Abu Dhabi and Egypt have discussed mutual relations and cooperation for investments from both sides as Egyptian officials visited the emirate, said local reports on Thursday, October 7.

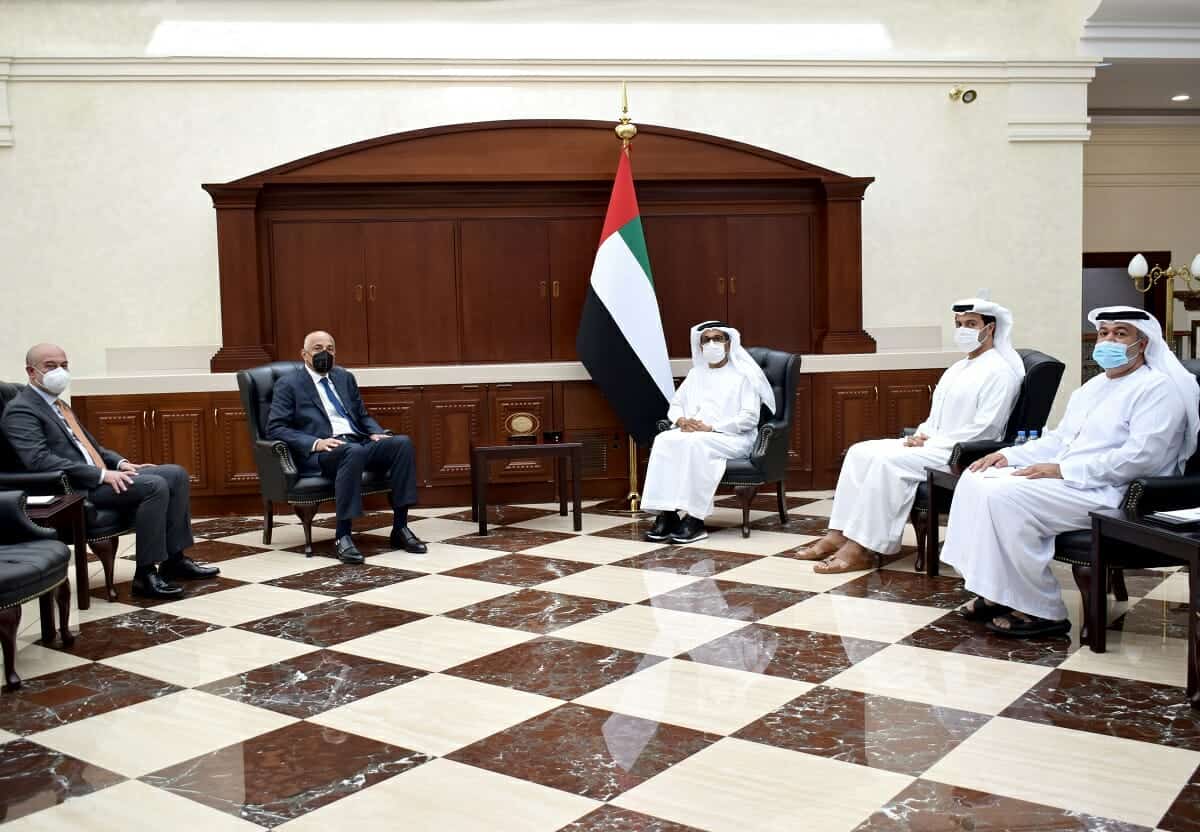

Abu Dhabi Fund for Development Director-General Mohammed Saif Al Suwaidi received the delegation from the Central Bank of Egypt, said the local reports.

It was said to have been led by the bank’s Governor Tarek Hassan Amer.

During the meeting, they explored bilateral relations and economic cooperation, among other things.

Al Suwaidi emphasized that the delegation’s visit to ADFD was a great opportunity for dialog and discussion on mechanisms to future cooperation and potential economic opportunities deemed as a national priority by the Egyptian government.

He reiterated ADFD’s vision to continue its developmental role by analyzing investment opportunities at the Egyptian central bank and utilizing the fund’s available investment tools to support the Egyptian government in the pursuit of its future aspirations.

Amer, in turn, commended the efforts by the UAE, represented by the ADFD, to help the Egyptian government achieve financial and economic stability.

He also showcased reform programs and legislative measures taken by the Egyptian government to help create a more conducive investment environment.

Since it commenced its activities in Egypt in 1974, ADFD has funded more than 75 strategic projects in the country with a total value of approximately AED3.3 billion (around $900 million) in projects spanning several sectors.

The fund also reportedly owns an 84.3 percent stake in the Abu Dhabi Tourism Investment Company in Egypt.