”

That said, rising interest rates would be a considerable challenge to the private sector in the region, Ansari said, adding this is one of the key reasons companies are flocking to initial public offerings (IPOs) to lock in better valuations currently offered in the market.

When asked about sectors likely to perform better in Saudi Arabia and UAE, Ansari said that the food and beverage (F&B) and consumer staples sectors are predicted to see strong support going forward backed by higher earnings, as seen from the returns during the pandemic amid elevated food prices.

In addition, higher oil prices would support companies in the upstream energy sector, particularly in Saudi Arabia and Abu Dhabi. Listed utilities are also expected to benefit as the higher input costs are passed on to the end consumers.

The analyst said that bank stocks are forecast to remain resilient as higher interest rates would translate into higher Net interest margins (NIMs).

Ansari said that environmental, social, and governance (ESG) regulations are a top priority for regulators not only in the region but also globally. Therefore, the brokerage expects clarity and new rules governing ESG adoption in the near term.

Several new products are anticipated in Saudi Arabia and UAE to bring them closer to advanced and other more mature stock markets. These new products would also see related regulations by the lawmakers.

In addition, rules governing investor protection and greater transparency, mainly related to cryptocurrency, will extensively expand in the region, Ansari concluded.