Ankara, Turkey – The Central Bank of the Republic of Turkey decided on Thursday to maintain the interest rate at 9 percent for a second straight month.

Inflation rates and trends have started to improve in Turkey, supported by the comprehensive policies the country is pursuing, the bank pointed out in a statement.

It affirmed that all tools will be decisively utilized, pending construction of solid indicators that show permanent reduction of inflation, in a step that is consistent with the key objective of price stability.

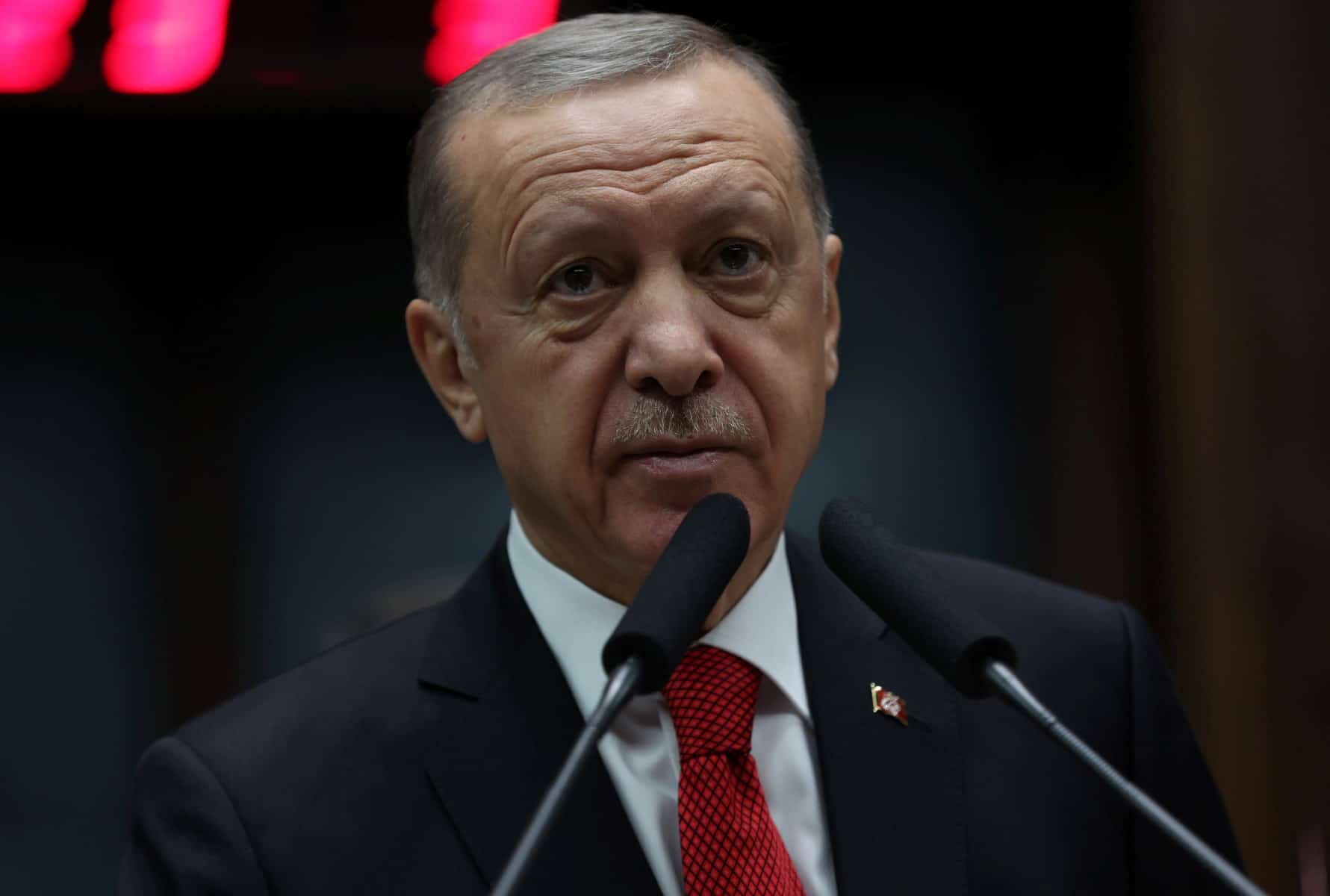

In the past, Turkish President Recep Tayyip Erdogan hoped that the bank’s monetary policy committee would embark upon reducing interest rate, and go down the price to single digits by the end of 2022.

Erdogan faces tight elections in four months in which the cost-of-living crisis is a top concern. He could soon urge more rate cuts as part of his unorthodox stance that policy easing also lowers prices, analysts quoted by Reuters said

A previous easing cycle in 2021 triggered a currency crash, which fueled a wave of inflation that peaked in October at a 24-year high above 85 percent. It fell to 64.3 percent in December, owing largely to a favourable base effect.

Erdogan’s economic programme has prioritised rate cuts to boost production, employment and investment.