Rising inflation rates are one of the most pronounced effects of the pandemic. The Gulf Cooperation Council region is also experiencing a surging inflation rate.

Amid the anxieties associated with high inflation, experts have said that such rates are still “not intensive” and can be tamed. And one of the ways to taming the inflation monster is to raise interest rates.

The inflation in the US, the world’s largest economy is at its 40-year high. Expectedly, the Federal Reserve raised the interest rate recently and could repeat it again in the coming months.

Now, most GCC currencies are pegged to the US dollar. A currency peg means that the US Federal Reserve is in charge of establishing policy for the GCC member states. As a result, GCC central banks hike interest rates if the Federal Reserve does so. They might need to do so several times a year, according to experts.

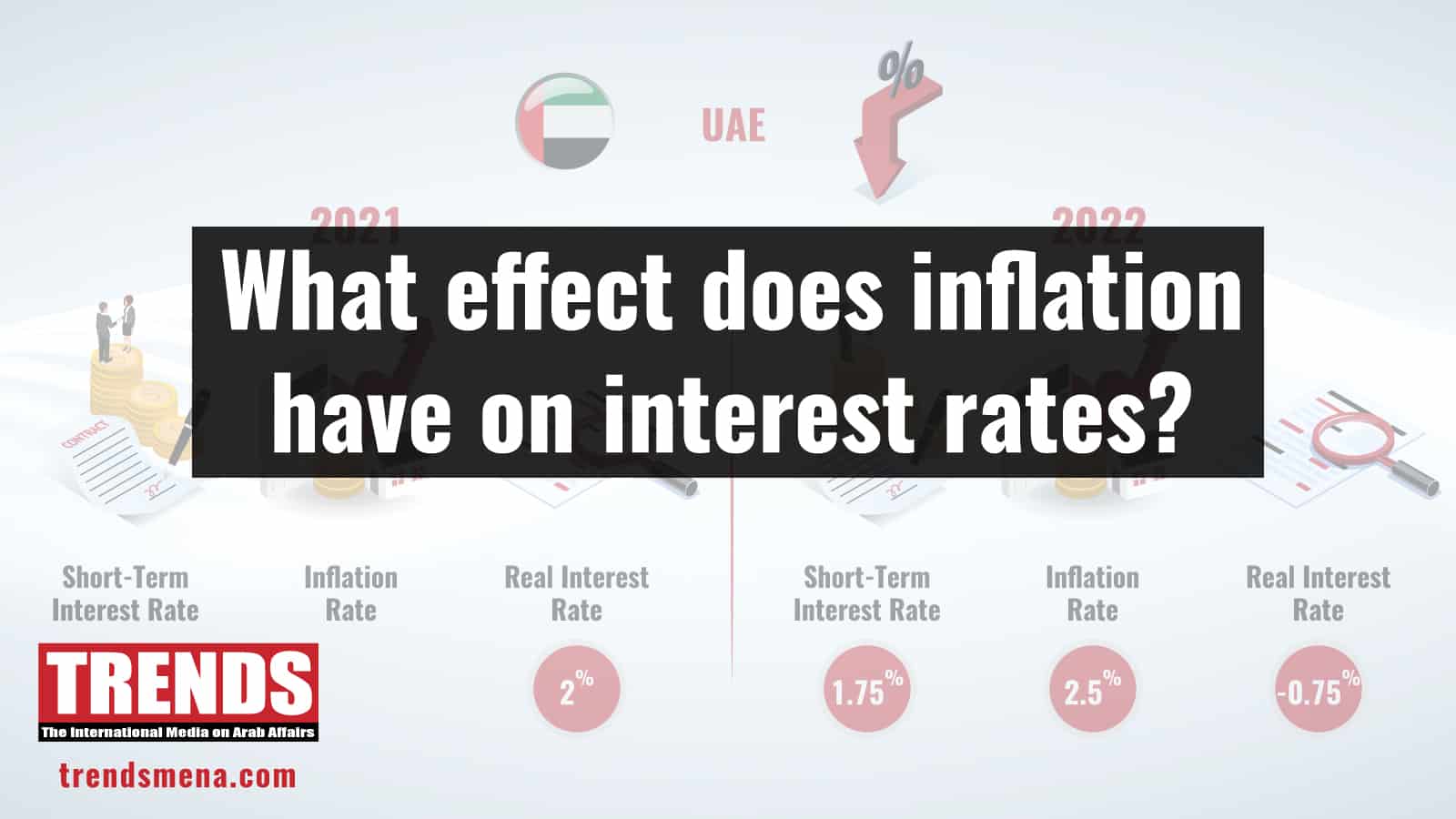

TRENDS takes a look how inflation rates have affected interest rates in the GCC countries.