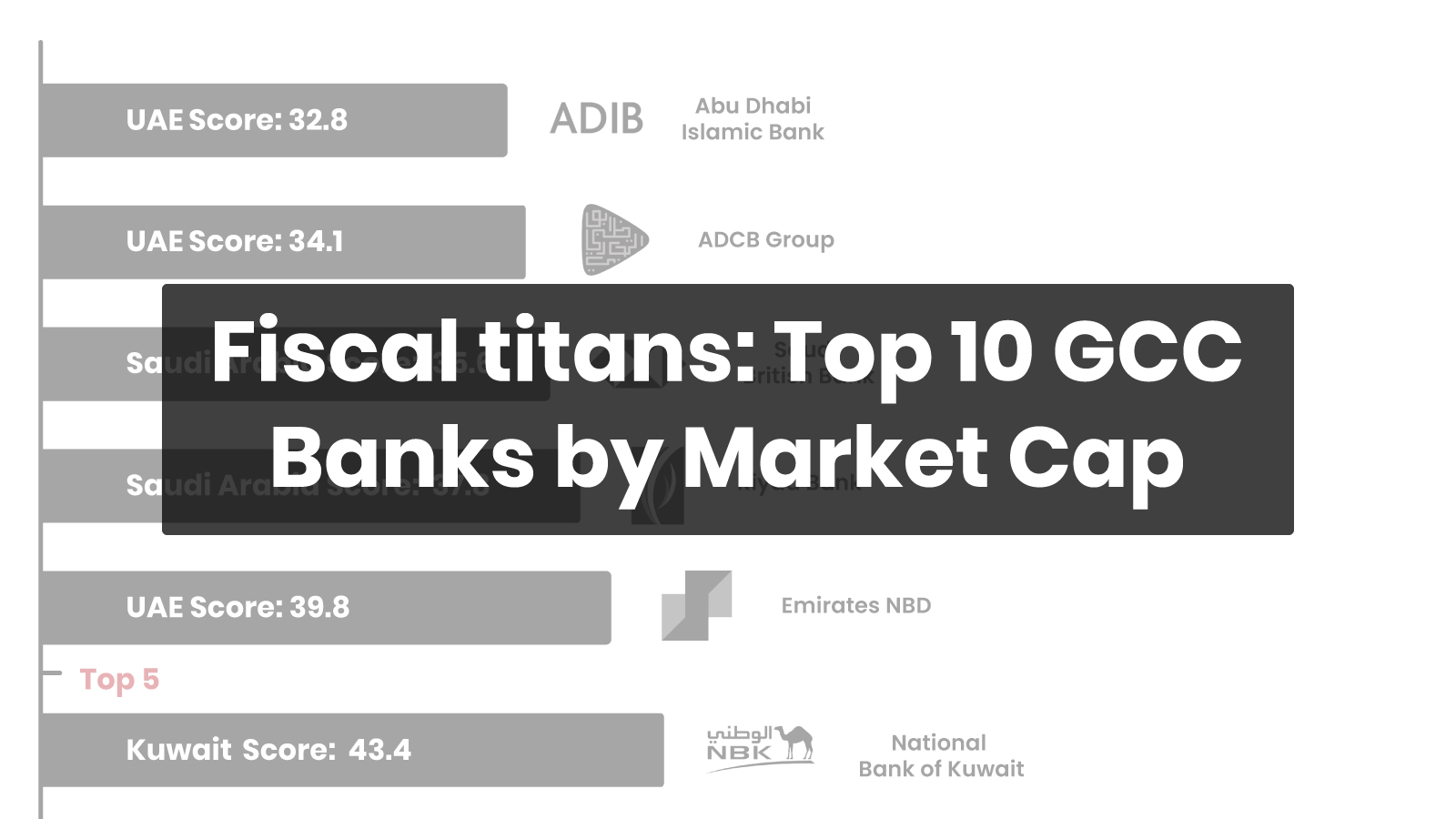

Dubai, UAE — The United Arab Emirates (UAE) and Saudi Arabia dominate the Gulf Cooperation Council (GCC) banking sector as both have large and growing domestic markets, which provides a strong base for their banking sectors. Both countries attract a high level of foreign investment, which provides capital for their banking sectors. The UAE is the second-largest recipient of foreign direct investment (FDI) in the Middle East, and Saudi Arabia is the largest recipient of FDI in the Middle East. In 2022, the UAE’s banking sector had assets of over $1.5 trillion, and Saudi Arabia’s banking sector had assets of over $1 trillion. Here is a look at top 10 GCC banks by Market Cap and the top 10 Islamic banks in the region: