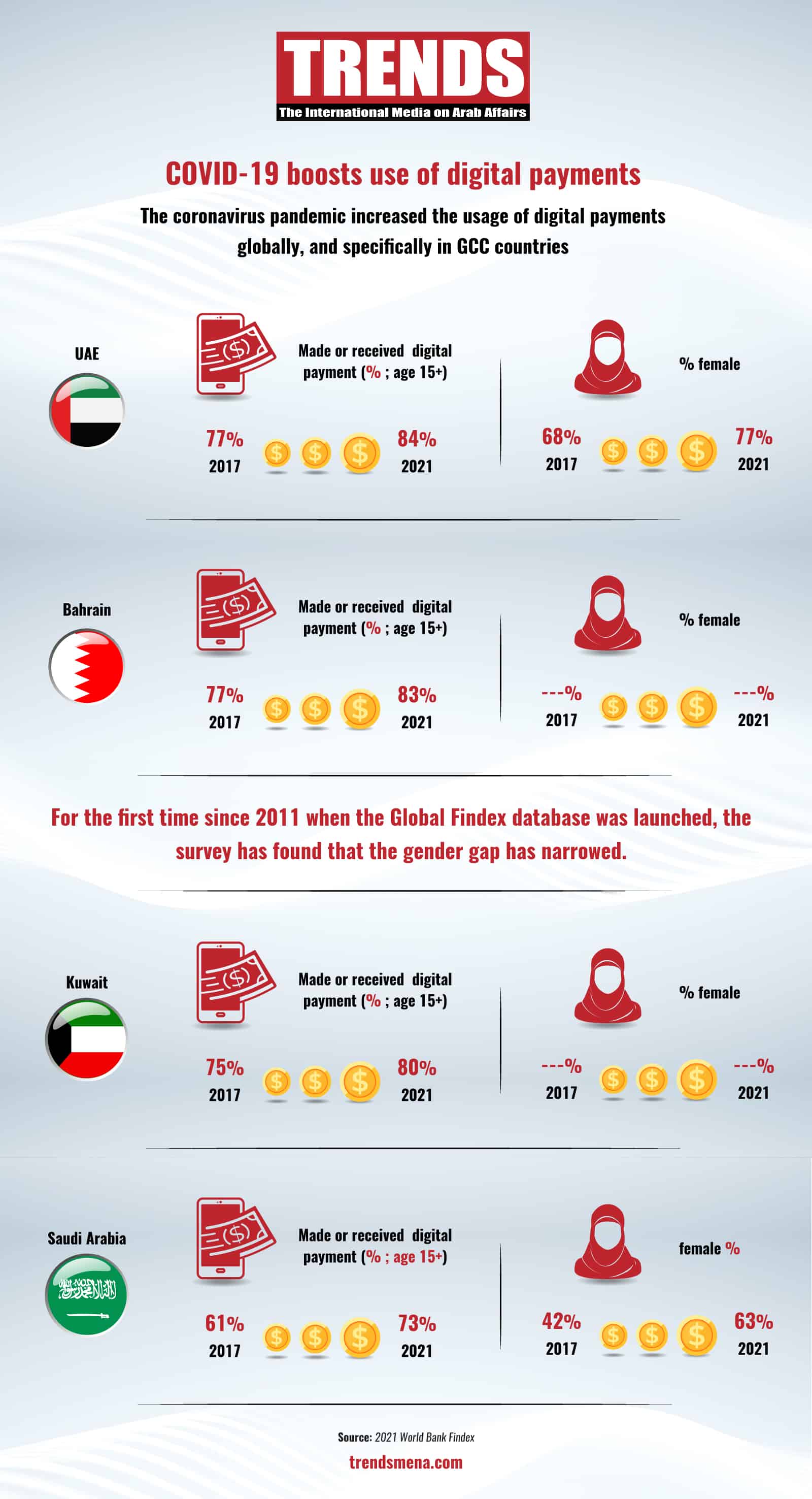

The COVID-19 pandemic, which spurred financial inclusion, has driven a huge increase in digital payments amidst the global expansion of formal financial services.

This expansion created new economic opportunities, narrowing the gender gap in account ownership, and building resilience at the household level to better manage financial shocks, according to the Global Findex 2021 database.

Here is how the pandemic aided the growth of digital banking across the GCC countries: