Dubai, UAE – Sales of properties worth more than $1.35 million and $2.70 million in Dubai hit record levels in 2023, reaching 10,296 and 3,806, up 54.5% and 68.4% from a year earlier, respectively, says CBRE in its study.

Off-plan sales in both segments of the market have been the primary drivers of activity, where, in the $1.35 million and $2.70 million segments of the market, off-plan sales accounted for 67.2% and 70.8% of total transaction volumes, respectively.

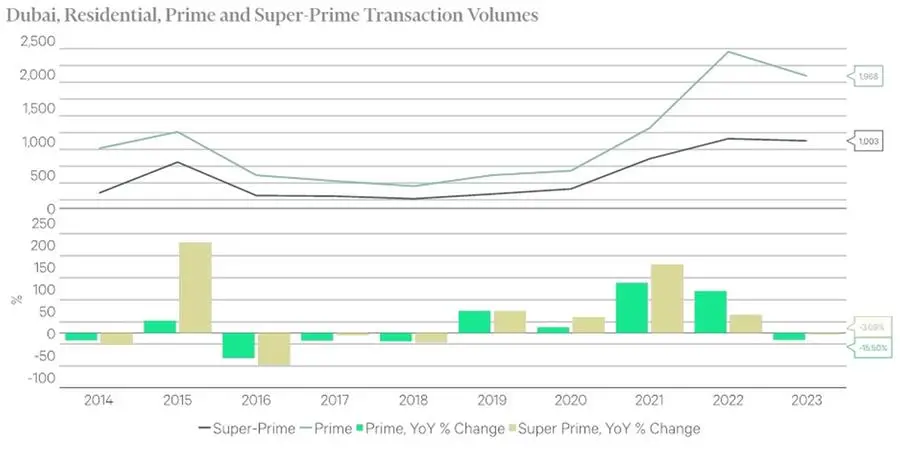

“In 2023, the total volume of sales transactions within the prime segment of the market declined by 15.5% compared to the year prior, reaching a total of 1,968,” the study says. “Over this period, within the super-prime segment of the market, the number of transactions stood at 1,003, marking a decline of 3.1% compared to a year earlier.”

Among the communities tracked by CBRE, in 2023, Palm Jumeirah registered the highest volume of transactions in both the prime and super-prime market segments, with the total number of units sold worth more than $1.35 million standing at 963 and the total number of properties sold above $2.70 million reaching 593, over the same period.

“In both the prime and super-prime segments of the market, these slowdowns in activity levels have been primarily underpinned by softening in off-plan sales, whilst secondary market sales registered significant increases,” the study points out. “Despite strong levels of demand given the mature nature of prime and super-prime locations, much of the available supply in the market has already been absorbed, and new launches have been very limited in recent months, this backdrop has led to a softening in transaction levels, in 2024, this is something we expect will be the case in the broader AED5m+ and AED 10m+ markets.”

Source: CBRE Research/ REIDIN

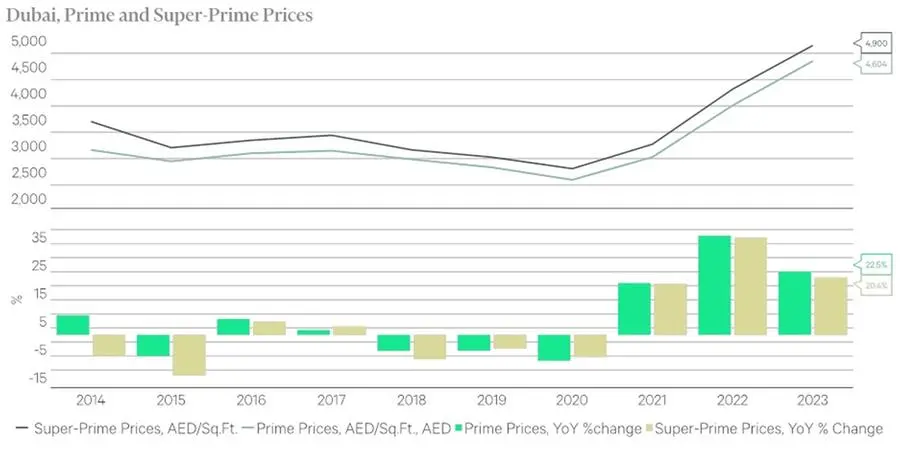

PRIME AND SUPER-PRIME PRICE GROWTH LIKELY TO REMAIN STRONG

As at Q4 2023, average prices within the prime segment of the market stood at AED 4,604 per square foot, marking an increase of 22.5% from a year earlier, the study finds.

“The growth has been underpinned by significant price growth in the likes of Jumeirah Bay Island and District One, where average prices grew by 35.6% and 27.2% year-on-year,” says the study. “More so, in Q4 2023, the average sales value of prime residential assets within the communities that CBRE monitors reached AED 28.3 million.”

Looking at the super-prime market segment, the study finds that average prices registered a growth rate of 20.4% in the year to Q4 2023, reaching AED 4,900 per square foot.

“Over this period, Jumeirah Bay Island and District One recorded the most significant increases in their average sales rates of 28.5% and 22.4%, respectively,” says the study. “Super-prime units within selected submarkets monitored by CBRE registered average selling prices of AED 34.1 million in the last quarter of the year, supported by high-value transactions on Emirates Hills and Jumeirah Bay Island.”

“In the year ahead, we expect that given the lack of new supply, price growth in the prime and super-prime segments of the market are likely to remain relatively strong, although we do expect the rate of price growth to taper off somewhat slightly,” Taimur Khan, Head of Research, MENA at CBRE in Dubai, says.

S