BAGHDAD, IRAQ – Iraq’s prime minister said on Monday the country’s central bank governor had been relieved of his duties as the local currency continues to fall against the dollar.

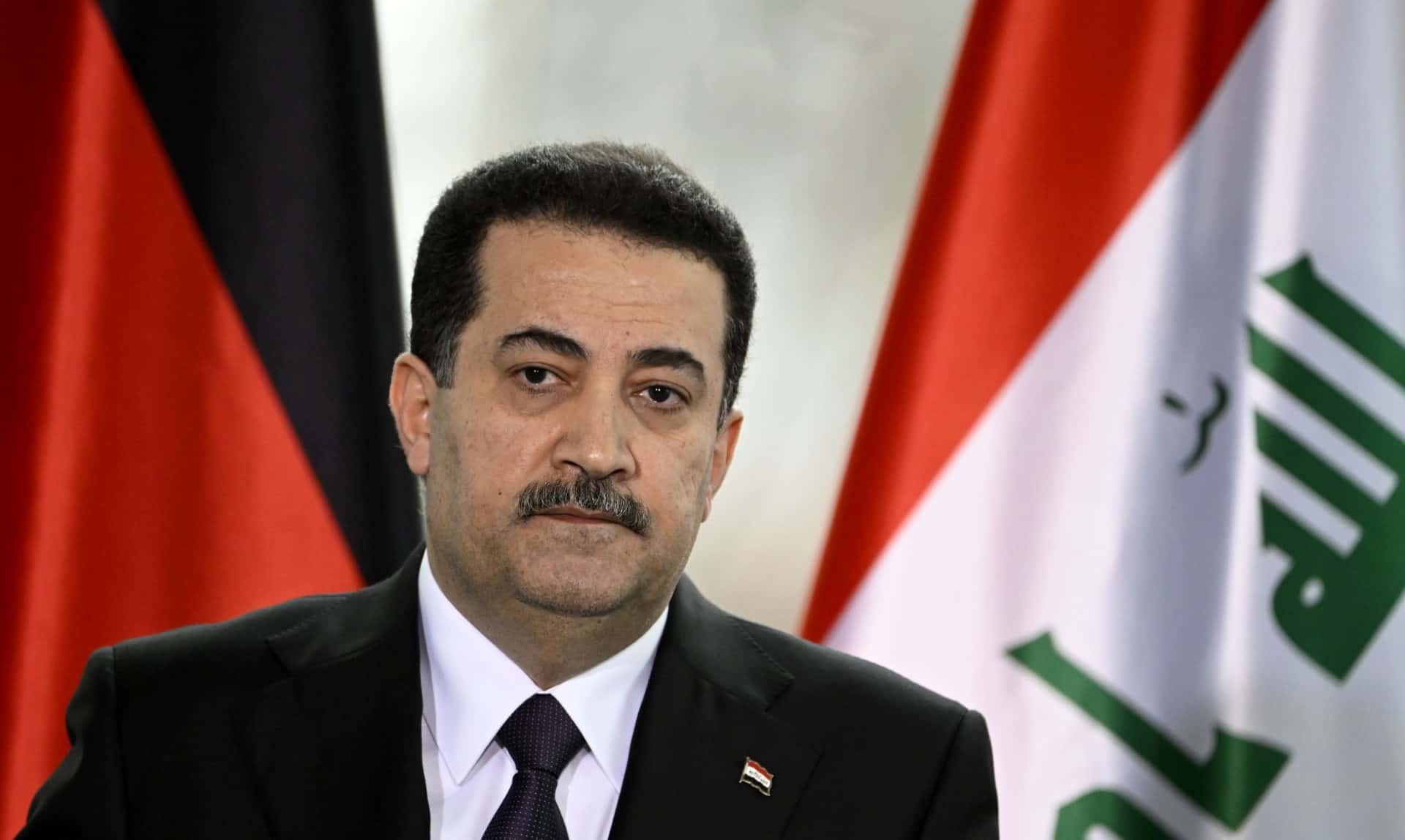

“Today, the central bank governor’s request for discharge was approved, as was the request for retirement by the president of the Trade Bank of Iraq,” Prime Minister Mohammed Shia al-Sudani said during a televised address.

Mustafa Ghaleb Mukhif’s departure as head of the Central Bank of Iraq comes after the market value of Iraq’s dinar fell against the greenback in recent months.

Without identifying the successors for the key posts, Sudani said they were “known for their experience, their abilities and their integrity”.

While an official exchange rate is set by Baghdad at 1,470 dinars to the dollar, the market value of the currency has dropped to 1,620 dinars since mid-November, according to the official INA news agency.

Analysts and officials say the drop in value coincides with efforts to make Iraq’s banking system compliant with the international electronic transfer system, known as SWIFT.

Muzhar Saleh, an adviser to the prime minister, previously told AFP these steps, which began in mid-November, were required to access Iraqi funds held in the United States.

Iraqi banks must now make “transfers on an electronic platform, verify the requests… and if it (the US Federal Reserve) has doubts, it blocks the transfer”, he explained.

Banks in the oil-rich country have an estimated US$100 billion in funds held at the US Federal Reserve.

However, since the introduction of the SWIFT mechanism, US regulators have declined 80 percent of requests from Iraqi banks over suspicions about the funds’ final recipients, according to Saleh.

As a consequence, dollars have become more sought-after in Iraq and risen in value against the dinar, he said.

The adoption of the SWIFT system was supposed to allow for greater transparency, tackle money laundering and help to enforce international sanctions, such as those against Iran and Russia.

But some officials close to Tehran, such as Hadi al-Ameri, the head of the Iraqi parliament’s pro-Iranian Fatah Alliance, say this is a deliberate policy by Washington to “starve people”.