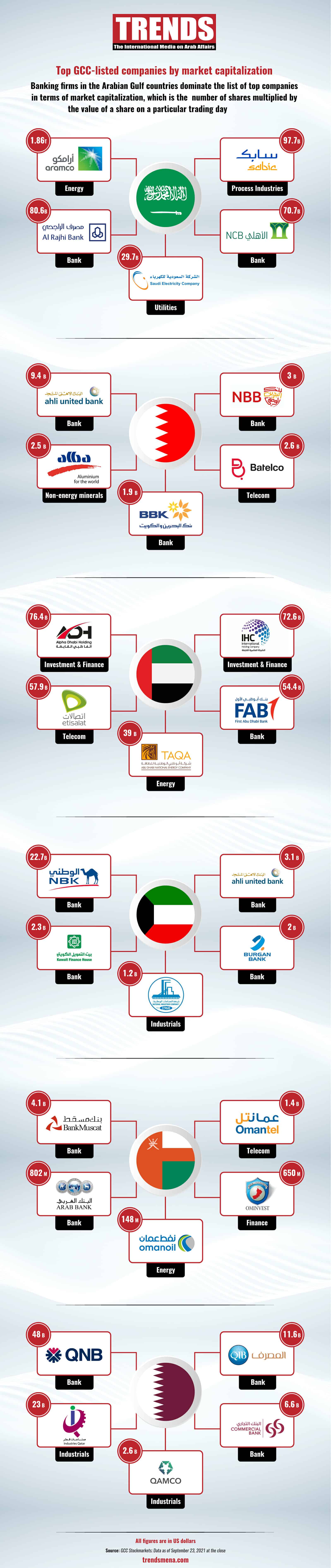

Banking firms in the Arabian Gulf countries dominate the list of top companies in terms of market capitalization, which is the number of shares multiplied by the value of a share on a particular trading day.

Saudi Arabia, which is home to nearly 30 percent of the GCC’s total banking assets and the largest in terms of market capitalization, is leading from the front.

Al Rajhi Bank and National Commercial Bank have the market capitalization worth $80.65 billion and $70.72 billion respectively.

The market capitalization of the UAE’s First Abu Dhabi Bank stands at $54.4 billion, according to the data available at GCC stock markets as of September 23, 2021.

Qatar’s QNB reported its market capitalization at $48 billion, while Qatar Islamic Bank was worth $11.6 billion.

In the energy sector, Saudi Aramco was much ahead of others with $1.862 trillion, according to the September 23 GCC stock market data.