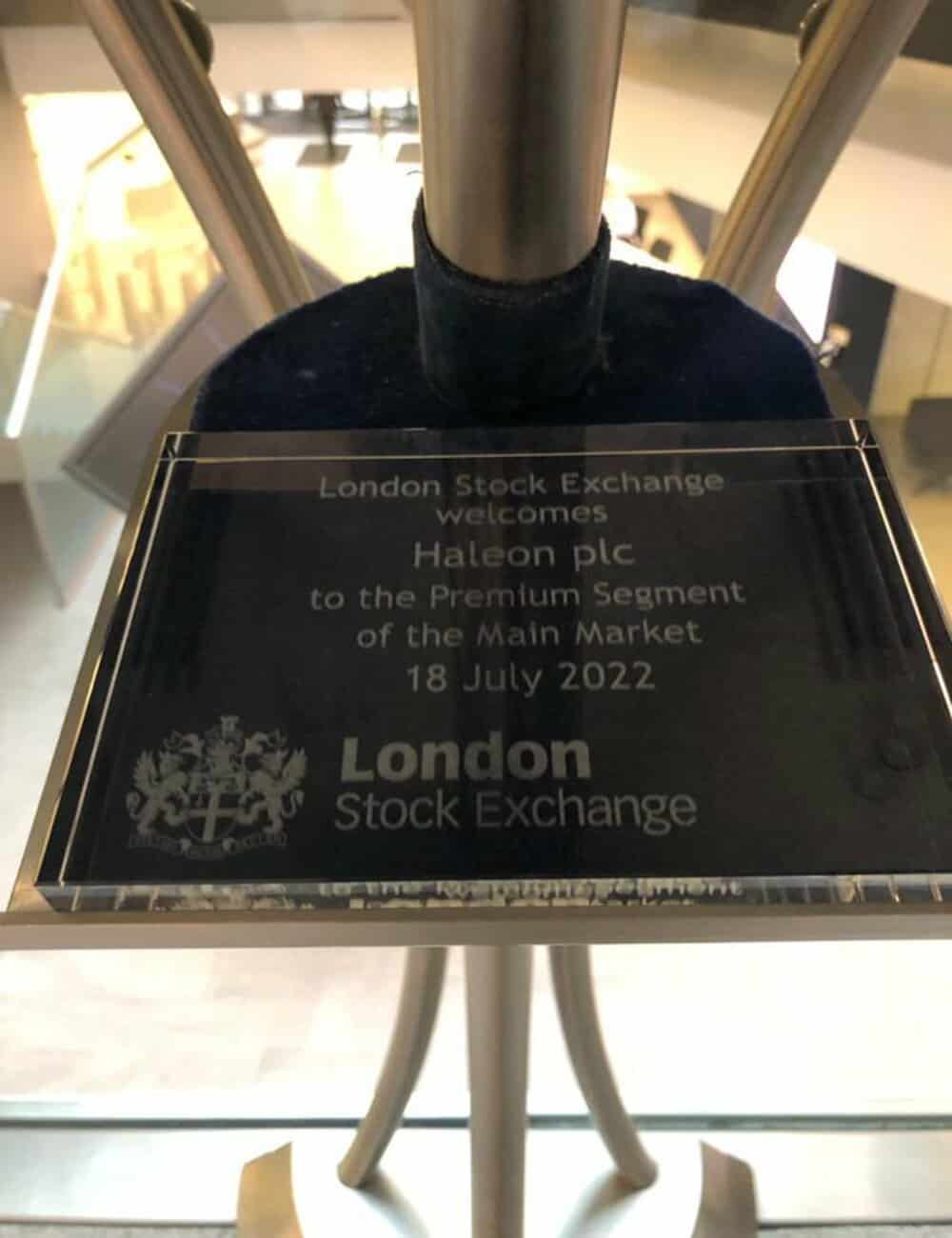

Haleon, the consumer healthcare unit spun off by British drugs giant GlaxoSmithKline, was worth around £31 billion ($36 billion) when it began trading in London on Monday.

The new company — which owns brands including Sensodyne toothpaste, pain relief drug Panadol and cold treatment Theraflu — was worth lower than an expected £40 billion, with its shares down five percent.

The major strategy shift by GSK chief executive Emma Walmsley to focus on GSK’s core pharmaceuticals business comes after she faced intense activist shareholder pressure over its delays in producing Covid jabs and treatments.

“It’s day one of our new era and our new purpose: we’re now 100% focused on biopharma innovation, uniting science, technology and talent to get ahead of disease together,” GSK wrote on Twitter.

GSK’s share price tumbled 20 percent in early London trading following the demerger.

“For Haleon, there’s no doubt this is an extremely challenging time to come to market, with this year’s equity market volatility,” noted Victoria Scholar, head of investment at Interactive Investor.

“It is also a challenging time for the consumer health sector, given that inflation is close to double digits in the UK and in the US.”

The consumer healthcare division, whose portfolio of products includes also Centrum multivitamins and anti-inflammatory Voltaren, generates annual sales of about £10 billion.

GSK, which owned 68 percent of Haleon, plans to retain six percent of the group.

US pharmaceutical titan Pfizer has said it plans to sell its 32-percent minority stake.

Walmsley, who had led the consumer unit prior to her promotion as head of GSK in 2017, sees more long-term value in the demerger than a sale.

However at the start of the year, GSK rejected a £50-billion bid for the unit from consumer goods titan Unilever.

“GSK shot themselves in the foot by not accepting (the bid),” Michael Hewson, chief market analyst at CMC Markets UK, told AFP on Monday.

At the same time, “£30 billion is still a pretty decent valuation given the cost-of-living crisis”.

GSK future

Walmsley, part of a group of less than 10 women chief executives running companies on London’s top stock market index, the FTSE 100, has described the demerger as the group’s most significant corporate change in two decades.

Alongside the demerger, GSK is expanding further into the field of vaccines. In May it snapped up US biopharmaceutical firm Affinivax for up to $3.3 billion.

Also this year, the British company spent $1.9 billion on US group Sierra Oncology, a specialist in medicines for rare forms of cancer.

Haleon will be headquartered in Weybridge, southwest of London.