KUWAITY CITY — The GCC region witnessed a surge in project awards during the first quarter of 2023, despite the global economic challenges of elevated inflation and the Ukraine-Russia conflict.

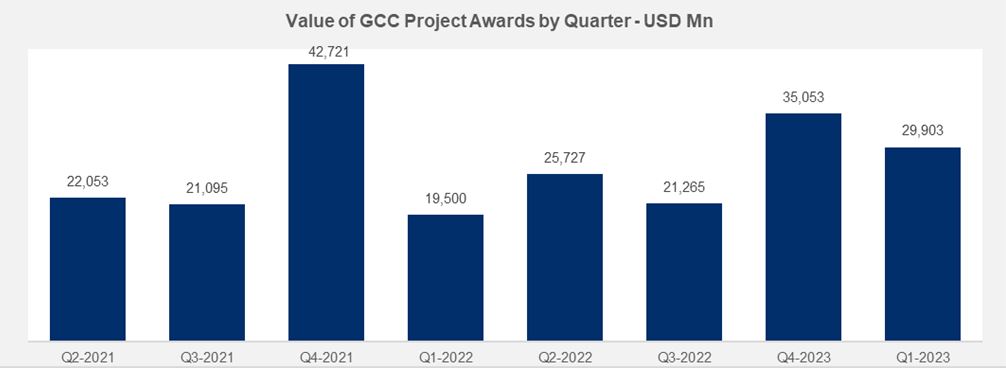

According to Kamco Invest’s report, GCC contracts’ total value awarded increased by 54.7 percent year on year to reach $29.9 billion, with all GCC project markets except Bahrain recording year-on-year growth.

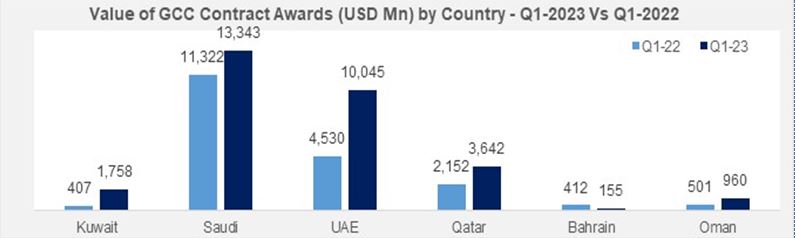

Saudi Arabia was the largest projects market in the GCC, recording 17.9 percent growth during Q1-2023, while the UAE’s contract awards more than doubled to reach $10 billion during the quarter.

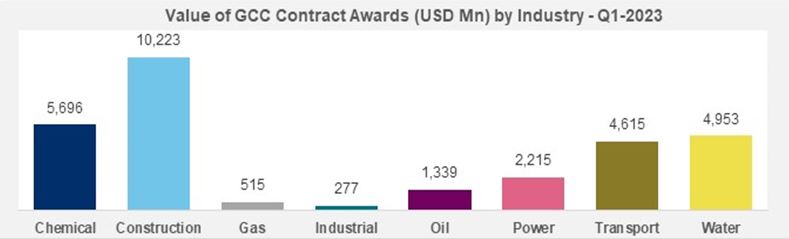

The report highlighted that the Chemical sector witnessed the biggest increase in project awards, recording a year-on-year increase of $4.7 billion. The growth in GCC project awards has been fueled by the countries’ determination to diversify their economies, backed by investments in industrial sector projects.

The GCC’s construction sector is expected to take the lion’s share of project awards in 2023, with the Water, Petrochemical, and Power sectors expected to perform very well during the year.

Saudi Arabia

Saudi Arabia remained the largest projects market in the GCC during Q1-2023. The country’s project awards recorded 17.9 percent growth during the quarter to reach US$ 13.3 billion as compared with US$ 11.3 billion in Q1-2022.

Comparatively, the UAE project awards more than doubled to reach US$ 10.0 billion during the quarter while Kuwait’s contract awards reached US$ 1.8 billion during Q1-2023 as compared with US$ 407 million in Q1-2022 recording the highest percentage y-o-y contract awards increase in the region during the quarter.

In terms of sector classification, the Chemical sector witnessed the biggest increase in the value of projects awarded during the year recording US$ 4.7 billion y-o-y increase in new contract awards to reach a total of US$ 5.7 billion during Q1-2023.

The report revealed that Saudi Arabia alone accounted over 44.6 percent of the contracts awarded in the GCC region during Q1- 2023, while Saudi Arabia, UAE and Qatar combined represented 84.1 percent of the overall projects in the GCC.

Saudi Arabia’s growth in contracts during the quarter was mainly fueled by Saudi Aramco bumper profits during FY-2022 which reached US$ 161.1 billion. It is reported that Aramco’s Capex is expected to grow 20 percent during 2023 as the energy giant undertakes its mission to build its long-term oil and gas production potential.

Economic diversification

The growth in the GCC project awards during this quarter has been partly fueled by the determination of the GCC countries to diversify their economies away from hydrocarbons.

GCC member states have backed and invested in projects in the industrial sector such as aluminum, steel, and other industrial equipment manufacturing projects. For instance, Saudi Arabia plans to invest US$ 453.2 billion in its National Industrial Development & Logistics Program by 2030.

The UAE has 11 initiatives in its industrial strategy which covers 11 sectors and forecasts its Industrial sector’s GDP contribution to reach US$ 81.7 billion by 2030.

In Kuwait, the government streamlined 164 programs and projects for its national industrial strategy with US$ 100 billion earmarked for development through public-private partnerships.

Projects in the region

According to MEED Projects, GCC projects could reach an aggregate of US$ 110 billion in 2023 sustained by elevated oil prices and high energy demand around the world.

All GCC countries are expected to see growth in contract awards with the possible exception of Qatar which may see dip in contract awards during the year.

In terms of sectors, GCC’s Construction Sector is expected to take the lion’s share (58 percent) of project awards in the region during 2023. Saudi Arabia and the UAE Construction Sector has an estimated US$ 1.36 billion worth of projects under development in 2023 according to real estate experts CBRE.

- Highlights

- GCC project awards increased by 54.7% YoY in Q1 2023, reaching $29.9 billion.

- All GCC project markets except Bahrain recorded YoY growth.

- Saudi Arabia remained the largest projects market in the GCC, with project awards growing by 17.9% in Q1 2023.

- The Chemical sector saw the biggest increase in project awards, recording a YoY increase of $4.7 billion.

On the other hand, the total value of real estate projects which are currently planned or under construction in the GCC region reach at an estimated US$ 1.36 trillion.

However, new project awards in the Water, Petrochemical and Power sectors are expected to perform very well during the year. In terms of planned contracts during the year, Qatar’s North Field South development project for two LNG trains clinches the top spot in terms of estimated value with US$ 6 billion followed by UAE’s Al Marjan multipurpose integrated resort which has an estimated value of US$ 2.5 billion. Of the 10 top valued projects planned for the year, six are expected to be awarded in Saudi Arabia, three in the UAE and one in Qatar.